🌊 Let us be "wise" on Wise

How wise is it to buy Wise stock right now?

Hi all,

and welcome to the 4th edition of “Business Wave Investment Club” 🎉🎉🎉

Before we start…

this is the last edition that will go out to free subscribers 😱

So, if you like this type of content, and you want to support us your path forward is clear 👇

For the price of $8 a month you get 2 posts extra per week that focus solely on investment.

(One of the posts will always be stock analysis)

Of course, you can stay with us for free, and receive your regular “Business Wave” newsletter without the investment content.

But, enough of that, let’s focus on today's topic👇

How wise is it to buy Wise stock?

I must say…I’m quite proud how I structured the question 😎

Today we will go into Wise business model, ownership structure, revenue, customers, stock price, and other things that are important to answer the question above.

Before we start, just one thing 👇

Wise intro

Wise, formerly known as TransferWise, is a financial technology company that was founded in January 2011 by Kristo Käärmann and Taavet Hinrikus. Its headquarters are located in London, United Kingdom. The company operates as a peer-to-peer money transfer service, offering a cost-effective alternative to traditional bank transfers for private individuals and businesses. One of its key services is a multi-currency account with a debit card, allowing users to hold, manage, and convert between multiple currencies. Wise is particularly known for using the real, mid-market exchange rate for currency conversions, which can result in lower costs for users.

In July 2021, Wise became a publicly-traded company through a direct listing on the London Stock Exchange. The company has experienced rapid growth and expansion, gaining popularity as a trusted platform for international money transfers. Wise is recognized for its innovative approach to financial services, continuously updating and expanding its offerings to adapt to the changing needs of its customers.

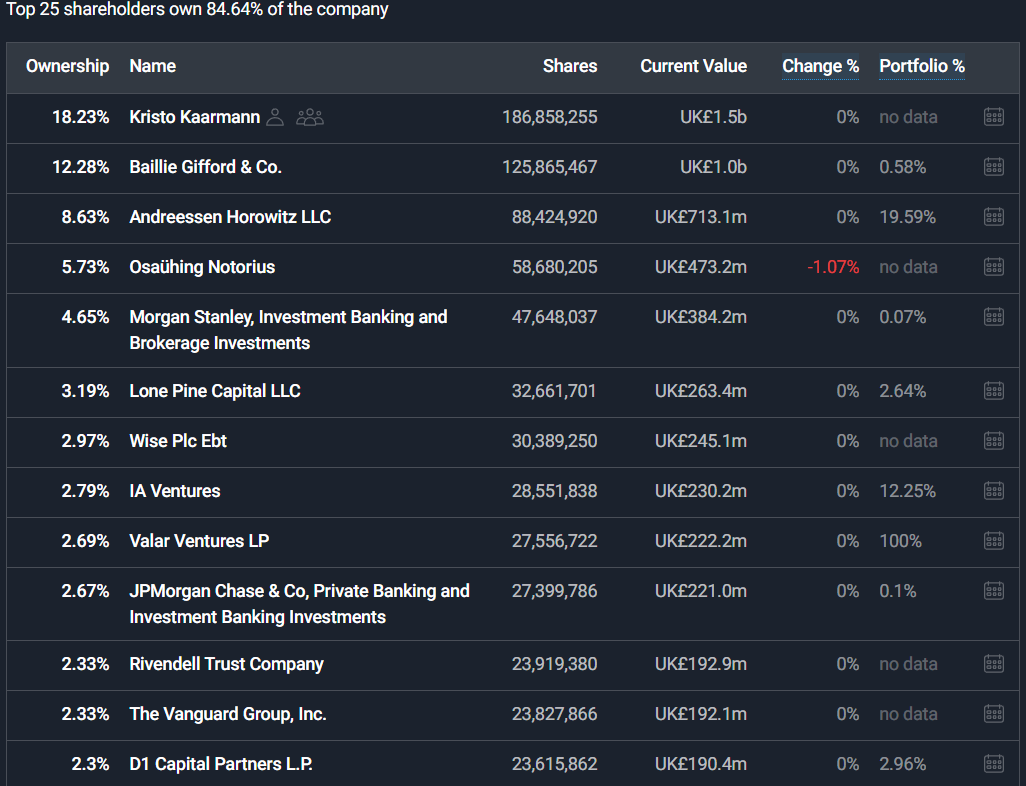

Ownership structure

If you remember the past three “Business Wave Investment Club” editions, the ownership structure was pretty much straightforward, but Wise is different 👇

Here we can see that a lot of Individual Insiders still holding on to their shares which shows that they do believe in the company.

Top shareholders are as follows 👇

Co-founder of the company holds 18,23% stake in it…not bad 😉

Business model

Let’s see what Wise is all about…

Here is the overview of the company 👀

Source: C-innovation

In a fintech world, 6 years to reach profitability is not bad at all, and in 12 years of existence Wise managed to cover with its services the majority of the world. 🌎

Source: Wise Annual Report and Accounts 2023

Europe is by far the biggest market for Wise (which is expected since they started in the UK) but the Asia-Pacific region shows a lot of room for growth. North America is a tough market to crack but a very lucrative market if you establish yourself, and Latin America…

Latin America in my personal opinion is a very potent market for Wise but there is a problem there: Nubank. They dominate the market, and it’s tough to fight against them.

Africa is…a strange market. There are a lot of families from Africa living and working abroad that are sending money back home, but the overall payment infrastructure is still very much under development (when compared to other parts of the world).

Maybe that is the reason why Wise is not present that much there 🤔

Ways to make a living

As with pretty much any fintech, the revenue formula is simple 👇

more users=more fees=more revenue

Unlike standard banks that charge you a monthly fee for just being their user, Wise earns money only if you are using their services.

Source: C-innovation

In case you like this edition so far, sharing is caring ❤️

Cross-border payments

If you don’t own your business or if you don’t work with other countries you have no idea what a problem cross-border payments are 😤

Take our own example!

We are based in Croatia (Europe), Substack is based in the USA, and Stripe is the payment processor. When someone subscribes to the paid edition of our newsletter it takes us 7-10 days to receive the money 😐

So, it’s really a “pain in the ass”, and Wise is very well positioned here.

Source: C-innovation

Product stack

Source: C-innovation

When Wise started in 2011, the business model was about online currency exchange, and this business model progressed into a money transfer application. Over time Wise management realized that it’s lucrative to expand their offering to B2B payments, and they are slowly getting into expense management as well (Employee expense cards).

What I like here is that Wise is focused on its core business (payments), and they don’t go too much outside of it. Some fintechs, and here I mean neobanks struggle to reach profitability so they are ever increasing their offering.

Sure, Wise will increase its offering at some point but their core business model is profitable, and it’s a good basis to build upon.

Regulations

When it comes to expanding your offering, and you are a payments provider…it’s all about regulations and different licenses. This becomes more and more complex as you try to be a global payment provider.

Here is the overview of Wise current licences 👇

Source: C-innovation

I’m not sure that they will become neobank (check this out) but for personal clients they might introduce wealth management services, and business clients will most likely enjoy even more services/products that will enable them faster and cheaper international payments.

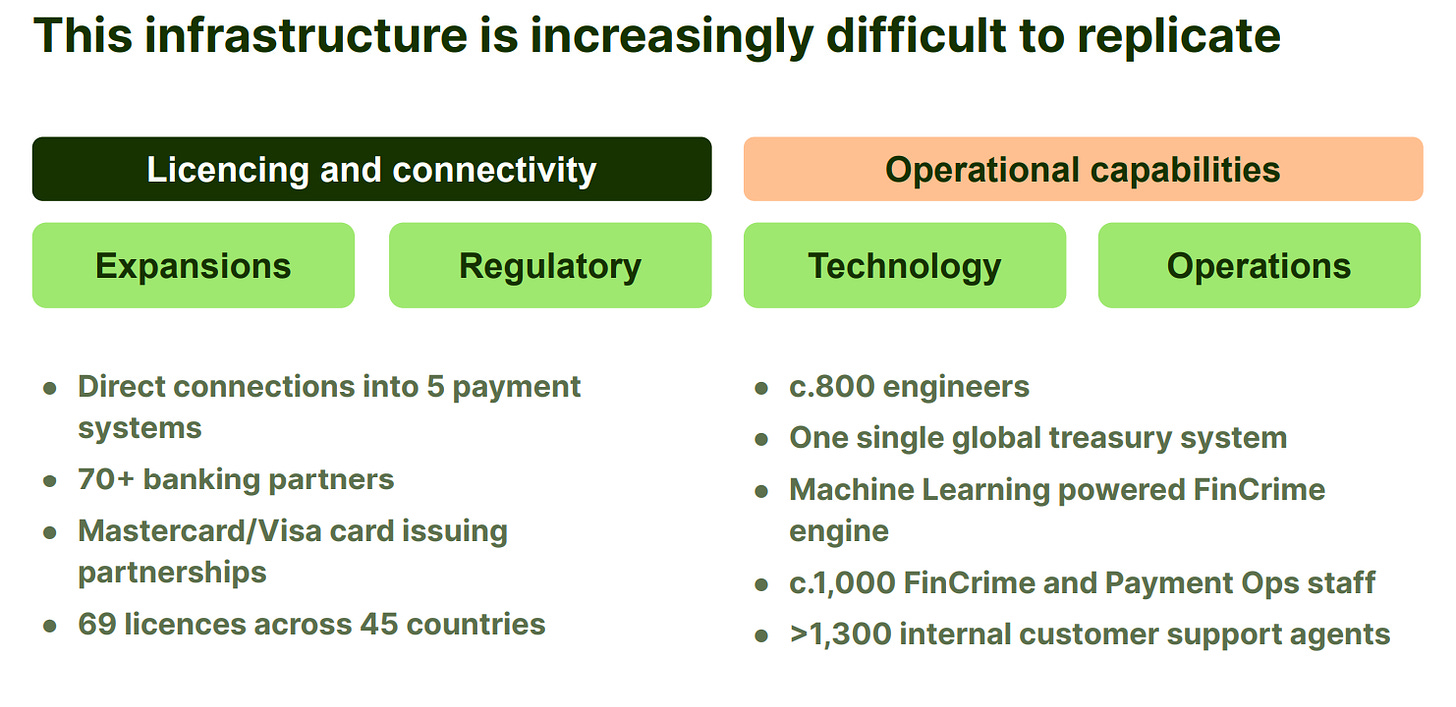

Uniqueness factor

Competition can cause a lot of pain but if your business is hard to copy…you sleep better.

So, how well does Wise management sleep?

Source: Wise H1 FY24 Sep-23 Analyst Presentation

Now, you can’t really believe everything that you see in a company's official report, but they do have a point here. Wise is truly an international payment company with many integrations, licenses, and more importantly…partnerships with the right companies.

Source: Wise H1 FY24 Sep-23 Analyst Presentation

It takes years to build something like this, and even though some neobanks such as Revolut can compete with Wise…Wise has a competitive advantage over them.

Banks will never incorporate Revolut as part of their solution while they can use Wise for a specific purpose (international money transfer) while keeping their core business intact.

Customer numbers

When it comes to customer numbers the most important number is the number of active customers. You can have 50 million customers but if only 5 million are using your product…in reality you have 5 million customers, not 50.

Source: Wise H1 FY24 Sep-23 Analyst Presentation

In all honesty, 7,2 million active customers combined (private and business) is not something that is “over the moon”. Don’t get me wrong, it’s a lot of people but Wise needs more users if they want to compete with fintechs such as Nubank or Revolut.

Source: Wise H1 FY24 Sep-23 Analyst Presentation

The good thing is that the number of customers who are using more than one Wise product is growing, and that indicates that the quality of customers is getting better.

Finance talk

So, finance?

Wise is a bit special here as well but this time this specialty can bring confusion 😥

As it happens, Wise uses Fiscal year reporting

Calendar year reporting refers to financial reporting for the period from January 1st to December 31st, aligning with the calendar year. This is commonly used for general purposes and is straightforward for comparison across different entities.

Fiscal year reporting, on the other hand, involves financial reporting for a twelve-month period that does not necessarily align with the calendar year. A fiscal year can start and end in any month as chosen by the company, often based on industry practices, tax considerations, or operational cycles.

For Wise, their fiscal year ends on March 31st so even though it’s the end of 2023, Wise is well into 2024 so to speak.

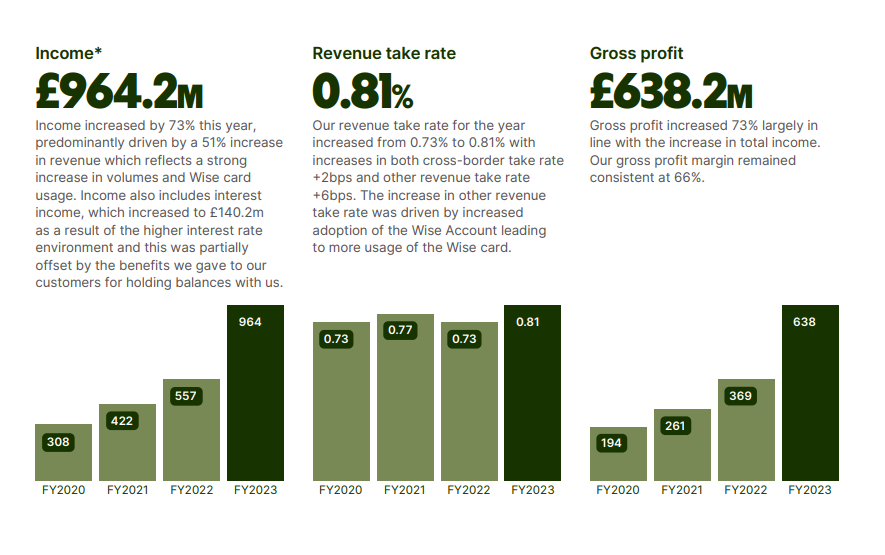

For instance, this is the revenue data from the 2023 annual report which was published in June 2023 👇

Source: Wise Annual Report and Accounts 2023

and this 👇

Source: Wise Annual Report and Accounts 2023

If you look at the calendar year, in reality these numbers consist of 2022 (Q2+Q3+Q4) and Q1 2023.

Since it’s the end of 2023 already, better way to see how Wise is doing this year is to look at H1 2024 report which consists of Q2+Q3 2023 really 👇

Source: Wise H1 FY24 Sep-23 Analyst Presentation

and here is revenue distribution by regions 👇

Source: Wise H1 FY24 Sep-23 Analyst Presentation

The majority of Wise revenue comes from cross-border payment fees. We already mentioned above how well-positioned Wise is in that segment so it’s not a surprise that the majority of their revenue comes from it.

Europe (including the UK) is the leading market while APAC and North America are “neck to neck” really.

However…is there more?

Yes, there is!

Source: Wise H1 FY24 Sep-23 Analyst Presentation

Wise is earning quite nicely on interest from their customer deposits so their actual revenue in H1 2024 is not £ 498,2 million but £ 656 million when we add interest income.

You can see the full interest income breakdown bellow 👇

Source: Wise H1 FY24 Sep-23 Analyst Presentation

In the end, Wise business model is more than profitable but the most obvious way to increase their revenue is still to bring in more (active) customers.

Source: Wise H1 FY24 Sep-23 Analyst Presentation

Stock performance

IMPORTANT!

GBX, often referred to as "pence sterling," is a subunit of the British Pound Sterling (GBP), where 1 pound equals 100 pence. Stock prices in the UK are commonly quoted in pence rather than pounds, hence the use of GBX. This convention helps in providing more precision and avoids the use of decimal points, which can be especially useful for stocks that are valued at lower prices.

So, the price 805 GBX is equivalent to £ 8.05

Now, Wise stock all-time performance is not spectacular at the moment, but their YTD performance is better 👇

Like any fintech stock, Wise had its ups and downs but it was a very good buy at the beginning of 2023…

Stock metrics

Source: Simply Wall St

P/E Ratio is high but it’s the same story across the fintech industry. If you do find a good fintech stock that has a low P/E ratio…let me know! 😁

Is the current price too much? 🤔

Source: Simply Wall St

To be honest, I don’t believe there is a single fintech stock that is not overpriced at the moment 😂

EPS is not great, but having an 18,05% Net Profit Margin in their line of business…that is something 👀

Source: Simply Wall St

Also, Wise’s Return on Equity (ROE) is excellent 💪

Source: Simply Wall St

However…analysts believe that future growth will be moderate 👇

Source: Simply Wall St

So, what is the verdict in the end? Should you buy the stock right now or not?

Final Thoughts

The current price is a bit high but looking mid/long term…Wise stock price should go up.

Why?

Because it’s a company that has good products/services, people love to use them and they have enough room to grow their current customer base.

I don’t believe it’s a better buy than Nubank for example but if you buy it today, and hold it for 2 years…you should be able to make money on it.

DISCLAIMER

Our content is intended to be used and must be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances.