🌊The Fintech Wave(#38)

TLDR: Discover legal compliance templates. Awesome week for the fintech scene in Germany. Frauds in the NFT world. Insurtech focused on pets. New problems for one-click checkout startup.

If you like this newsletter please share it with friends and encourage them to sign up👇

Europe News and Funding

$250M for trading platform📈

Berlin-based startup, Trade Republic, is now valued at €5B. One pension fund from Canada led the round.

Trade Republic’s mission is to empower millions of Europeans to put their money to work. They offer various investment products: stocks, ETFs, crypto, and derivatives. Also, there is a saving plan option with automated investing, where users basically subscribe to monthly purchases of stocks or crypto.

The platform has over 1M customers (Germany, Austria, France) with €6B assets under management.

Also, another 4 German fintechs raised funding

Alloy (decentralized finance) raised $3M Seed

GetQuin (social investing platform) raised $15M Series A

ecolytiq (payments) raised €13.5 Series A

Mondu (Buy Now Pay Later) raised $43M Series A

Insurtech for pets🐶

Paris-based insurtech for pets raised €15M Series A. The interesting thing is the market size: there are over 200 million cats and dogs in the EU.

Along with insurance, Dalma app has other services such as unlimited video calls with vets, direct payment to vets, and an e-commerce marketplace for day-to-day pet products. Insurance starts from 9 EUR for cats and up to 50 EUR for dogs.

Americas News and Funding

Coinbase base is rescinding accepted job offers😡

Due to economic uncertainty, Coinbase is pausing all hiring. But the worst thing is that they will rescind accepted offers.

So, people quit their jobs to accept Coinbase offers and now Coinbase rescinded offers. Since health insurance is mostly tied to employment, people are also without health insurance and other benefits. Thye will provide some severance package but still, it doesn’t look good on Coinbase.

You can read the whole update here.

A great read for regulatory nerds - a free repository of legal and compliance templates📝

Fintech startup Lithic (which allows users to quickly issue debit/credit cards) just launched a free library of legal documents. This is excellent news for the ecosystem.

You can find 15 different documents, from Anti-Money Laundering to Chargebacks and you can you use them for your fintech startup. These things usually cost tens of thousands of dollars in legal fees to create. You can find the library here.

One-click check out startup, Bolt⚡, is becoming an absurd story

Bolt raised over $1B in total and was valued at $11B which is ridiculous after you see the financials. The company is spending $20M per month to generate $2.4M. The biggest parody of all is that their ex-CEO is still writing threads about business tips.

Also, the startup was encouraging employees to take loans to buy company stocks that are basically worthless now. Here is a great thread if you want to deep dive.

Crypto ₿ites

Do not ask DeFi company where the difference comes from

A lot of people recently discovered that most of the DeFi (decentralized finance) high-yields were Ponzi schemes, and a lot of money was lost. Some crypto protocols promised up to 200% APR which of course is not sustainable, but people still pour money into it.

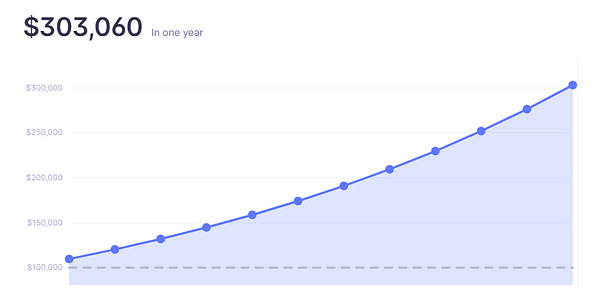

I found the above offer from one of the crypto companies. In traditional finance it would be the opposite: APR to take a loan should be much higher than APY for savings. So, if you decided to take 17% APY don’t ask where the difference comes from :)

OpeaSea🖼️ employee facing charges from FBI

This week is only about frauds in crypto. FBI accused ex-OpenSea Product Manager of insider trading. So, he used to buy NFTs before they were featured on OpenSea home page and then sell them when they pumped the price. A sentence can be up to 20 years in prison.

Tweets and Threads of the Week