Hi all,

we have a big (well, for us it’s big) 😅 announcement for you today!

Business Wave has a paid section💡

The paid section will focus on investments and it will have a minimum 2 posts per week:

stock analysis (like the one you will read today)

investment tips&trics, interesting news etc

Additionally, we will do collaborations that will be investment-focused with other content creators and people from the industry.

Every month our paid subscribers can expect 8-12 additional posts focused on investing.

(the post that you are reading today is a type of post paid subsribers will receive)

If you are like me, you might be wondering how much will this cost 💰💰💰

Of course, readers who are not interested in investing can continue to read Business Wave as usual. The only difference is that you won’t be getting investment-type posts, that is all.

(and of course, you won’t pay anything).

To help you with the decision if you want to pay for our newsletter or not, we decided to give all of you 3-week trial period.

For the following 3 weeks (until November 29th) you will be getting “Business Wave investment club” for free, and starting from December 6th, only paid users will receive investment type of posts.

Readers that subscribe before this 3-week trial period ends will get 2 additional stock analyses as an early Christmas present in December 😎

How can you subscribe?

Easy 👀

Type in your email in the form, click subscribe and you should be able to choose a paid version.

If this doesn’t work at the end of this email there is “Upgrade to paid” button.

In case there is a problem, just contact us via comments or email.

Also, it would mean the world to us if you would share this post on your social media profile/profiles.

We are open to your suggestions on the content via email or comments!

Also, at the end of this post, there is a poll 😉

DISCLAIMER

Our content is intended to be used and must be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances.

But, enough of this introduction part, let’s dive into what you are here for…Nubank stock!

Nubank intro

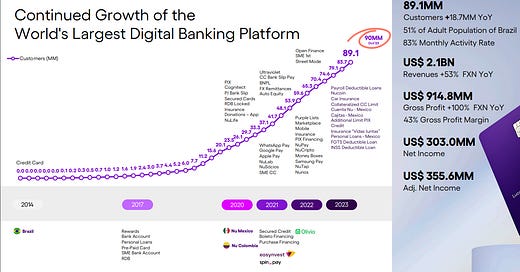

Nubank, established in 2013, has rapidly evolved into a prominent player in the digital banking landscape of Latin America. Headquartered in São Paulo, Brazil, Nubank is recognized as the world's largest neobank. As of Q3 2023, the company boasts a remarkable customer base of 89.1 million users on 3 markets: Brazil, Mexico, and Colombia.

Source: Nubank Q3 23 Earnings Presentation

The bank's innovative approach to financial services has enabled it to offer a diverse range of products. In 2023 alone, Nubank launched over 25 new products and features, demonstrating its commitment to expanding its portfolio and catering to varying customer needs. This product diversification, along with a focus on user-friendly digital interfaces, has played a significant role in attracting and retaining customers.

Financially, Nubank has shown impressive performance. In 2023 (Q4 is still missing of course), the company reported a record high revenue of $2.1 billion, marking a 53% increase from the previous year. This growth is attributed to the compounding effects of customer growth and enhanced levels of customer monetization, particularly in Brazil. This financial success underscores Nubank's ability to effectively leverage its large customer base and diversified product offerings.

Warrent Buffet is quite fond of Nubank. Buffett's conglomerate originally plowed $500 million into Nubank in June 2021, then piled another $250 million or so into the crypto-friendly Brazilian bank when it went public in December 2021. Berkshire owned around 107 million shares of the digital lender at the end of June this year, giving it about a 2% stake worth $845 million at the time.

Who invested so far?

Now, we are not saying that big investors are always right but they tend to catch up with new trends faster than small investors so it’s always good to understand where they invest their client's money.

Ownership overview 👇

Source: Simply Wall St

Ownership in more detail 👇

Source: Simply Wall St

If you want to keep track of who is buying Nubank stock in more detail you can click HERE for more information.

As you can see from the data we presented, Nubank stock is being “trusted” by some of the biggest investment companies in the world, which is a good sign.

However, does this mean you as a small investor can make money on Nubank stock🤔

This depends on when do you buy the stock 💡

Current stock price

So, how are things looking at the moment? 👀

Nubank had a pretty warm IPO welcome in December 2021 where it opened 25% above the IPO price. The analyst expected Nubank's share price to be between $8 and $9 but the share went over $11. This is not uncommon for “hot” shares, and back in 2021 Nubank had an etiquette of “Warren Buffet's favorite bank”.

However, there is one thing that “bothers” me.

Nubank announced its Q3 2023 results yesterday, and they are really good. Usually, if the results are in line with expectations/excede them, the stock price goes 📈

Nubank shares didn’t gain that much, even though the results are great in all categories (we’ll talk later about Nubank results).

This doesn’t have to mean anything, but it could mean that the current Nubank price is at its “maximum”, and unless something unexpected happens the stock price won’t move too much.

This unexpected can be connected to Nubank (expansion into new markets) or it can be connected to the general market conditions. But, keep in mind that fintech stocks in general are not performing well, and investors are really careful with them.

For instance, if you take a look at YTD resuls 👇

Nubank stock was a great buy in January this year.

When buying a stock, picking the right time to buy is super important.

The question you might be asking yourself is…is it safe to buy Nubank stock at this price point?

If you are okay with holding the stock for 2-3 years, then our opinion is YES.

Let’s see why!

Nubank deeper look

Key metrics in a blink

Let’s take a look at Nubank’s key metrics 👇

Source: Nubank Q3 23 Earnings Presentation

What we like about Nubank is that all relevant metrics are growing with a huge, huge potential for further growth.

By the end of 2023, Nubank should have over 90 million customers, revenues exceeded $2 billion, and what is the most important thing…net income is positive 😍

In case you need CAGR explanation, click HERE

Profitability is there

How the things look at the moment, 2023 will be Nubank’s first profitable year ever 💡

Source: Nubank Q3 23 Earnings Presentation

Revenue breakdown

Source: Nubank Q3 23 Earnings Release

Interest Income and Gains (Losses) on Financial Instruments increased 64% YoY FXN, to $1,732.7 million in Q3’23. The increase reflected mainly two factors: (1) consistent high interest income in the consumer finance portfolio, associated with the ongoing expansion of both personal loans and credit cards and (2) credit mix, mainly associated with the increase of installments with interest within the credit card portfolio and accelerated loan origination. Fee and Commission Income in Q3'23 increased 18% YoY FXN to $404.1 million. This resulted mainly from interchange fees driven by the increase in credit and debit card purchase volumes, reflecting continued growth in Nubank's customer base and activity rates.

Cost control is on point

For banks handling your costs is super important, maybe even more important than growing your revenue. Nubank is very well positioned when it comes to the costs of acquiring, serving, and managing its customers.

Source: Nubank Q3 23 Earnings Presentation

Customers product distribution

Of course, saying that you have 90 million customers looks awesome, but their distribution is the most important thing.

In Nubank’s case, customer distribution is…well…magnificent? 🤔

Source: Nubank Q3 23 Earnings Presentation

Nubank defines an Active Customer as a “customer that has generated revenue over the last 30 calendar days for a given measurement period”. When you take this into account, things start to get interesting.

What separates Nubank from other neobanks is that they do have “regular” banking products, not just a “hipster” neobank story.

For instance, some time ago we wrote about Revolut's problems with obtaining a UK banking license 👇

What is the deal with Revolut💳UK banking license?

There we talked about Revolut's current revenue streams; Revolut revenues are primarily driven by their trading/investment division, and after that come interchange fees for card payments.

Interchange fees/rates are the “bread and butter” revenue for neobanks. To put things simply, every time you pay somewhere with a neobank card, neobank gets paid.

More info about interchange fees/rates you can find HERE

The more users neobank has…more likely is that the people will pay with their cards…

You get the picture by now 😉

But Nubank…not only do they have a huge customer base, but they also have a diversity of products; both “regular” bank standard products and neobank type of products such as stock/crypto investing

Customers use Nubank as their primary account

This is something most neobanks have huge problems with. Customers download their application but they use neobank services sporadically. With Nubank, the situation is different, and more than 50% of their active customers are using Nubank as their primary banking account.

To make things even better, active customers use on average 4 Nubank products, and Nubank is known as the innovative bank that is constantly adding new products to its mix.

Source: Nubank Q3 23 Earnings Presentation

Things to consider with Nubank

Now, this would be the part where we go away from concrete data you can find in financial statements and try to connect the dots.

The first thing any potential Nubank investor should consider is Nubank’s current markets.

Nubank is operating only in 3 markets, but if we look at the data it’s obvious that Nubank is operating only in 1 market: Brazil.

However, they are “killing” in a Brazilian market 💵💵💵

Source: Nu Holdings earnings call presentation

With the knowledge they have from a Brazilian market, continued advancement in Mexico and Colombia is almost a sure thing.

In Brazil, over 46% of the adult population is a Nubank customer, and check this out 👇

Mexico's population is 126 million, Colombia 51,5 million.

If Nubank gets similar results in Mexico and Colombia, we are talking of 200 million customers bank that operates only in 3 markets 😱😱😱

LATAM consists of 33 countries and as of 2023, the largest segment of the population in Latin America falls within the age group of 19 to 30 years, which consists of the youth population. This age range comprises approximately 127.9 million individuals across the countries encompassing the region.

Young people tend to “break the rules” and they are open to solutions such as Nubank. Nubank is by far the largest neobank in the area, and it’s not difficult seeing it expand to other LATAM countries.

Here we haven’t even mentioned the best market in the world; the USA. Many neobanks have tried to expand into the USA but with limited success. We believe that Nubank has a chance to be a different story.

Business Wave opinion

Dear readers, for us, Nubank is “no brainer”. If you like to hold your stocks for a couple of years, we believe that Nubank stock price will rise in the next 3-5 years for sure. Of course, when it comes to investing anything is possible, and there is no such thing as a “sure thing”, but Nubank is pretty close to it. Also, due to the current stock price of $8, it’s pretty affordable for small investors.