🌊The Fintech Wave(#19)

Upstart ($UPST) stock analysis📈

Hope you all had a great time during Christmas and the Holidays. Let’s kick off the new year with a stock analysis. Our idea is to find public fintech companies and do an analysis, to see if it would be a good opportunity to invest in. We will put emphasis on business model analysis to see if the company has long-term potential. For the first analysis, we picked Upstart.

Let us know how you like it and what can we improve.

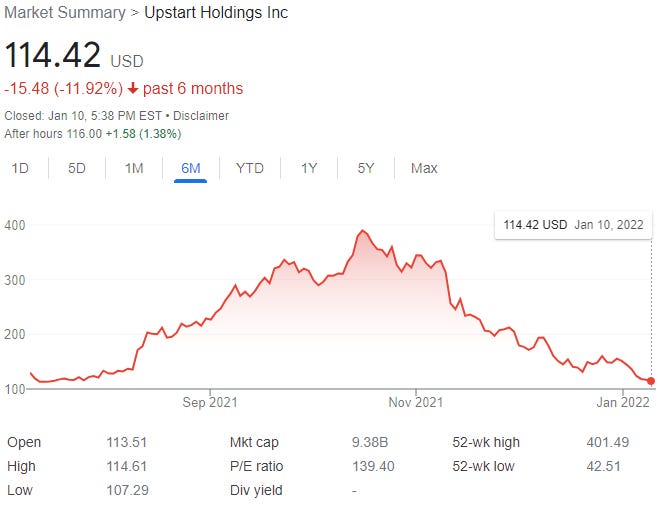

Upstart is one of the most exciting fintech companies out there and it is public ($UPST) so you can actually invest in it. In stock was up 271.3% in 2021. The company had insane growth in business, but after the last Q-call, the stock went down from an all-time-high $390 to $175 (now it’s about $120), so I decided to do an analysis to see if it is a good time to buy the dip. So, let’s deep dive into it👇

Ticker: $UPST

Website: UpStart.com

IPO Date: December 15, 2020

Price at IPO: 9 million shares at $20

52 Week High: $401,49

52 Week Low: $42.51

Market Cap: $9.38B

HQ: San Mateo, CA

Employees: 430

Introduction

Upstart is an AI lending platform that partners with banks and credit unions to provide consumer loans using non-traditional variables to predict creditworthiness (we will explain this a bit later). The company is funded in 2012 by former Google execs and Thiel fellows - pretty good references. At first, the startup launched as Income Share Agreement (ISA) product, which enables individuals to raise money by contracting to share a percentage of their future income. In 2014 they pivoted towards the personal loan marketplace.

Photo credit (upstart.com)

Before going public the company raised a total of $125M in a few rounds of fundings. Upstart went public in Dec20, at an initial market cap of $1.45B.

Business model and market

As we already mentioned, the company uses artificial intelligence to make lending decisions. To understand the need for this product, you need to understand the lending industry in the USA.

In the USA, credit trustworthiness is determined by Credit Score. A Credit Score is a number that rates your credit risk. It can help creditors determine whether to give you credit, decide the terms they offer, or the interest rate you pay. The Credit Score ranges from 300 to 850. Having a high score can benefit you in many ways. It can make it easier for you to get a loan, rent an apartment, or lower your insurance rate.

All loans, credit cards, etc. are reported to the three credit bureaus: TransUnion (FICO), Equifax, and Experian. This is where the problem is - these agencies introduced their model more than 30 years ago and they still use the same few variables to calculate your creditworthiness. For example, if you have 3 credit cards line open you will have a better score than if you have 2 cards. If you repay your car loan on time, your credit score will go down. The system is actually punishing customers if they don’t use loans or credit cards.

The even bigger problem is that low credit scores have a huge impact on people’s lives; some people cannot find housing because of low scores. Also, 22% of Americans don’t have credit scores so they cannot get any loan, credit card, etc. Around 1M people immigrate to the USA each year - it takes them years to build a credit score.

Now, when we have a better understanding of the problem, let’s see the Upstart business model. Upstart operates a lending marketplace that connects interested borrowers with bank partners. What makes Upstart special is that they apply AI to lending decisions which enable greater access to loans at lower rates with less risk. Traditional credit systems rely heavily on FICO scores, Upstart looks at more than 1,600 variables within its model, including educational and employment history, cost of living, and bank-account transactions, with an ability for the model to adjust based on macroeconomic conditions.

Using Upstarts’ alternative data to assess risk, banks are now able to give loans to a wider population that doesn’t have FICO scores. Also, interest rates can be lower since they have more data to assess risks.

How Upstart makes money?

The company’s main revenue source is fees collected by banks who’ve been referred to offer loans through Upstart’s platform. So, Upstart is not a bank, it just provides risk assessment for the banks.

Upstart receives referral fees for each loan, and platform fees are based on the number of loans referred. Upstart also receives a loan servicing fee as customers repay loans.

Financials

Q3 results were published on Nov 9, 2021

Revenue: $228M of total revenue for Q3. A 250% increase from Q3 2020.

Net Income: GAAP Net Income was 29.1M

Transaction volume and Conversion rate: using the Upstart platform Partner Banks originated 362,780 loans worth $3.1B. That is a 244% increase from the previous year.

As we can see, Upstart had triple digits growth, but the stock went down. Why is that? Because analysts expected even better growth. They expected unrealistic 300% growth, so after the earnings call, the stock went down and didn’t recover from that. We are still waiting for the Q4 results where Upstart is expecting to have $260M of revenue with around $20M Net Income.

Conclusion

The company has a good product and we believe more and more banks will sign up to use Upstart’s platform. Banks have record amounts of money they need to turn into loans, and Upstart is in a great position to expand its client base. As we saw, the consumers also need Upstart since millions of people cannot get loans using traditional channels. Looking at the analyst’s target price for this stock I saw $160 as the lowest target price. At the current price of $120, Upstart stock is definitely on the discount.

*This newsletter is not investment advice and we are not responsible for any financial loss.