🌊The Fintech Wave #65

TLDR: Dell earnings report. UK fintech infrastructure startup raised money. Digital bank Revolut was profitable in 2021. A crypto-focused bank is in a problem. New mobile wallet from crypto unicorn Uniswap.

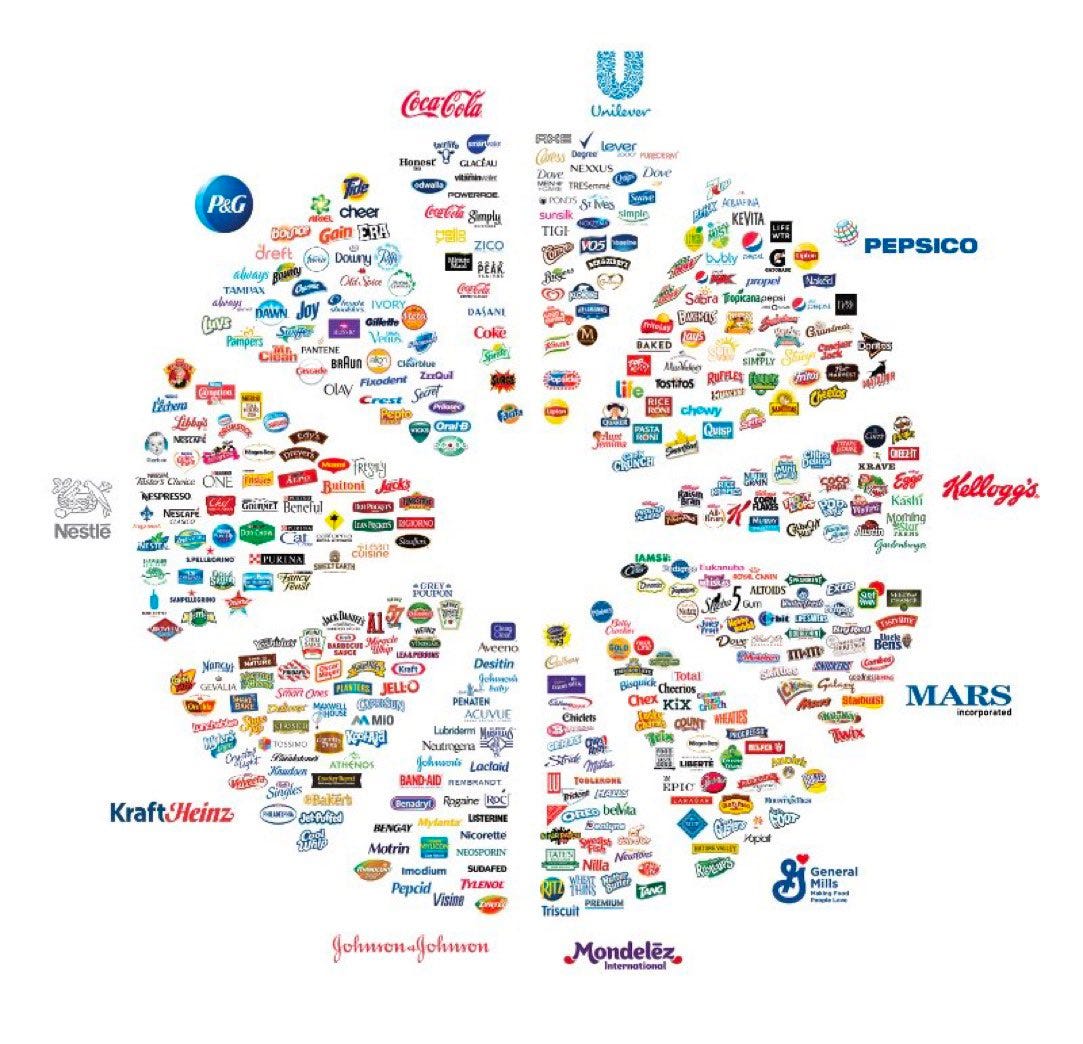

It’s worth owning some of these stocks

Pretty much all the products we use on an everyday basis (except tech) are owned by these 11 companies. $2.1 Trillion of combined market value. All of these companies are public and pay dividends to their investors, so dividends could pay off for the products you are buying from these companies. The dividend yield is anywhere from 2% to 5% depending on a company

Image source: Twitter @ Hero Dividend

Earnings report📈

Dell Technologies has a record revenue👇

Record full-year revenue of $102.3B (1% YoY) and a record full-year operating income of $5.8 billion, up 24% YoY.

Infrastructure Solution Group (servers, storage, etc) is still 12% for the full year, but Client Solution Group (PC, laptops) are down 5% (expected because demand for PC/laptops is slowing after Covid growth)

In after-hours trading, the stock was up 5%, but when the market opened the stock fell 6%, because the outlook for this year is not very good. Companies are cutting IT spending and companies like Dell or HP will feel that.

European News and Funding

Always great to see that fintech infrastructure⚙️startups are raising money

UK-based Rackle raised $200K for its banking-as-a-service platform. Using this platform you can launch fintech products (even a neobank) quickly and without a banking license (because Rackle solved) - a banking app, debit card issuing, or payments app. There are more and more players in this field which is great for fintech founders.

Interestingly, Rackle is from the UK, but it’s working mostly with German startups that want to offer fintech solutions for Turkish people - Rackle founders are from Turkey, so they know they want specifically target this niche from the beginning.

Revolut announced its first-ever annual profit💰

Although it’s already 2023, Revolut published financial results from FY21. Net profit was £26.3M, while the year before the net loss was £223.6M

But, revenue growth is even more impressive - £636.2M (from £219.9M in 2020). Revolut is currently valued at $33B. Looks like the IPO could be soon.

Americas News and Funding

The crypto-focused bank could face a bankrupt

Silvergate Bank stock is down more than 50% in one day because they postponed FY22 results. Silvergate is a crypto-focused bank, which was hit hard by the FTX fall. Some speculations say they were the biggest creditor to FTX. Just a year ago the stock price was $220 while now is moving towards a few bucks. Deposits have fallen from $12B to $3.4B. Doesn’t look good.

Crypto Bites

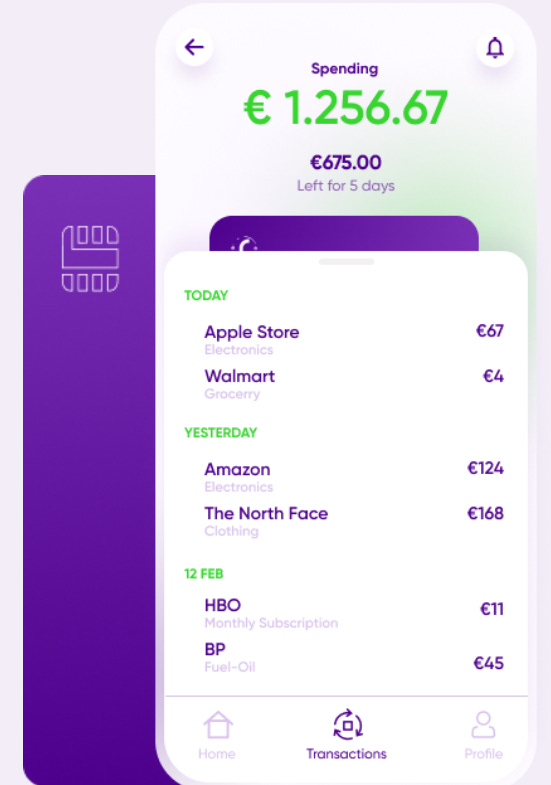

Uniswap🦄has a new mobile wallet

One of the best crypto apps (which is not fraud) launched a mobile wallet app. Uniswap is the most well-known decentralized cryptocurrency exchange that uses a set of smart contracts (liquidity pools) to execute trades on its exchange and so far it was only available as a web app.

Now they launched a self-custodial wallet that is simple, safe, and easy to use for - swapping, buying NFTs, and purchasing crypto. Looking at the screenshots UX looks really good and this is what users need in order to adopt DeFi. It is still in the early phase so it is not available to all users, but you can try to request early access.

Tweets and Threads of the Week

This scammer raised $200M from investors. Anything is possible👇

Slack can turn off your service if they don’t agree with your political views. Act accordingly👇

The worst layoffs announcement ever👇

Useless, but interesting info👇