🌊The Fintech Wave(#26)

Hi everybody, fintech is the last thing we should be thinking about now, but here is some fintech news if you want to divert your thoughts for a few minutes from what’s happening around us.

TLDR; Italy has its first unicorn🦄. A platform that lets retail investors invest in IPO. Pipe acquired Purely Capital. $1.7M of NFTs stolen from users on OpenSea. Don’t miss Vitalik’s outfits at the end.

If you like this newsletter please share it with friends and encourage them to sign up👇

Europe News and Funding

A platform that lets retail investors invest📈at the same time and price as institutional investors

The idea is really good - to give the retail investor an option to invest in IPO. Usually, IPOs are reserved for institutional investors which buy large blocks of stocks before the exchange is open. When the trading starts prices mostly go up so retail investors already missed a good price for the stock. So, Primary Bid wants to change that by organizing retail investors into syndicates to buy a block of shares.

Another good thing is that PrimaryBid is not charging any commission to individual investors for using the platform. They charge a fee to a company that raised money through PrimaryBid.

Currently, the platform is only investing in UK companies.

Italy has its first unicorn🦄

“Buy Now Pay Later” startup Scala Pay became the first Italian unicorn after raising $497M Series B. This is probably the biggest Series B ever in Europe. Of course, Tiger Global invested in this round.

Scala Pay product Pay Later offers customers an option to get products without any money down and pay after 14 days.

Recently, there was a discussion in the USA, on how BNPL could create a new financial crisis within consumers. Almost every online store offers BNPL options and almost every customer gets approval to use it. This can create a fake sense for customers that they can afford some products because they can pay in installments, which is sometimes not the case.

Americas News and Funding

Pipe acquired Purely Capital🤝

Revenue-based financing startup Pipe acquired UK-based Purley Capital. The terms of the deal are not disclosed. This is the first acquisition for the Pipe. Purley Capital is a media and entertainment company.

With this acquisition, Pipe opened a new vertical - upfront revenue for movie producers. Independent movie producers get the opportunity to trade their revenue streams in the same way a SaaS company could. I would never think that could be Pipe’s new vertical.

Wealth management platform for retirements account

Pontera raised $80M for its wealth management by making it possible for financial advisors that actively manage 401K accounts (retirement accounts in the USA). Their selling point is that retirement accounts can grow 76% larger when actively managed by financial advisors. The more people give 401K accounts to financial advisors to manage, the more customers Pontera will have.

Crypto ₿ites

Vitalik Buterin’s outfit at the Ethereum conference in Denver

Like it or not, this is the how peak performance looks like. Once you are a billionaire you can dress however you want.

Shiba Ino pajama

$1.7M of NFTs🖼️ stolen from users on OpenSea

The biggest NFT marketplace, OpenSea, was a target of the phishing attack. This is how it all happened: hackers sent a “fake” email, impersonating OpenSea.

Users clicked the fake email and then connected their wallets to the fake OpenSea site. That gave the hackers access to wallets. The hacker waited three weeks and then stole NFTs worth $1.7m+ from 32 users. Hackers stole some popular and expensive NFTs (like Mutant Apes) and quickly sold them below market price.

All of that happened when OpenSea CTO was talking on the stage at ETH Denver conference.

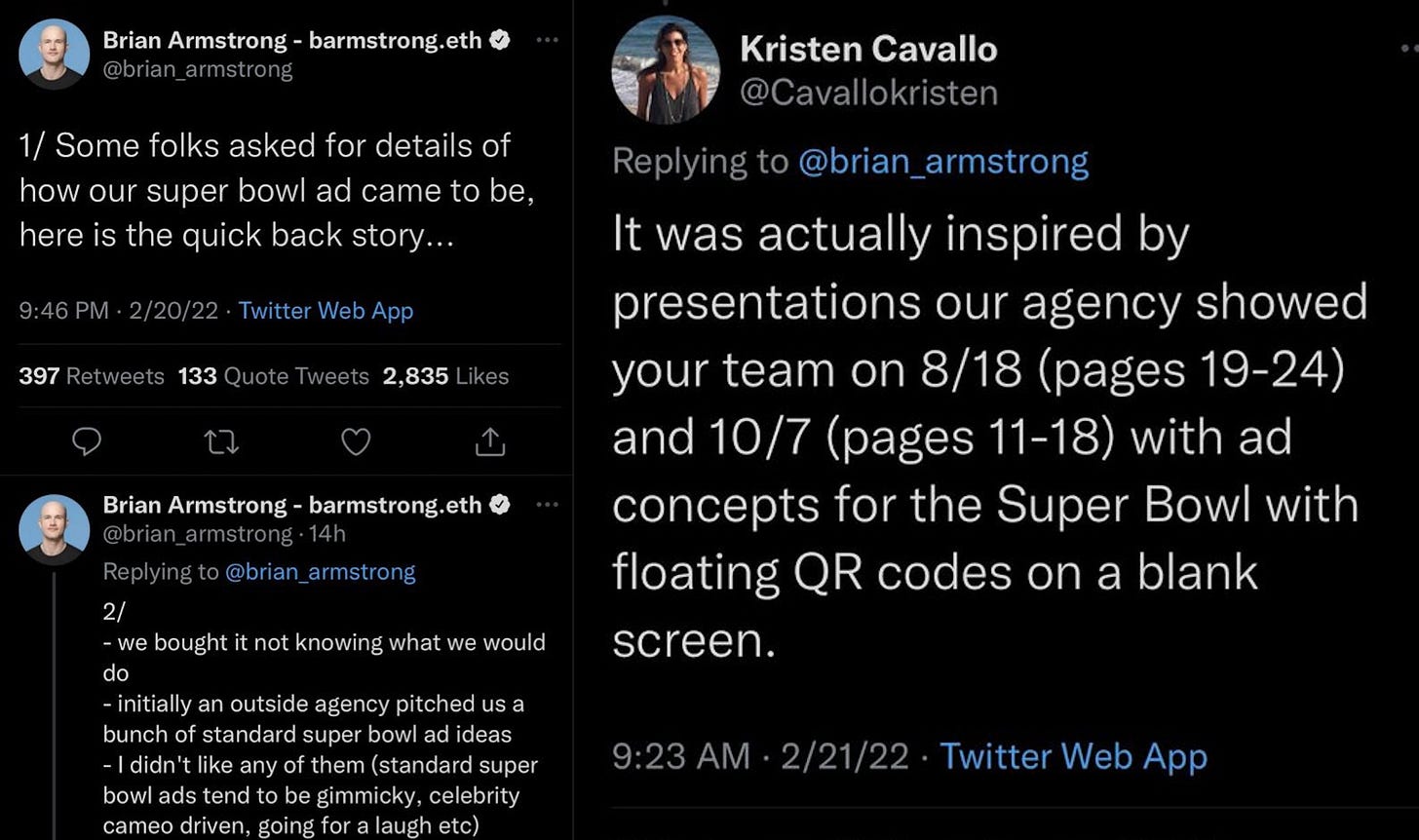

Coinbase co-founder caught in lie😂and it’s funny

For those who didn’t watch Super Bowl, Coinbase had one of the best commercials. So, Brian Armstrong made a Twitter thread about how they came up with the idea for the ad. The first thing he mentioned was that some agency pitch their idea and he didn’t like it.

But then, the agency CEO answered him that they presented the same idea and even mention the pages in the presentation. Obviously, Brian is not as creative as he wants to present himself.

Tweets and Threads of the Week