4rd edition of the Fintech Wave🌊 is out. This is your weekly source of what’s going on in the Fintech world in Europe and North America. Feedback is welcome (you can contact us at fw@fintechwave.co) and if you like this newsletter please share with friends and encourage them to SIGN UP HERE.

TLDR; European fintech scene is catching up with the USA with massive investment rounds. Now you can use BNPL to pay off pizza. Social investing is becoming a thing. Crypto lending platform is giving up to 17% yield on your crypto. BTC above $60K. Also, make sure you check Tweets of the week, they are really good. Keep reading for details👇

Europe News and Funding

SumUp acquired the U.S. based Fivestars

London-based global payment provider SumUp acquired Fivestars for $317M in cash and stock deal. Fivestars is an integrated payment and marketing solution for small businesses serving more than 14.000 clients. Investors so far put $115M into Fivestars, so they earned a nice return on investment after this acquisition. This acquisition will help SumUp to increase its presence in the USA market. In March this year, SumUp raised 750 million euros, so probably this won’t be their last acquisition.

London-based GPS raised $300M for their payment💳 solution

So far, one of the biggest European investments into embedded finance startups. GPS is an API payment technology platform for credit/debit card programs serving fintechs, online banks, and other embedded finance companies. So far they issued 190 million physical and virtual cards.

Since it is B2B, GPS was under the radar, but the company is huge - they operate in more than 60 countries and supporting 150 currencies for payments. Even Revolut is their customer. Interesting fact: GPS is not serving the North American market. If you are planning to start your fintech startup, you can use GPS to issue cards to your customers.

Online bank for E-commerce business

Sweden-based Juni is the first online bank focused on e-commerce and marketing. The last 2 years were the best years in the history of e-commerce, and Juni wants to take part in it. Currently, the company is offering debit cards with cashback if you spend money on ads, but they want their main product to be short-term credits and financing for e-commerce businesses. This would allow anybody to purchase inventory, sell it, pay back the short-term loans, and keep the profits. That means you can start your e-commerce business with almost no cash down. Looking forward to checking how it works when they roll out the product.

Also, it is impressive to raise $52M while still having an early beta version of the product.

North America News and Funding

You can use BNPL for Domino’s pizza🍕

The craziest thing I saw in fintech so far just pop up a few days ago. An ad to use BNPL to buy pizza in Domino’s and pay off the pizza in 6 weeks 🤣🤣🤣. I knew that BNPL is the next big thing in Fintech, but I would never expect BNPL to go that far.

Social investing is getting into focus🔎

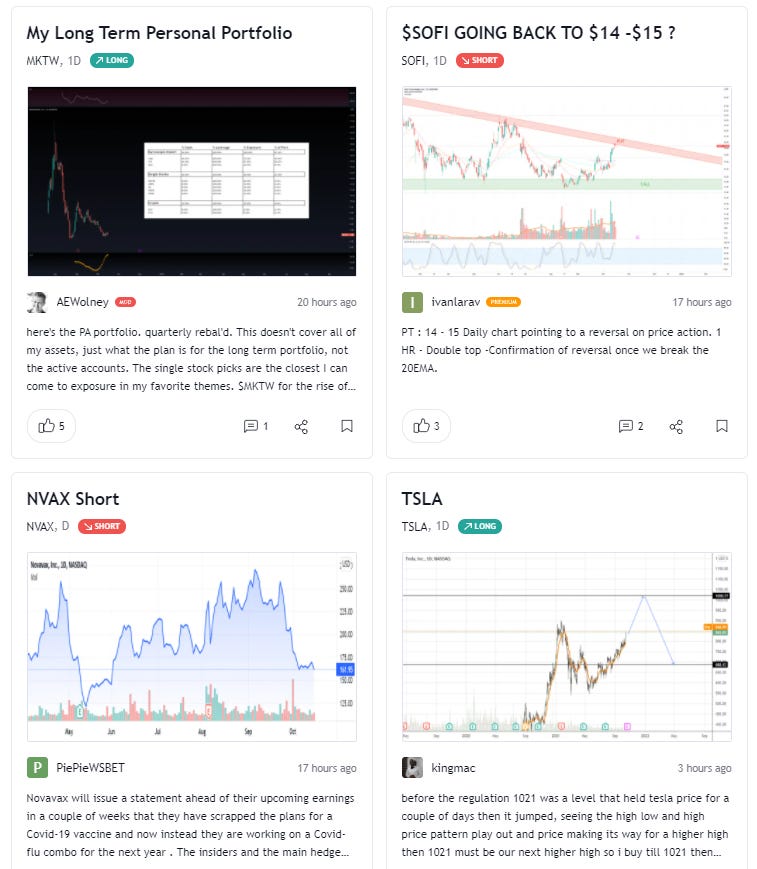

Truth is, people like to talk about investing, stocks and crypto (maybe even too much sometimes). Especially, if they were right and make nice returns on their investments. With the development of fintech in the last 5 years, a lot of new products came into focus. One of them is “social investing apps” - apart from investment platforms they offer interaction between users. Users can share their analysis, comment on the investment ideas, create charts, educate, etc. Social investing became extremely popular in the USA.

TradingView is a charting and social investing app that just raised $298 million. Users can easily create charts and share them with others to start a discussion. Also, it is a great way to discover new investment ideas and learn. The app is used by more than 30 million investors, so if you are investing make sure to check it.

Crypto ₿ites

Now you can lend your crypto and earn up to 17% yield💵

Celsius Network, a cryptocurrency lending and borrowing platform, just closed a massive $400M financing round led by WastCap. The company valuation is now more than $3B. Celsius claims that users can earn up to 17% yield on their crypto. This sounds unbelievable if compared to a savings account in the bank that gives you 0.1%. Currently, the platform has more than 1 million users.

Borrowers can use their cryptocurrency for collaterals and borrow funds with interest rates starting from 1% APR. This makes the finance industry more inclusive since there are no credit checks and origination fees. The future of crypto is bright.

Bitcoin above $60K after SEC announcement

The U.S. Securities and Exchange Commission will allow the first Bitcoin futures ETF. This ETF should be listed this week. After the announcement Bitcoin jumped above $60K - the highest value in the last 6 months.