🌊The Fintech Wave(#20)

Hi, y’all, we are back with our regular Monday edition. Last week, Upstart stock analysis was one of the best performing newsletters so far, so we will have to do that more often. Thanks for reading it.

TLDR; Buy Now Pay Later for airline tickets. London fintech is valued at $40B. $15M Pre-seed round. a16z secured billions for crypto and fintech startups. Neobank for SMBs raised $700M. Venture Capital funds invested in Hedge Fund. The biggest NFT marketplace raised another $300M.

If you like this newsletter please share it with friends and encourage them to sign up👇

Europe News and Funding

Fly Now Pay Later✈️

It was just a matter of time before the Buy Now Pay Later option will come to the travel industry. London-based fintech Fly Now Pay Later just raised $75M for US expansion. It works pretty simple; using the Fly Now Pay Later app you can find your ideal holiday tickets and choose a repayment plan - it can be from 3 to 12 months.

But there is a catch if you choose a long repayment plan you need to pay an interest that can go up to 42.4$ APR, so be careful.

$15M💰Pre-seed round

Just a year ago, Pre-seed rounds were around $100K. Then it went up to $1M. And now one fintech startup raised $15M Pre-seed. Vitt offers revenue-based financing for startups based on annual recurring revenue streams. Vitt is joining other EU startups that offer the same: Ritmo, Requr, Viceversa, etc.

To differentiate from its competitors, Vitt will make a decision about financing within 24h. Applicant’s company needs to have at least $100K ARR to apply. If the application is successful, Vitt will offer up to 12 months of upfront cash with a small discount. For some companies, this will be a better way to finance growth than taking money from VC.

London-based fintech valued at $40B👏

Payment processor Checkout.com raised $1B Series D, which makes it one of the most valuable Europe’s startups. The company offers complete payment solutions for businesses from fraud detection to crypto payments. Some of the customers include Netflix, Revolut, and Sony.

Americas News and Funding

Andreessen Horowitz secured billions for Fintech and Crypto startups

The most famous VC in the world, a16z, announced that they raised $9B of fresh capital to invest in startups. $2.2B is secured for crypto startups and $400M for Seed Fund with checks ranging from $25K up to hundreds of millions of dollars.

If you need funding you can apply here.

Novo bank🏦 raises $90M to support SMBs

Miami-based bank Novo is now valued at $700M. Novo is an online banking platform focused on small and medium businesses.

The company wants to be an all-in-one banking solution for SMBs when lending capabilities and products such as invoicing, cash flow management, etc. There is 30 million small business in the USA, but they were always overlooked by big banks. Also, traditional banks charged them fees for everything. With Novo, a checking account is free. Novo already has more than 150,000 SMB customers with transactions worth $5B.

Crypto ₿ites

The largest NFT🖼️ platform, OpenSea, scored new funding

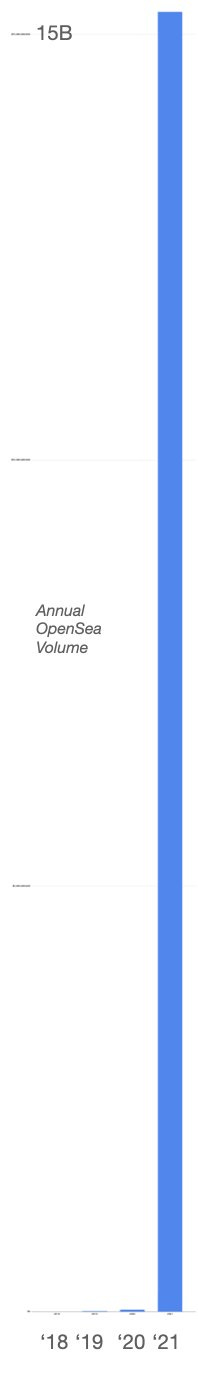

Leading NFT marketplace, OpenSea, raised $300M at $13.3B valuation. OpenSea hold more than 70% of global NFT trading volume.

With this new funding, both co-founders became billionaires. Timing is everything. Just a few months before the NFT boom, founders were thinking to close the business since they were doing less than $100K of trading volume per month. Their biggest competitor closed its doors just a month before the NFT boom, so OpenSea was just positioned to succeed.

The below graph is fascinating - OpenSea volume per year👇

Venture Capital funds invested money in Hedge Fund📈

Unusual situation: Sequoia Capital and Paradigm (crypto-focused VC founded by Coinbase co-founder Matt Huang) invested $1.15B in Citadel Securities. Citadel became known after GameStop stocks trading were blocked by Robinhood. Citadel was accused of making pressure on Robinhood to halt the trade of GameStop stocks.

Citadel provides trading services to asset managers, banks, brokers, and hedge funds. It looks like they are getting into crypto.