🌊The Fintech Wave(#13)

Hi all, thanks for reading the 13th edition (hopefully it won’t be an unhappy number for us). Super interesting few days in fintech and crypto. Take a few minutes to keep yourself up to date. TLDR; Buy the piece of the US Constitution. $6B valuation for a credit card company. BNPL for the Mexican market. Payment solution for micro-businesses.

If you like this newsletter please share with friends and encourage them to SIGN UP HERE. All details are below👇

Europe News and Funding

Payment solution for retailers with no hardware🧰 needed

Micro and small businesses are still adapting to accept credit card payments. One of the reasons why many of them are only accept cash payments is because of hardware requirements. London-based fintech Nomod is trying to solve this problem by building payment infrastructure that doesn’t require hardware (except smartphones).

The company’s target markets are the Middle East and Southeast Asia. Sellers just have to download an app to the phone and they can start receiving contactless payments from Visa, Mastercard, Amex, etc. The startup is charging 2.9% of the transaction + 30 cents fixed fee, which is in line with other payment providers, such as Stripe.

Paysend reach 5 million customers👏

Paysend allowed users to send money instantly to anybody in the world and they just announced that they passed 5 million customers. Fintech is supporting sending and receiving money in over 110 countries. Really great milestone for a 5-year-old startup.

Americas News and Funding

$6B valuation for💳credit card company

Investors are pouring money into fintechs like there is no tomorrow. Upgrade just raised $280M. The fintech is offering affordable loans and credit cards. They introduced an interesting feature - up to 1.5% cashback in Bitcoin rewards for using a credit card. Also, customers can loan up to $50K. It took them less than 5 years from 0 to $6B valuation and more than 1 million customers.

BNPL coming to Mexico

After the USA and Europe, Buy Now Pay Later, is coming to Latin America. Just a few months after they raised $5M, Aplazo now raised another $27M for the BNPL solution for Mexico. What differentiates them from the USA and EU competition is that it is supporting BNPL for offline payments because, in Mexico, online purchases account for less than 5% of total transactions. Seller pays the fee to offer BNPL to customers, but Apazio is taking the risk of installment payments. Customers are paying in 5 installments.

BNPL really became a phenomenon in fintech. Probably in a year or two BNPL will be covered in every country in the world.

Crypto ₿ites

DAO (decentralized autonomous organization) is buying US Consitution

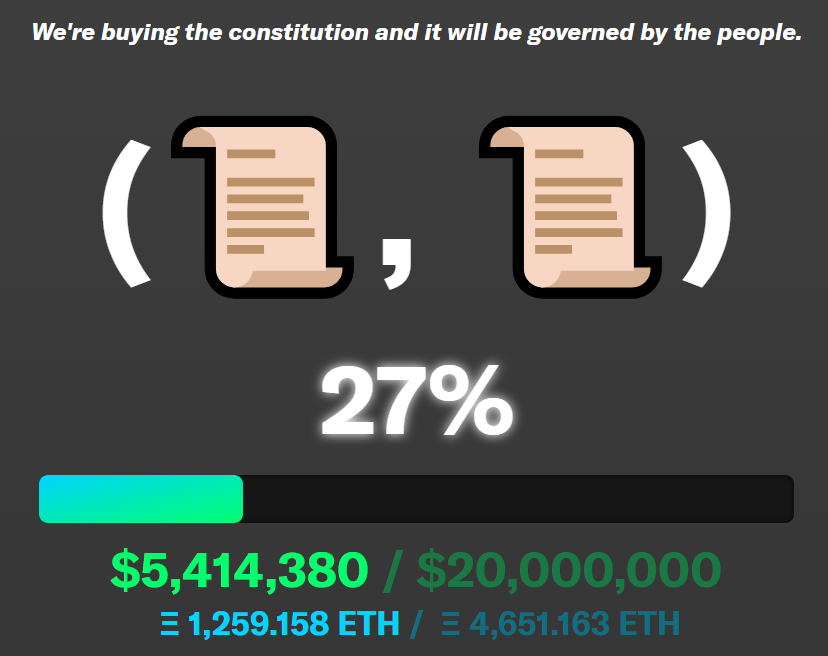

We are witnessing a great experiment based on web3 and blockchain technology. One DAO is trying to buy US Consitution and give the ownership to the people. US Constitution is signed in 1787 and from 500 originals only 11 have remained. From this 11 only 1 is owned by an individual and it will be put on auction on Thursday by Sotheby’s. It is expected to hit the $20M price.

2 guys (Austin Cain & Graham Novak) had a different idea - gather the people and buy a constitution using blockchain technology. The idea could actually work - more than 3000 people already contributed and collected more than $5M in a few days.

This idea is only a few days old and they build - website, legal formation, fractional ownership contract, and relationship with Southeby’s. It was only possible because of the community who engaged in the project.

UPDATE: it is collected over $40M, so it is almost 100% certain that the USA Constitution is going to be owned by the people.

If you want to buy the piece of history, you can do it here.

Tweets of the Week