The curious case of Adyen 📉 📈

Should you buy Adyen stock?

Hi all,

and welcome to the second edition of “Business Wave Investment Club” 💴

Today, we have a very interesting stock to talk about, Adyen 💳, a payment processing company, and one of the most famous Dutch unicorns.

Don’t worry if you don’t know anything about it, after reading today’s newsletter edition you will be able to say

To make the reading easier for you, below you will find the “Table of Contents”.

Everything is linked there, so by clicking on a specific title, it will take you straight there. This way we can skip parts that are not interesting for you.

(This is if I manage to “hack” the Substack editor)

Just a reminder for all of you, from December 6th this type of post will be just for paid subscribers 💴💴💴

So, if you like this…😉

As always, you can show us your support by sharing this post 👇

Table of Contents

Business model & associated risk

Before we start out of curiosity…

Company intro

Adyen, a Dutch financial services company, was founded in 2006 by Pieter van der Does (can’t find his Linkedin) and Arnout Schuijff, who currently serve as the CEO and CTO, respectively. The name "Adyen," meaning "start again" in Sranan Tongo, signifies the founders' fresh start following their previous project, Bibit (it was a payment company also).

In 2012, Adyen began global expansion, opening offices in San Francisco, Paris, and London, and obtaining a pan-European acquiring license. By 2015, the company's valuation reached $2.3 billion, making it Europe's sixth-largest "unicorn" – a term for startups valued at over $1 billion. The following year, Adyen obtained an acquiring license in Brazil and was ranked #10 on Forbes' Cloud 100 list.

In 2017, Adyen was granted a European banking license, expanding its acquiring capabilities to Singapore, Hong Kong, Australia, and New Zealand. The company went public in June 2018, listing its shares on the Amsterdam stock exchange. Adyen continued its global growth in 2019, opening offices in Tokyo and Mumbai and launching Adyen Issuing, a card-issuing business.

In 2020, Adyen capitalized on the accelerated digitalization of global e-commerce, launching mobile Android POS devices and expanding its Middle Eastern presence with a new office in Dubai.

If you are lazy, here are screenshots from their website about their products and industries they serve 💡

Industries 👇

Industry intro

Adyen operates in the financial technology (fintech) industry, specifically focusing on payment processing. The company provides a platform that offers end-to-end payment capabilities, integrating various payment methods, risk management, and data analytics into a single solution.

This allows businesses to accept payments across online, mobile, and in-store channels globally.

If you don’t know too much about payment processing, don’t worry, I’ll explain through an example 👇

Card Swiped/Inserted: You swipe or insert your credit card at the point-of-sale (POS) terminal.

Payment Authorization: The POS terminal sends your card details to Adyen for processing. Adyen forwards this information to the card network (e.g., Visa, MasterCard) and then to your bank (card issuer) to check if you have enough funds.

Transaction Approval/Denial: Your bank approves or denies the transaction based on fund availability and security checks. This decision is sent back through the same chain to the POS terminal.

Completing the Transaction: If approved, the terminal completes the sale. Adyen will then manage the settlement process, ensuring the merchant receives the payment, minus the processing fees.

Why can't card network such as Visa be connected to the POS terminal directly, why do they need Adyen?

Visa and other card networks could technically be connected directly to POS terminals, but payment processors like Adyen offer several key benefits:

Integration and Compatibility: Payment processors ensure compatibility with various payment methods and technologies, not limited to just one card network.

Additional Services: They provide value-added services such as fraud detection, risk management, and data analytics, which are not typically offered by card networks.

Simplified Merchant Services: Processors handle the complexities of payment infrastructure, allowing merchants to focus on their business without needing to manage multiple relationships with each card network and bank.

Global and Multi-Currency Support: Processors like Adyen support global transactions and currency conversions, which can be complex to manage directly with each card network.

In essence, payment processors serve as a bridge and facilitator between merchants, card networks, and banks, offering a streamlined, secure, and comprehensive payment solution.

Industry size

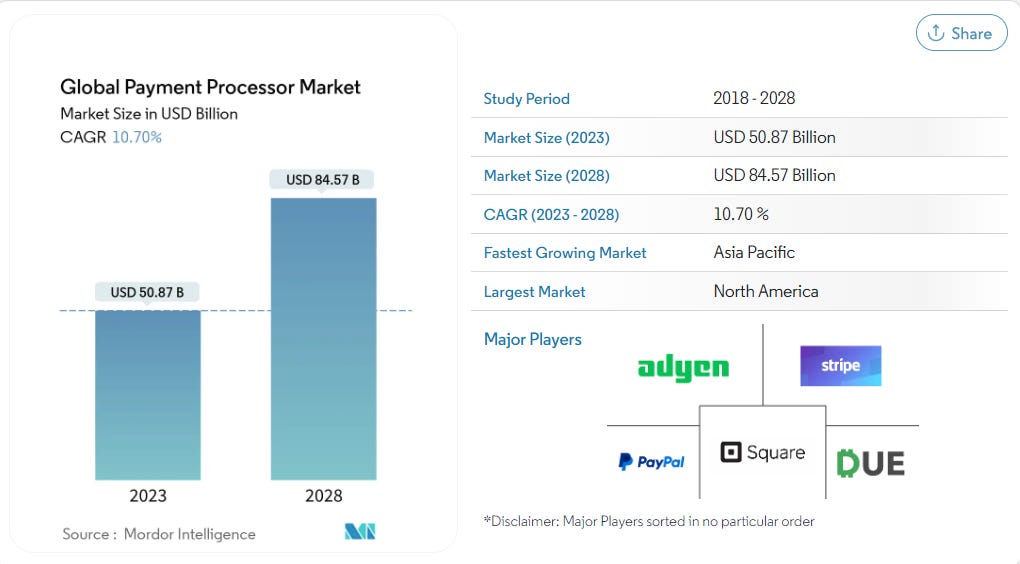

Of course, we are interested to know the actual size of the industry so that we can assess what is the potential for Adyen stock price growth.

With this you always have to be careful because the data varies depending on the source, and the majority of small investors will be using free sources they can find online.

Here are 3 examples where you can find different numbers about the same thing 👇

The Global Payment Processor Market size is expected to grow from USD 50.87 billion in 2023 to USD 84.57 billion by 2028, at a CAGR of 10.70% during the forecast period (2023-2028). The market growth can be attributed to the rising global prevalence of the internet and smartphones.

Finance Yahoo reports that the global payment processing solutions market was valued at USD 36.91 billion in 2022 and is anticipated to reach USD 52.06 billion by 2029, with a CAGR of 5.9%

Business Wire forecasts that the global payment processing solutions market size will reach USD 139.90 billion by 2030, registering a CAGR of 14.5% from 2023 to 2030

However, you should notice that every single report talks about the growth of the category, and this is the most important thing.

To better understand Adyen as a company, it’s important to know more in depth about payment trends in specific world regions.

Business model & associated risk

Based on Adyen financials this is how Adyen earns their money 💵💵💵

Settlement Fees: These are fees charged for settling (or completing) transactions. This involves transferring funds from the payer's bank to the merchant's account after a transaction is processed. Settlement fees can vary based on factors like the transaction amount, currency, and the countries involved.

Processing Fees: Processing fees are charged for the actual processing of transactions. This includes services like authorization, capturing card details, fraud checks, and ensuring secure transaction processing.

Sales of Goods: This refers to revenue generated from the sale of physical products. In the context of a payment processing company like Adyen, this could include the sale of point-of-sale (POS) terminals and related hardware that merchants use to accept payments.

Other Services: This category typically includes various ancillary services provided by Adyen. These could encompass additional features like analytics and reporting services, consulting, or any other non-standard services that are not directly related to payment processing or settlement.

Per Adyen financial report for 2022, Settlement fees are 92% of its revenue 😮

I’m telling you this because other payment processors are in the same “boat” so to speak. The more transactions they have, the more money they will make.

What is interesting to mention is Adyen’s “Processing fee” is a fixed fee of €0.11, and in terms of 2022 revenue it’s less than 5% 💡

More information about Adyen pricing (with a special look at fees for different payment methods) can be found HERE

This brings us to the risk side ❌

Legislation and technical development are pushing for making digital payments as cheap as possible. What that means is lowering fees connected with digital payments. Taking everything into account, the major risks Adyen’s business model is facing are the following:

Competition: The payments industry is highly competitive, with companies like PayPal, Stripe, and Square offering similar services. Increased competition can lead to price wars, reducing Adyen's profit margins.

Regulatory Changes: Changes in financial regulations can have a significant impact. For instance, tighter regulations on transaction fees or data privacy can affect Adyen's revenue model and operational costs.

Technological Disruption: The emergence of new payment technologies like cryptocurrencies, blockchain, or central bank digital currencies (CBDCs) could disrupt traditional payment processing models, potentially reducing the need for intermediaries like Adyen.

Economic Downturns: Economic downturns can lead to a reduction in consumer spending and, consequently, in the volume of transactions processed by Adyen, directly impacting its revenue.

Dependency on Merchant Fees: Since Adyen’s revenue is largely derived from fees charged on transactions, any change in the volume of transactions or in the fee structure can significantly impact its revenue.

Market Saturation: In many developed markets, the payment processing market is nearing saturation. This limits growth potential unless Adyen can expand into new markets or offer additional services.

Customer Concentration Risk: If a significant portion of Adyen’s revenue comes from a limited number of large clients, losing any of these clients can have a substantial impact on its financials.

But of course, every business has its risks. The risks we mentioned above can all be mitigated if the overall payment volume (everything except cash) grows…

Payments trends by regions

To make it easier for you, everything will be in pictures, and all the data is taken from the FIS Global Payments Report which you can download HERE

E-commerce growth

Of course, e-commerce growth means more payments with payment methods that Adyen supports 😉

Payment trends by regions

LATAM 👇

North America 👇

Europe 👇

Asia & Pacific 👇

Basically, the only payment method where Adyen doesn’t have anything to say (cash) is in decline all over the world.

Competition

With fintech companies it’s often difficult to understand competition; not because the competition isn’t obvious (offering same services) but because fintech companies like to expand into similar areas as their core business.

For instance, if you take a look at the list of Adyen competition, you will notice companies such as Klarna, Shopify payments, and Amazon pay, companies that were not originally in Adyen space 👇

PayPal: A widely recognized leader in online payment solutions, offering services for both individual consumers and businesses.

Square (now part of Block, Inc.): Known for its point-of-sale solutions and payment processing services, especially popular among small businesses.

Stripe: A technology company that builds economic infrastructure for the internet, offering payment processing solutions for online businesses.

Worldpay: One of the global leaders in payment processing technology and solutions for merchant customers.

Mastercard: Although primarily a card network, Mastercard also offers payment processing solutions through its acquisitions and services.

Visa: Similar to Mastercard, Visa is a major card network and provides payment processing and financial services.

Shopify Payments: Powered by Stripe, it's integrated into the Shopify platform and caters to e-commerce businesses.

Braintree (a PayPal service): Specializes in mobile and web payment systems for e-commerce companies.

Klarna: Known for its "buy now, pay later" service, it's expanded into a comprehensive payment solutions provider.

Amazon Pay: Amazon's own payment processing service, allowing users to pay with their Amazon accounts on external merchant websites.

Also, in pretty much every market there are local/regional payment processing companies that have a certain leverage over big global players such as Adyen. In most cases that means lower fees but it also can mean better market understanding.

I can talk about my own experience in Croatia. Two local payment options are really popular here: Aircash and KeksPay.

For a company like Adyen integration of Aircash and KeksPay is not important on a global scale because Croatia is too small a market to make that much of a difference for them. However, if you are a Croatian e-commerce shop, not having Aircash or KeksPay as a payment option is a mistake.

So, a local/regional payment processor could still be a dominant player in the Croatian market if they play their cards right.

For a company such as Adyen, the growth is achieved when they sign companies that are processing a lot of payments, and not necessarily when they open a new market.

Financials

Now here comes the fun part…finance! But seriously, let’s make this a fun experience!

Adyen revenue breakdown for 2022 👇

Source: Simply Wall St

However, take a look at the numbers for 2021 👇

Source: Simply Wall St

So, from 2021 to 2022, Adyen's revenue grew by almost €3 billion 😱

And here is Adyen's revenue breakdown for H2 2023 👇

Source: Simply Wall St

It’s quite obvious that the Adyen 2023 financial results will be better than 2022. Of course, unless something unexpected happens, such as the end of the world.

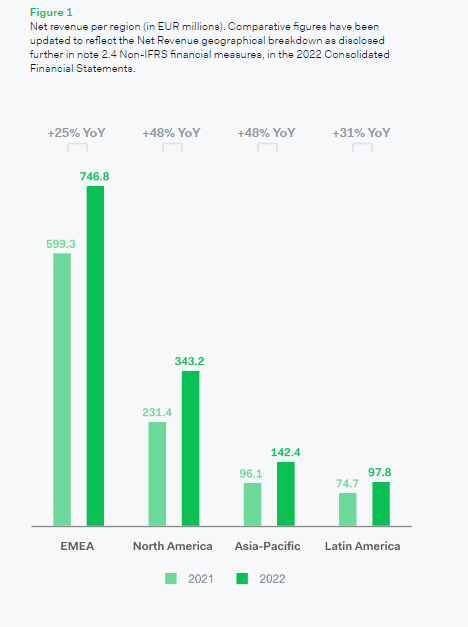

Here is a screenshot from Adyen’s financial report for 2022 that talks about Net Revenue👇

I wanted to highlight this part in particular because it shows the markets Adyen operates in, and how each market is developing.

Now, here you will have to use your brain a little bit 💡Connect the financial data we presented above with the payment trends and current industry size you read above.

EMEA is still the strongest market by far, but it’s interesting to notice the growth in 2 markets: North America and Asia-Pacific.

North America is still considered the best fintech market because of the standard of living, and overall economy/technology conditions. In Adyen's case, this is where they can find the best new clients in terms of their size.

Asia-Pacific has a lot of people, and the payment market has seen some crazy development over the last 5 years. If Adyen continues to show this kind of results in those 2 markets year after year, that should affect Adyen's share price as well.

For instance, if you take a look at the 2022 workforce, there is still a lot of room for expansion in their North America and Asia-Pacific offices 👇

Stock price & trends 📉📈

Now that you know more about Adyen as a company, their industry, business model & risks, competition, and financial data it’s time to see what is going on with their stock 👀

Current price

Adyen’s IPO date was June 13th 2018, and if you invested then your return would be 🚀🚀🚀

Now, every stock has its ups and downs, and there were a couple (to put it mildly) of moments in Adyen's history when stock proved to be very volatile. However, you should always look for the reasons for such drops to asses if this was just panic or something is behind it.

Important drops & ups

As you can see from the picture above, Adyen stock was “quiet” for 2 years, and then the honeymoon phase started. If you are following the fintech scene, you know that pretty much all fintech stock “boomed” during the Covid-19 pandemic.

The overall trend of fintech stocks from the start of the COVID-19 pandemic in February 2020 up to May 2021 can be summarized as follows:

Initial Drop (Early 2020): At the onset of the pandemic, the stock market experienced a significant downturn, impacting almost all sectors, including fintech. This initial drop was a reaction to the uncertainty and potential economic impact of the pandemic.

Rapid Recovery and Growth (Mid 2020 to Early 2021): Fintech stocks experienced a rapid recovery and significant growth following the initial drop. This growth was driven by several factors:

Increased Digital Transactions: With lockdowns and social distancing measures in place, there was a surge in online shopping and digital transactions, benefiting companies involved in digital payments, e-commerce, and related financial technologies.

Adoption of Digital Financial Services: The pandemic accelerated the shift towards digital banking, contactless payments, and online financial services, boosting the prospects of many fintech companies.

Investor Optimism: Investors quickly recognized the growth potential in the fintech sector given the accelerated digital transformation, leading to increased investment in these stocks.

Market Volatility (Late 2020 to Early 2021): Despite the overall growth trend, fintech stocks experienced volatility during this period. Market fluctuations were influenced by varying news about the pandemic, vaccine developments, and economic recovery prospects.

Divergence in Performance (2021): Starting in 2021, there was a noticeable divergence in the performance of fintech stocks. While some companies continued to experience growth, others faced challenges. This divergence was due to a variety of factors, including:

Market Saturation and Competition: As the fintech space became more crowded, competition increased, impacting the performance of some companies.

Regulatory Challenges: Increased regulatory scrutiny in some regions affected certain aspects of the fintech market.

Economic Reopening: As economies began to reopen and traditional financial services started to bounce back, some fintech sectors experienced a slowdown in their rapid growth.

Now we come to May 2021, an important moment for Adyen stock. Why? Because this is the first time that you can see how much “knowledge” investors in Adyen have about the company, and industry in general.

In May 2021, Adyen stock has a sharp decline in value that was attributed to the company's revision of its sales-growth and profitability targets. Specifically, Adyen revised its target for net revenue growth to be between "the low-twenties and high-twenties" until 2026, down from the previously forecasted "mid-twenties and low-thirties." This revision led to concerns among investors about the company's growth prospects, which in turn impacted the stock price.

However, just a couple of days later, Adyen stock had a 4 month “unstopable” growth spur.

Adyen's stock growth from May to September 2021 can be attributed to several factors, as reported by Reuters:

Strong Financial Performance: Adyen reported a 65% increase in core profit for the first half of 2021, with adjusted earnings before interest, taxes, depreciation, and amortisation (EBITDA) reaching 272 million euros. This performance exceeded market expectations.

Revenue Growth: The company's net revenue rose by 46% compared to the same period in the previous year, reaching 445 million euros, which was also higher than analysts' forecasts.

Growth in North America: A significant part of Adyen's growth was driven by increased volumes and strong performance in North America. The company processes payments for major clients like Netflix, Facebook, and Uber.

Increased Volumes from Existing Customers: Higher volumes from existing customers, including McDonald's, contributed to the overall increase in Adyen's volume, which was up by 67% to 216 billion euros.

Positive Market Trends: Adyen benefited from macroeconomic trends, particularly the shift toward online retail and the declining use of physical cash, trends that were accelerated by the COVID-19 pandemic.

These factors combined to create a positive outlook for Adyen, reflected in the stock price increase during this period.

Pretty much the same story continued from the end of 2021 until now. Adyen says they are going to grow XY %, the analyst has their expectations, and then when Adyen doesn’t meet expectations, the stock has a sharp drop. Give it a couple of days/months and the stock goes up again.

The reason for this volatiliy can be found in the ownership structure of the company.

Ownership structure

Adyen has an ownership structure that is suitable for stock price speculations due to the high % of General Public ownership 👇

Source: Simply Wall St

Price Volatility 👇

Source: Simply Wall St

You are up against the people who are not looking to hold on to Adyen stock but they are more into the “get rich quickly” scheme. You need to keep that in mind when deciding when to buy the stock.

Looking at the institutional owners, there are some familiar “faces” there 👇

Source: Simply Wall St

Adyen stock metrics 📊

The stock analysis wouldn’t be stock analysis without stock metrics 😍

Now, due to Adyen's ownership structure, I’m not sure how useful they are in this case because, in Adyen's stock price, there are a lot of pre-built expectations.

However, we are going to mention the most important ones. Take into account that by pretty much every single stock metric, Adyen stock is way overvalued but…rarely you will find an undervalued stock and other investors don’t know of it.

Especially if we are talking about fintech stocks. The most important thing after all is to “buy low, sell high”.

P/E ratio

Source: Simply Wall St

A high P/E ratio means that the current stock price is overvalued.

P/E vs Peers

Source: Simply Wall St

Share Price vs Fair Value

Source: Simply Wall St

Take into account that on October 27th 2023, Adyen’s share price was €640 so the opportunity was there. It will come back again, don’t worry about it.

Free Cash Flow

Source: Simply Wall St

No worries here, Adyen has a plenty of 💵💵💵

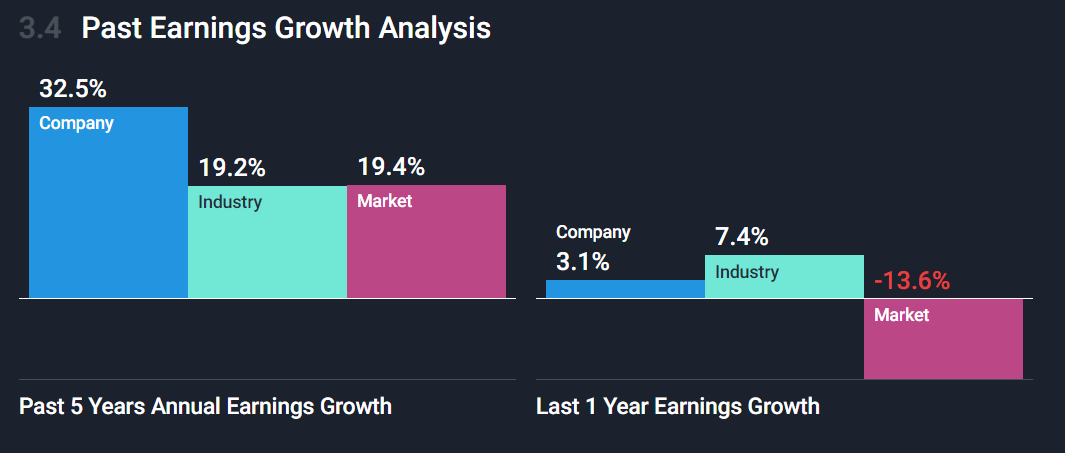

Past Earnings Growth Analysis

Source: Simply Wall St

This is super important, and that is the fact that if we are looking at 5 year average, Adyen grows faster than the industry.

Conclusion

First of all, congrats on making it to the end 🎉🎉🎉

Look, it’s a fintech stock, and with it comes the risks…but…

Adyen has a good business model, they are growing year after year, and it’s only a matter of you picking your moment when to buy their stock.

Not even a month ago (October 27th) was a great chance to buy Adyen stock, and even today the stock price is not that bad in our opinion…

DISCLAIMER

Our content is intended to be used and must be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances.

A bit late to this but still roughly in the same place as last year, adyen is a dominant player no doubt, but paypal seems to be trading at more attractive multiple for being the biggest payment processor in NA.

Why not look at paypal instead of adyen when your fundamentals are inline with paypals but at a more attactive valuation to adyens 20+x p/fcf compared to paypals 12x?