🌊The Fintech Wave(#35)

We are welcoming 5 new members of the Fintech Wave community who have joined us since Monday.

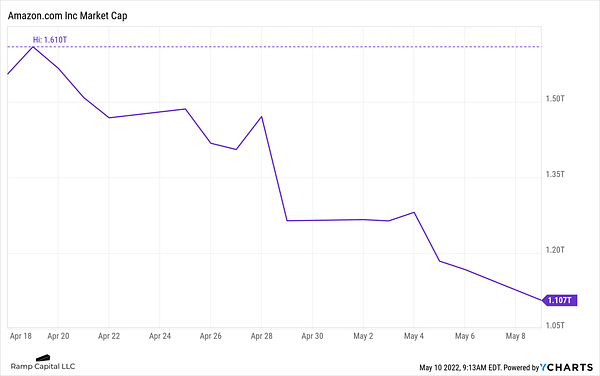

Markets are still in free fall without any sight of stopping. $200 billion dollars are erased from the crypto market cap. Coinbase lost 77% of its share price since its IPO. Fintech and insurtech stocks are probably the biggest losers in the current market.

The stock of the insurtech company Metromile fell to $1.

Investors’ favorite fintech stock, Upstart, lost more than 50% of its value in the last 5 days.

Although the market is bad, a lot of things happened last week in the fintech so let’s check it.

TLDR: $200B lost in crypto market cap. Famous VC funds are having enormous losses. UK has a new fintech unicorn. $350M for a new fintech and crypto venture fund. Crypto exchange became decacorn.

If you like this newsletter please share it with friends and encourage them to sign up👇

Europe News and Funding

$350M💸 Venture Capital fund for fintech and crypto

London-based Fasanara Capital has a new fund focused on fintech and crypto. They will invest from Seed round and above. Fasanara is one of the biggest investors in the Buy Now Pay Later startup ScalaPay. The average check size of its investments would range between $500,000 and $5 million, so if you are looking for funding check their website.

Paddle raised Series D from KKR and became a unicorn

Paddle built a complete payment stack: checkout, tax compliance, reporting, invoicing, subscription management, etc. The problem they are solving is significant for software companies: while they can sell software all over the world, companies need to make sure they are compliant with every local market. And that is the hard part.

Pricing is simple: 5% of transaction + 50cents. No monthly fees. Currently, more than 3000 software companies are using Paddle.

Americas News and Funding

Huge losses📉for venture capital firms

Venture capital companies are also counting losses. Softbank just announced a $26B loss in the last fiscal year. Looks like they didn’t learn much after WeWork debacle. Tiger Global, the most active investor in the last 2 years, lost $17B. You can find more information in the excellent article from Newcomer.

Invoice🧾financing marketplace raises $10M

Revenue-based financing is getting super popular and we are seeing a lot of new players on the market trying to take their share of the pie. One of them is Crowdz, which just raised $10M Series B.

The company offers small and medium businesses ways to sell its receivables to investors. This way they get cash upfront minus the investors’ fees. What differentiates them from competitors is that platform is built on top of the Ethereum blockchain, which helped them develop a risk scoring board used by banks and financial institutions. So far, Crowdz financed $55M in receivables.

Crypto ₿ites

Billions are lost in the collapse of cryptocurrency Luna

Luna token lost almost all of its worth. It went from $100 to a few cents. People lost billions. If you invested $10.000 into Luna last week, you would have had around $2 now. Luna was obviously a Ponzi scheme, but nobody want to admit it as long as they were giving 20% APR for yields.

If you want to know how exactly it happened this is the best explanation I found online. It’s about a 10-minute read.

Popular crypto exchange💱 scored a new funding

What started as an exchange, now is one stop shop for web3 - crypto wallets, DeFi, NFTs, DAOs…KuCoin became popular for listing tokens/coins with small to midsized market cap which couldn’t be listed on Binance or Coinbase. Some people made a pretty good profit on these tokens, but there could be a lot of scams around tokens. KuCoin has around 18 million users.

Tweets and Threads of the Week