🌊The Fintech Wave(#30)

Welcoming 20 new members of the Fintech Wave community who have joined us since Monday.

TLDR; Apple acquired a fintech startup. $80M for Swiss spend management software. Fintech app for kids. $100M of funding and only $600K in revenue. No-Code platform for NFTs.

If you like this newsletter please share it with friends and encourage them to sign up👇

Europe News and Funding

$80M for Swiss spend management💳software

After huge rounds for US-based spend management startups (Ramp and Jeeves) this week is time for the European company to raise the money. $80M Series B led by Sequoia.

Yokoy is a European version of Brex or Ramp. Businesses can easily issue credit cards to their employees and monitor all expenses with automated reporting. Yokoy is focused on medium to enterprise-size companies and currently has 500 customers.

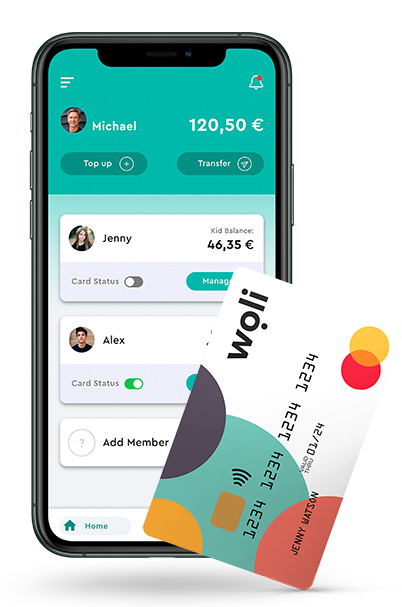

Fintech app for kids from Greece

Athens-based Woli, raised €700K for a fintech app targeting kids and teens. The concept is very similar to Greenlight or GoHenry. Parents open accounts on behalf of their kids and give them Mastercard debit cards for pocket money. The debit card design looks pretty cool IMO.

Financial education is an important part of the app. The team built what they call Academy with bit size learning for parents and kids about financials. The startup had 1,000 accounts in its first 3 months of operation. Not really impressive, but they are growing. Also, it is hard to launch and scale consumer fintech in the EU due to regulations. The next markets for Woli are Spain and Italy.

Americas News and Funding

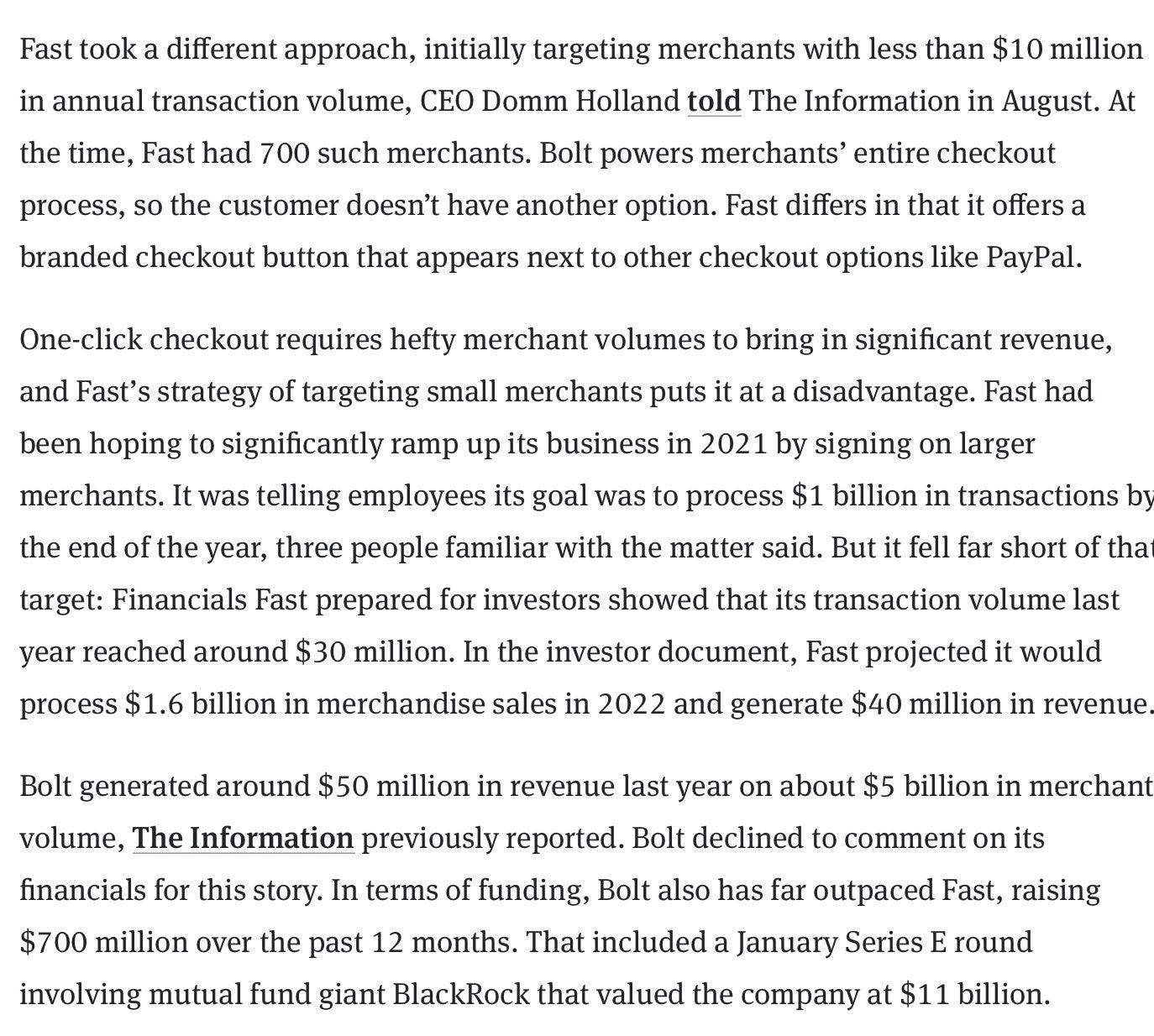

$100M of funding and only $600K in revenue📉

Super-hyped startup Fast (1-click checkout) raised $100M from Stripe and it was valued at $584M. Its CEO became a famous business guru on Twitter, but somebody leaked the internal investor’s documents which show a little different reality. It looks like Fast did only $600K in revenue while having 500 employees! That is $1200 of revenue per employee. Looks like we are looking at a new Theranos. Somebody said on Twitter, that they would make much more money if every employee drive an Uber😅

If you want to read more, below are some screenshots.

Apple🍏 acquired open banking startup

Credit Kudos, a UK-based, open banking startup was acquired by Apple for around $150M. Looks like Apple could build its own financial ecosystem or in-house payment processing.

Credit Kudos is a company that offers insights and scores based on loan applications sourced by the UK’s Open Banking Framework. Their products help lenders streamline underwriting and improve accuracy in decision-making. So, why did Apple acquire a credit bureau?

Apple already has Apple Pay and Apple Card (with Buy Now Pay Later coming soon), but they are using third-party providers for lending risk assessment, fraud analysis, credit checks, and dispute handling. For example, Apple Cash's partner is Geen Dot, for iPhone Upgrade Program it is Citizen Bank.

There were rumors before that Apple is developing its own payment processing technology, so the Credit Kudos acquisition would be in line what that. Also, it could be that Apple is planning to launch Apple Card for the UK market and they would be able to have better risk assessments.

Maybe Apple Bank with loans to Apple users in the future is not that crazy idea. Via iPhone they would have access to billion customers.

Crypto ₿ites

No-Code platform for NFTs🖼️

One thing that still keeps a lot of creators from NFT/crypto is that it still requires some technical skill to successfully launch a project. So, Berlin-based startup, FUEL, wants to change that by launching a No-Code NFT platform. The startups raised €1.5M.

Using its platform, artists or business can launch, manage and grow their NFT collection. It will be an all-in-one solution where creators can easily offer real-life value to your NFT holders, such as exclusive content, VIP tickets, or merchendise. Also, it will allow customers to buy NFTs with a credit card, which is currently not the case on most NFT marketplaces.

Tweets and Threads of the Week