🌊The Fintech Wave(#33)

We are welcoming 12 new members of the Fintech Wave community who have joined us since Monday.

TLDR; Interesting week, especially in the crypto world where Fidelity will offer retirement savings in Bitcoin. Also, BlackRock launched Blockchain ETF. New 1-click checkout startup from the UK. Environmental friendly neobank. Single app for all things DeFi and Web3

If you like this newsletter please share it with friends and encourage them to sign up👇

Europe News and Funding

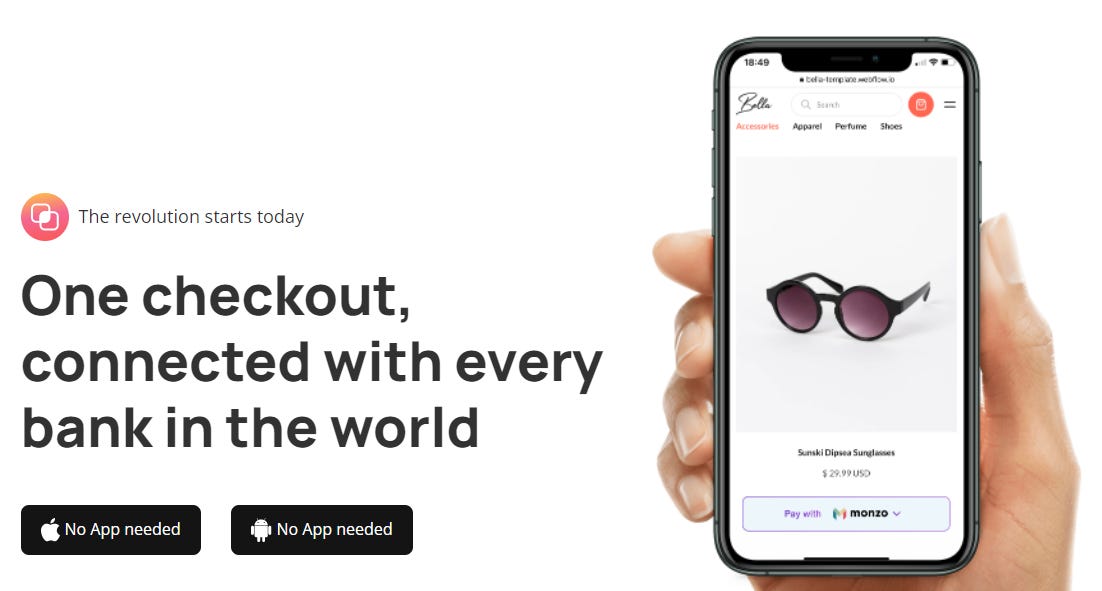

Universal checkout experience for the Internet

London-based Volume raised a $2.4M Pre-seed round for its fast checkout product. Pretty brave move after Fast just burned $100M for its one-click checkout and closed its door. The logic of 1 click checkout solutions is that customers are more likely to buy something if they don’t need to manually put all the info.

So, where is Volume’s differentiator from competitors? Volume is bringing transparency to pricing, as they state in their mission: to liberate the entire Internet from its hidden tax. When you buy something online, merchants pay around 5% fees (cards, wallets, BNPL, etc.) and these fees are usually transferred to consumers. So, Volume wants to show you all of these fees before checkout.

But as a customer, I’m not sure that I’m interested in seeing this. Personally, I don’t care about fees, I just want to see the final price I have to pay and make the decision about the purchase. Currently, the startup is operating only in the UK market.

Environmental friendly🌲neobank raised $9.2M

Paris-based fintech Helios wants to help limit global warming through its banking solution, where they invest funds only in environmental friendly investments, such as renewable energy, clean mobility, agriculture, etc.

To keep it transparent, Helios will publish the breakdown of expenses and investments each year in a detailed report allowing everyone to understand their economic model.

In terms of banking, they offer a standard bank account and debit cards with a banking app. But here is the catch: there is no free account. It will cost you €6 per month. This is even more expensive than traditional banks, so I can see this could be a factor that would limit the number of new users, especially in less developed countries. I hope in the future, they could find the model with a free basic account, because their mission can attract many users and their wooden Visa cards are really cool.

Helios is currently available for users in more than 30. You can find the list here.

Americas News and Funding

Maybe it's time to revisit private fintech valuations📉

There is a huge mismatch between Private and Public markets valuations in fintech:

Coinbase ($COIN): $68B private, now $28B

Robinhood ($HOOD): $12B private, now $8.8B

SoFi ($SOFI): ~$9B private, now $5B

Root ($ROOT): $4B private, now $420M

Robinhood just announced a 9% workforce cut, since growth is slowed. There are a few private fintech companies with huge valuations: Klarna ($46B) and Stripe (around $90B). Probably they will try to be private for as long as possible.

B2B payments infrastructure💳 startups raised $4M

Streamlined is a startup that is trying to bring intelligence to B2B invoicing.

The main selling point is time-saving - customers can pay with a check, ACH, or credit card and software automatically match payments with invoices saving, and hours on reconciliation tasks. If you ever worked in accounting, you probably spent hours trying to match payments with invoices, so the customer problem is real.

Their target niche is e-commerce, with up to $100M GMV (gross merchandise value).

Crypto ₿ites

Fidelity will allow Bitcoin for 401K accounts

The largest management company for the retirement accounts in the USA, Fidelity, just announced it will allow people to put part of their retirement savings into Bitcoin. This could really push the price up because every two weeks billions of USD will be used to acquire Bitcoin for these accounts.

BlackRock launched Blockchain ETF

The world's biggest asset manager ($10 Trillion AUM) launched Blockchain ETF. This ETF consists of companies such as Coinbase, Marathon Digital, Riot Blockchain (crypto mining company), Galaxy Digital, Hive Blockchain Technologies, etc.

Single app for all things DeFi and Web3

Argent just raised $40M Series B for its crypto super app. This is the ideal app for everybody who is heavily into crypto because you can manage everything from a single app.

Argent is an app for Ethereum-based digital currencies and blockchain applications. They started as an app to buy and sell crypto with lower fees, but now moving into DeFi and web3. If you are discovering web3 there are so many things going around that it is hard to track everything on multiple apps and wallets, so with Argent, you can consolidate all your NFTs and DAOs into one app.

Apps with this kind of UX are the key to getting more users into crypto and web3.

Tweets and Threads of the Week