🌊The Fintech Wave(#14)

Hi everybody, to get you some motivation on Monday read about how somebody sold 1000 invisible NFTs within 5 seconds. Everything is possible :) TLDR; N26 is closing US operations. London-based credit card startup valued over $6B. Crypto exchange raises $400M + story behind the founders. 1000 invisible NFTs sold out within 5 seconds.

If you like this newsletter please share with friends and encourage them to SIGN UP HERE. All details are below👇

Europe News and Funding

$2B valuation for a new London fintech🦄

Zilch just raised $280M for its fintech solution. Zilch is combining “Buy Now Pay Later” with a credit card. Although there are other BNPL players on the market, Zilch has a different approach - rather than serving as a checkout option on merchant's websites they adopted a direct-to-consumer model where consumers are using their credit card online and instore. Users pay 25% of the product at the time of purchase and then rest in the 3 installments.

I must admit, this is the most advanced BNLP model I saw so far, which is reflected on their user number - over 1M users currently, with 200 thousand new users per month. With this funding Zilch became the fastest growing unicorn in the EU - it took them only 14 months.

Americas News and Funding

N26💳 is closing its US operations

One of the most valuable online banks in the world, N26, is closing its US operations. That news came out just a few weeks after they raised $900M and announce they will concentrate more on European markets.

Closing US operations was kinda expected. They launched a year ago, but the bank never gained much traction. There are already tens of online banks in the USA. Almost all of them offer accounts and debit cards for free, so there is not much differentiation for N26. There was no point for them to even enter the USA market.

All US N26 accounts will be closed on January 11, 2022. So, if you have a US bank account with them, now is the time to withdraw the money.

Crypto ₿ites

Crypto exchange raises $400M

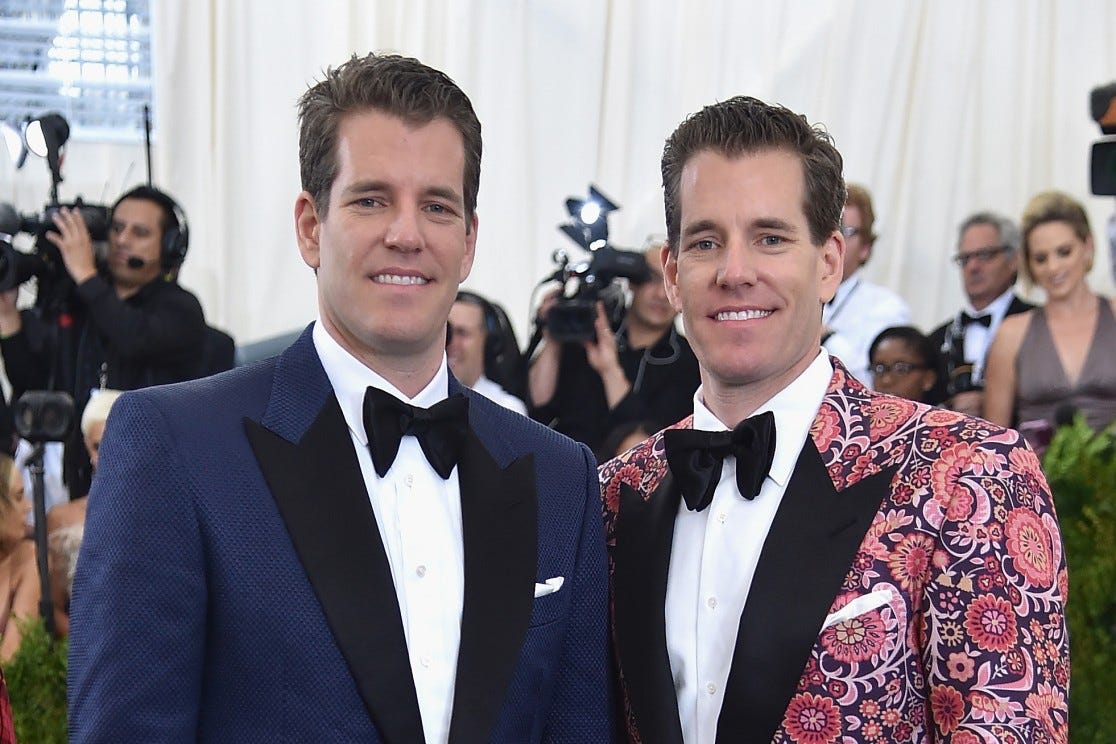

Gemini, a crypto exchange founded by the Winklevoss twins, is now valued at $7.1B. Interestingly, this is the first outside funding for this company. Before this round, it was entirely funded by its owners. Owners are still able to keep more than 75% of the company. The platform offers trading over 50 cryptocurrencies and earn up to 8% APY if you lend your tokens. Also, the best feature is that they offer their credit card where you can earn up to 3% in crypto rewards.

Gemini is founded by the Winklevoss brother, once of the first Bitcoin billionaires. They became famous after suing Mark Zuckerberg claiming he stole their idea to build Facebook. They studied together at Harvard, where twins launched ConnectU - a social network for connecting Harvard students (if that sounds familiar, you are right this is how Zuck also describes Facebook beginnings). They sued Zuck and Facebook claiming he stole their code and built Facebook. Zuck agreed to pay them $20M in cash and $45M in Facebook stock. Twins put that money early into Bitcoin, and now they are worth $10.5B.

(photo credit: The New York Post)

Invisible NFT🖼️ collection sold out in 5 seconds, reaching $250K market cap

We all know that the current NFT market is crazy, but one project just brought it to another level. Last week there was an NFT project called “Nothing” - the collection of 1000 invisible jpegs. The collection was sold out within 5 seconds. The initial offer charged $2.5 per NFT. In the secondary market, the collection reached up to $1200 per NFT. The marketing slogan was “pay nothing, get Nothing” - it’s brilliant.

The best thing for the collection founder is that he is getting 3% of royalty in perpetuity on all sales, which is deposited in his wallet via smart contract.

Below is not the blank space. It is an actual picture from the “Nothing” collection. Enjoy art.

Tweets of the Week