🌊The Fintech Wave #66

TLDR: Apple BNPL is now live. Check out healthcare dividend stocks. Ark Kapital raised a debt round. An app that helps you build a credit score by paying rent and streaming services. Bitcoin is above $28K and more news below.

From next Monday, we will move more into the general business newsletter and change the name to Business Wave - apart from covering investing and finance, we want to bring more tech news and trends.

Healthcare dividend stocks

If you are looking to buy more dividend stocks for your portfolio, healthcare stocks could be a good option. Pretty stable stocks even in recession with a nice dividend yield. Here are some of them👇

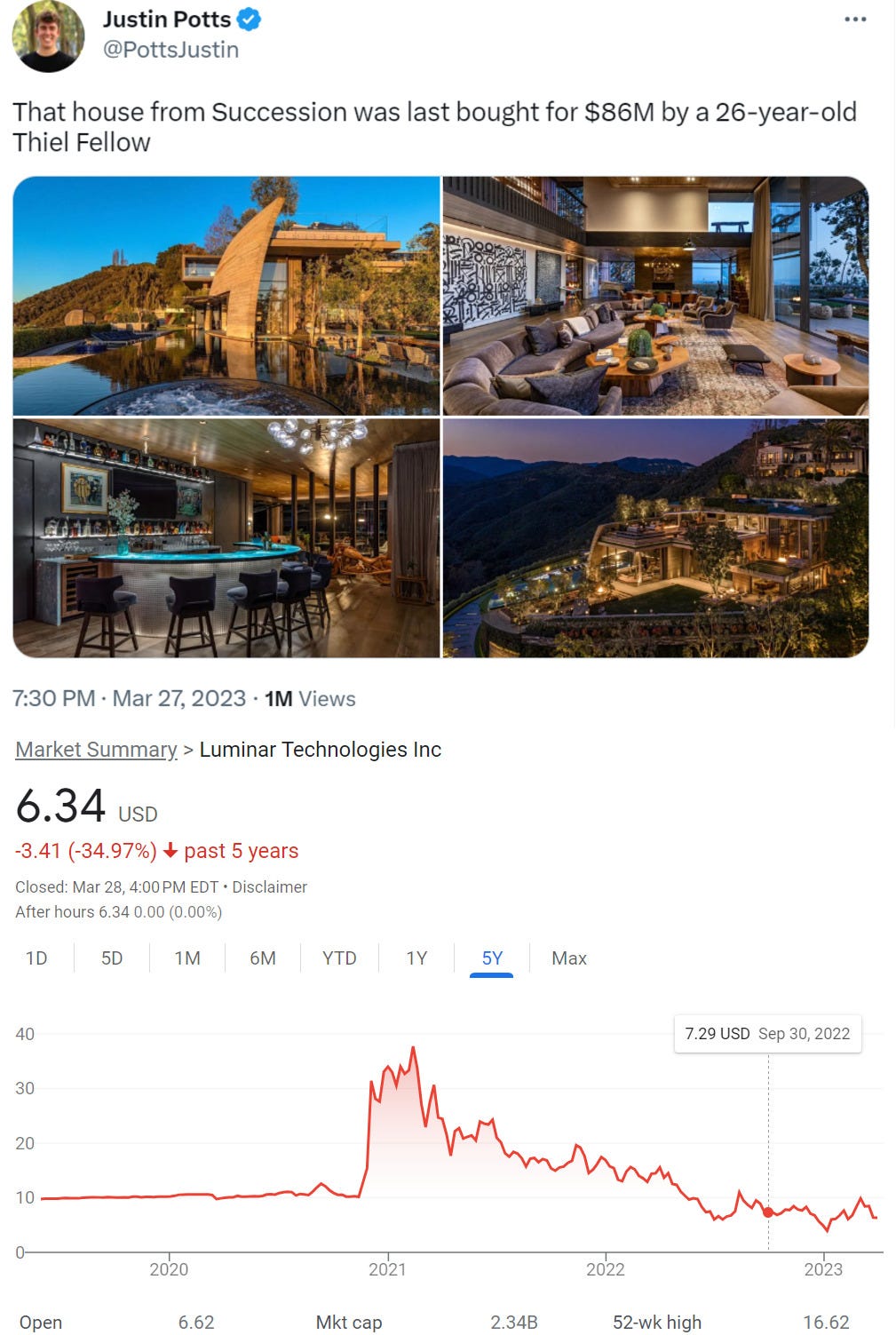

Only in America😂

The owner paid $86M for a house that was featured in the TV show Succession. His business, Luminar Technologies, is only doing $40M in revenue with a $440M loss. The company went public via SPAC, and the stock lost more than 70% since then.

Hope you didn’t buy Block ($SQ) stock recently

When the short-seller Hindenburg Research publishes new research, researched stock is certainly going down. The same happened to Block a few days ago. The stock lost 20% right away. Hindenburg spends 2 years on the investigation.

Hindenburg is most famous for uncovering the Nikola Motor Company as fraud; after research, the stock became pretty much worthless.

Block was founded by Jack Dorsey, the founder of Twitter and the company wants to develop financial technology from POS devices to debit cards. The research accuses Block of misleading investors, facilitating fraud, avoiding regulation & dress up predatory products as revolutionary tech.

Some of the highlights from the report:

- Block overstated the number of real users (up to 40% which is huge)

- Criminals were using the app for payments - rappers are mentioning Cashapp in their songs; Hindenburg did a compilation of a songs

- KYC process is broken - Hindenburg create an account with Donald Trump and Elon Musk's names and was able to send money. They even received a debit card in the name of Donald Trump

The list goes on. Block issued a statement that they will take legal action against Hindenburg Research for a misleading report that benefits short sellers.

European News and Funding

Ark Capital secured €100 million in debt

Revenu-based financing startup Ark Capital got a new line of credit, so they can continue servicing its customers. Ark provides up to €10M to high-growth companies with 7 years repayment term.

Revenue-based financing startups had their peak in 2020/2021 when interest rates were close to zero. It was a good business - raise money from investors and then loan that money with interest to other companies (mostly SaaS and webshops). But the problem is now that interest rates are higher and a lot of SaaS companies cannot repay the loans because they are far from profitability. So, companies like Ark needs to take debt round to keep running the business. It will be interesting to see the situation in the next year or two.

Americas News and Funding

Apple launched Buy Now Pay Later💳

After a long wait, it is finally live - Apple BNPL solution that offers customers to split purchases into four payments, over 6 weeks with zero interest and no fees. Currently only available in the US.

Loans can be anywhere from $50 to $1000. Everything is done via Apple Wallet. Mastercard is a facilitator of the loans in the background. All other players in the BNPL space should be worried because this means, many of them will shut down soon. The thing is, nobody can compete with Apple's distribution channel. While competitors need to spend tens of dollars to attract a single customer, Apple can just send push notifications from time to time to let iPhone users know that BNPL is now available. I don’t see how anybody can compete with that.

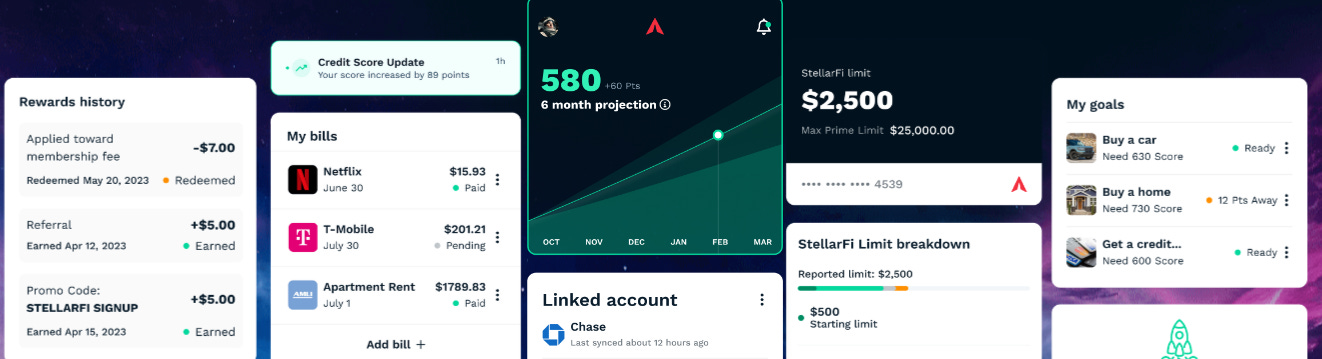

Build a credit score by paying rent on time

Building a credit score in the USA is a real pain (trust me, I went through the process when I moved to the USA). Usually paying for rent or streaming services is not counted toward your credit score, but startup StellarFi just raised $15M to change that.

The idea behind the startups is to build a credit score with every bill you pay. So this is how it works ➡️ First, the customer runs a credit card report to see the current status. After that, the customer needs to connect the bank account with set automatic bill payments using StellarFi Virtual Bill Pay Card. After bills are paid, StellarFi reports on-time payments to credit bureaus. So, SteallarFi is acting like your credit card even if you don’t have any.

I love this solution and this could end up as a pretty successful startup. It took them less than 6 months to hit $1M ARR.

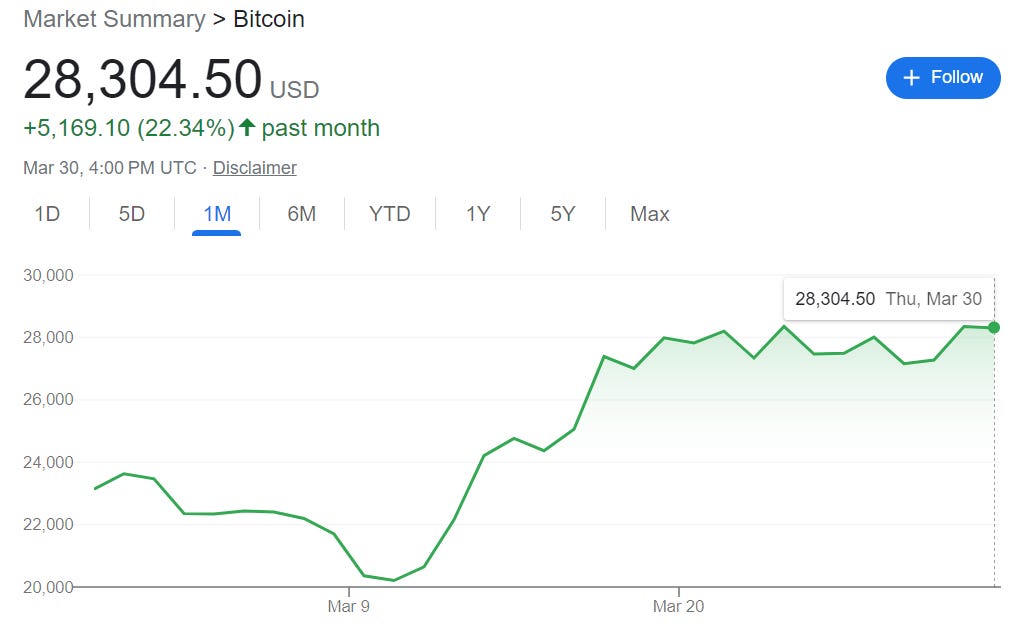

Crypto Bites

The only winner from the SVB collapse and possible banking crisis is Bitcoin. 22% growth in the last 30 days.

Physical crypto wallet💰Ledger raises €100M

Ledger is a Paris-based crypto security company that offers both physical and software protection of your crypto assets. They build pretty cool cold storage devices. I expect they will sell more and more of these because, with all the crypto exchanges bankrupt around, it’s just not safe to keep the coin on the exchanges. The safest way is to move it to cold storage and keep it if the bull market ever comes back again :)

Ledger Nano (in the picture) starts from $159.

Tweets and Threads of the Week

Job market situation👇

Shareholders paid for that👇

Cool thread about how you can use AI to launch the product faster👇

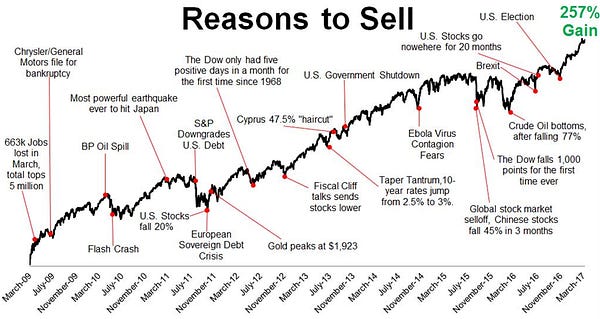

Just hold it will go up👇