🌊The Fintech Wave(#16)

Hi all, this is the 16th edition of The Fintech Wave and spend the next 3 minutes informing yourself about the latest trends in the industry. TLDR; The app that shares profit between renters and landlords. Use BNLP to pay for the bottle service in nightclubs. Thailand wants to attract crypto millionaires. New fintech unicorn. All details are below👇

If you like this newsletter please share with friends and encourage them to SIGN UP HERE.

Europe News and Funding

New platform for freelance workers raised €4M

There are over 22M freelance workers in the EU and French startup Jump wants to become a one-stop-shop for all of them. They host services such as invoicing, payroll, benefits, compliance, and accounting tools - pretty much everything you need to run your own business.

The company is making money through 2 revenue streams. Frist, monthly subscription - €79/month for using the platform. Some similar platforms are taking % of the monthly revenue, so I think for freelancers is better to pay a fixed fee. Second is affiliate marketing in case users buy 3rd party products from preferred vendors (such as access to insurance, health, training, etc.)

UK bank invested in💸cash management startup

More and more banks are realizing that fintech will change how they do business in the future, so it’s better to join the revolution. UK-based Co-operative Bank invested £500,000 in fintech BankiFi.

BankiFi provides a technology platform that enables banks to provide a set of integrated services, including invoicing, payments, cash management, and accounting, which are designed to help businesses reduce time spent on financial administration.

Americas News and Funding

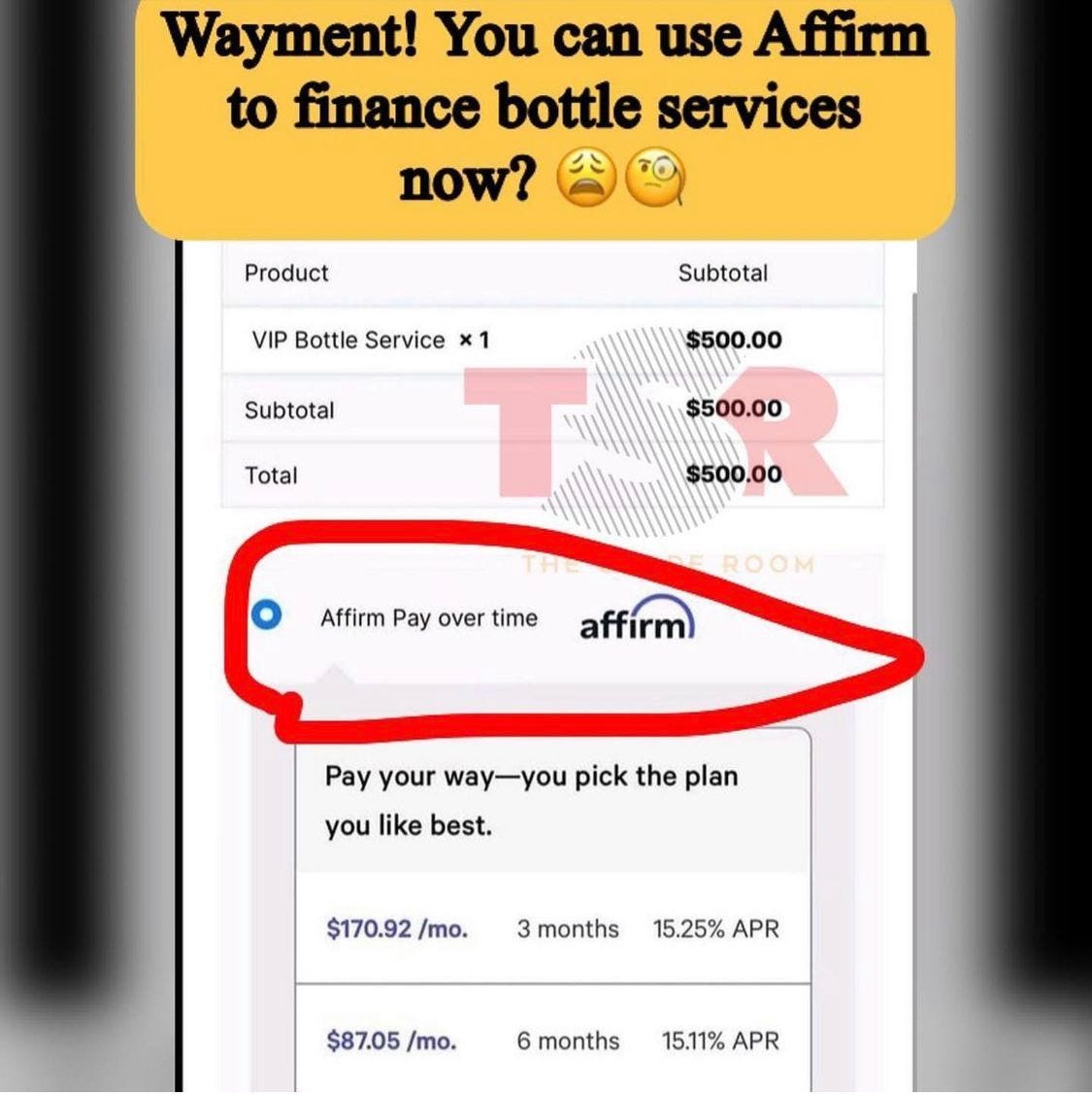

Use BNPL to pay for the bottle🥂service in the nightclubs

We all saw that BNPL is coming to every industry. A month ago, it was possible to buy pizza using BNPL. This week, BNPL came to the nightclubs via Affirm.

You can order bottle services and pay in up to 6 installments. I can just imagine how many drunk people will use this option and then later figure out what they did😂

Up&Up raised $312M👏

Up&up is probably the most innovative fintech startup focused on real estate. The company is building a totally new approach to renting a home where renters are able to share the profit with the landlord!

Sounds weird but this is how it works: The model is using a digital wallet where renters contribute an initial contribution equal to two months’ rent + monthly contribution, currently suggested at a minimum of $100 per month. Each month Up&Up determines the valuation of the home and shares any profits, less required maintenance costs, by adding them to the renter’s wallet.

The startup already purchased 300 homes. The whole concept is based on big data and the company’s ability to come up with accurate valuations for a home price. It is still too early to say if the concept is working, but if it is, this will become a new modality of housing.

New Fintech🦄unicorn

Every week, new fintech unicorn. This week, it’s Fundbox - a financial platform for small businesses, which raised $100M Series D at a $1.1B valuation. Fundbox is providing quick lines of credit up to $150K for working capital. Businesses have up to 24 weeks to repay the loans.

The company developed AI (they claim they spent $100M on development) that is helping with loan approvals and businesses will get answers within 1 day. Interest is relatively small for the USA, 8.99% for 24 weeks loan.

Crypto ₿ites

Thailand🐘wants to attract crypto millionaires

Thailand tourism which is responsible for 17% of their GDP, lost more than $80B since Covid-19 started. The government comes up with a plan how to recover this sector - by bringing crypto millionaires and making Thailand a crypto-friendly country.

The Tourism Authority of Thailand is collaborating with local cryptocurrency exchanges and companies to develop infrastructure for accepting crypto payments. They want to attract digital nomads to spend some time working in Thailand while spending crypto. Also, there will be no tax on crypto. This could actually work for Thailand.

A mobile app that aggregates data from crypto exchanges📈

If you do daily trades with crypto this app could be for you. TabTrader just raised $5.8M for its mobile app that aggregates data from different crypto exchanges so you can easily compare prices and get the best deal. The app is free and it already has more than 400 thousand users.

The business model is really smart: users can easily connect their wallets to the app, and TabTrader is getting a fee from the exchange that the user used to buy tokens. Also, there is a premium version of the app for $12/month.

Tweets of the Week