🌊The Fintech Wave #67

TLDR: check earning releases from Meta, LVMH, and Amazon. We got data for insurtech funding in Europe. Apple is turning iOS into a super app. Ethereum is up 60% this year. Coinbase is suing U.S. Securities and Exchange Commission. Check the most interesting tweets we came across at the end of the newsletter👇

LVMH became the first European company to surpass a $500M market cap

A few days ago, Moet Hennessy Louis Vuitton became the first Europan company to surpass $500B in market value 🚀 🚀 Not a tech company, not a financial company, but a luxury goods company.

Its share price is up 32.8% in the year to date. It reported revenue of 79.2B euros ($87.1B) for 2022, with profit from recurring operations of 21.1B euros — its second consecutive year of record results.

LVMH is currently the 11th most valuable company in the world. It is incredible how strong luxury goods are running. These are all the brands under LVMH. They are almost like a monopoly on luxury

Facebook is sooooo back!

The stock was 12% up in after-hours trading after Q1 results were published 👇

Revenue: $28.6B (3% growth YoY)

Net Income: $5.7B (-24% YoY)

Daily active users: 2.04B (4% growth YoY)

Q1 was OK-ish, but the outlook for the future quarters makes investors bullish. Meta expects Q2 revenue to grow by 13% and a huge reduction of Opex (due to layoffs).

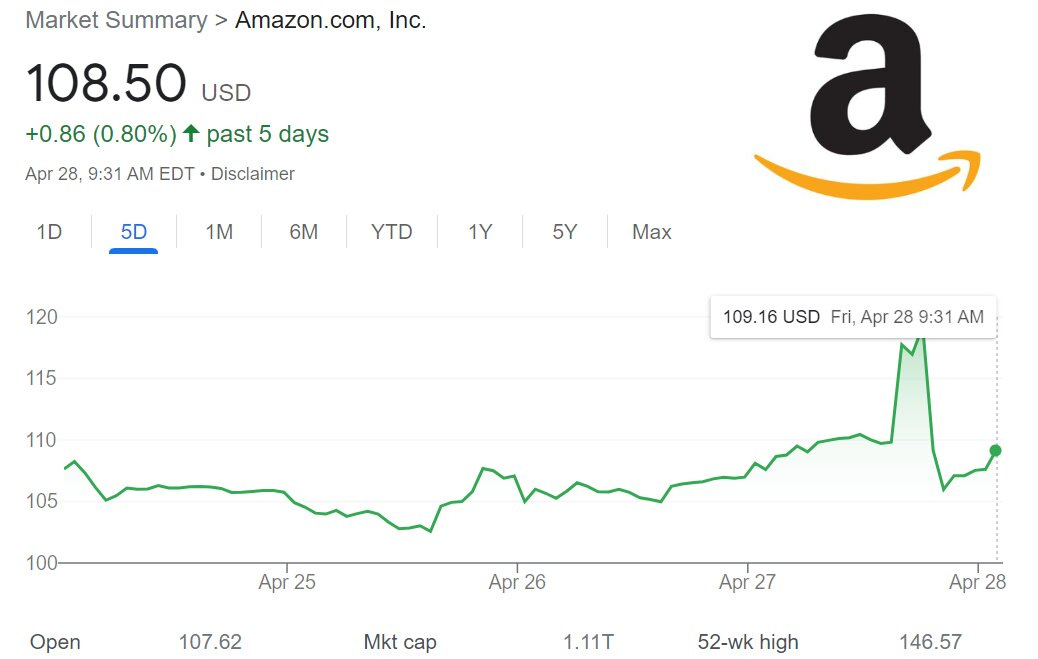

The first-ever decline in AWS revenue

First time ever Amazon Web Services had revenue decline quarter-over-quarter in its 17 years. Amazon just published Q1. Pretty good, but with some signs of a slowdown.

Revenue: $127.4B (9% growth YoY)

Net income: $3.2B

AWS grew to $21.4B (16% YoY), but it declined QoQ which will worry the investors. After 17 years of AWS growth, there has to be some slowdown.

The number of employees has declined 10% (YoY) after layoffs. The online store segment has 0% growth.

Airbnb rental management company turned into a penny stock📉

Vacasa is an Airbnb rentals management firm. STR management (short-term rentals management) companies are pretty popular in the USA, because they take care of renting and maintaining the property, so the owner can have a passive income. Seems like a pretty straightforward business model, but for some reason, it doesn't work, although they take 50% of the rental revenue. The other 50% is going to the property owner.

Probably they scaled into too many unprofitable markets and also from the Twitter comments, homeowners are not very happy with the services. The company went public in 2021 via SPAC 👇

$1.1B in revenue

Net loss of $178M

$70M went into R&D?? (what is there to R&D in a rental management firm)

European News and Funding

Insurtech funding in Europe💰

Recently I noticed that I haven’t seen many insurtech startups receive funding in the last few months, so went to check the Pitchbook to see the situation. As expected, a huge drop compared to 2021 which was the absolute peak at $3.2B invested in European insurtech startups.

Americas News and Funding

Apple🍏is turning iOS into the super app

Apple is offering 4.15% APY while the biggest banks in the USA (Bank of America, Wells Fargo, etc.) still offer 0.01%. The most interesting thing is the distribution channel that Apple has. 138M Americans are using iPhones, and Apple just has to send a push notification to users that 4.15% of APY account is available within a few clicks. Super cheap to acquire customers, while banks are spending up to $600 for that.

There are a lot of investment funds that have lower returns than what Apple offers for a simple savings account. Apple now offers Apple Card, Apple Pay, Daily Cash, Buy Now Pay Later, etc.

Love this tweet👇

$6M for an app that helps repay student loans🎓

As we all know, student loans are a huge problem in the USA. Some analysts even project they could be a source of the next financial crisis. 47 million people with $1.8 trillion in student debt. Summer is looking to help solve the problem (or at least make it a bit less painful).

The app allows users to sync current loan(s) and check if they are able for any federal help. Also, it gives them the option to refinance loans and get better interest rates. The good thing is that employers can use this platform as a benefit for employees to help them with paying off debts, which is a nice benefit to attract the workforce.

Crypto Bites

ETH is up 60% this year🚀

After last year's crypto debacle, I didn’t expect this. It is still far from all-time highs at $4.8K, but we are getting there.

Coinbase sues the U.S. Securities and Exchange Commission

SEC gave a “Wells notice” to Coinbase over some crypto products they offer. A Wells notice is a letter that the U.S. Securities and Exchange Commission (SEC) sends to people or firms at the conclusion of an SEC investigation that states the SEC is planning to bring an enforcement action against them. It is not a formal charge or lawsuit, but it can lead to one.

The problem that Coinbase is having is that SEC just won’t give clear instructions about how crypto is regulated and it’s hard to operate with this kind of uncertainty. Coinbase even said they are considering moving its headquarters outside the U.S.

You can read a long blog post here.