🌊The Fintech Wave #64

TLDR: check Q-reports for Coinbase and Teladoc. WeWork is now worth less than $1B. Some banks are moving their branches on wheels to drive around neighborhoods. Spend management software from Germany raised money. An app that allows you to buy houses with friends.

Learn how equity grants work and make you understand yours🎯

A lot of Fintech Wave’s readers are working in the tech industry and some of you might have equity in the company. Things are getting pretty complicated if your company is still private and you don’t know how much that equity is worth. I came across the best article I read so far, which explains how equity works. Spend 10min reading it, because it might come in handy in the future.

WeWork is now worth less than $1B

WeWork market cap is now below $1B. The company raised $22.3B in total funding before going public. Adam Neumann got more money to leave WeWork than the current market cap 😅

Earning reports📈

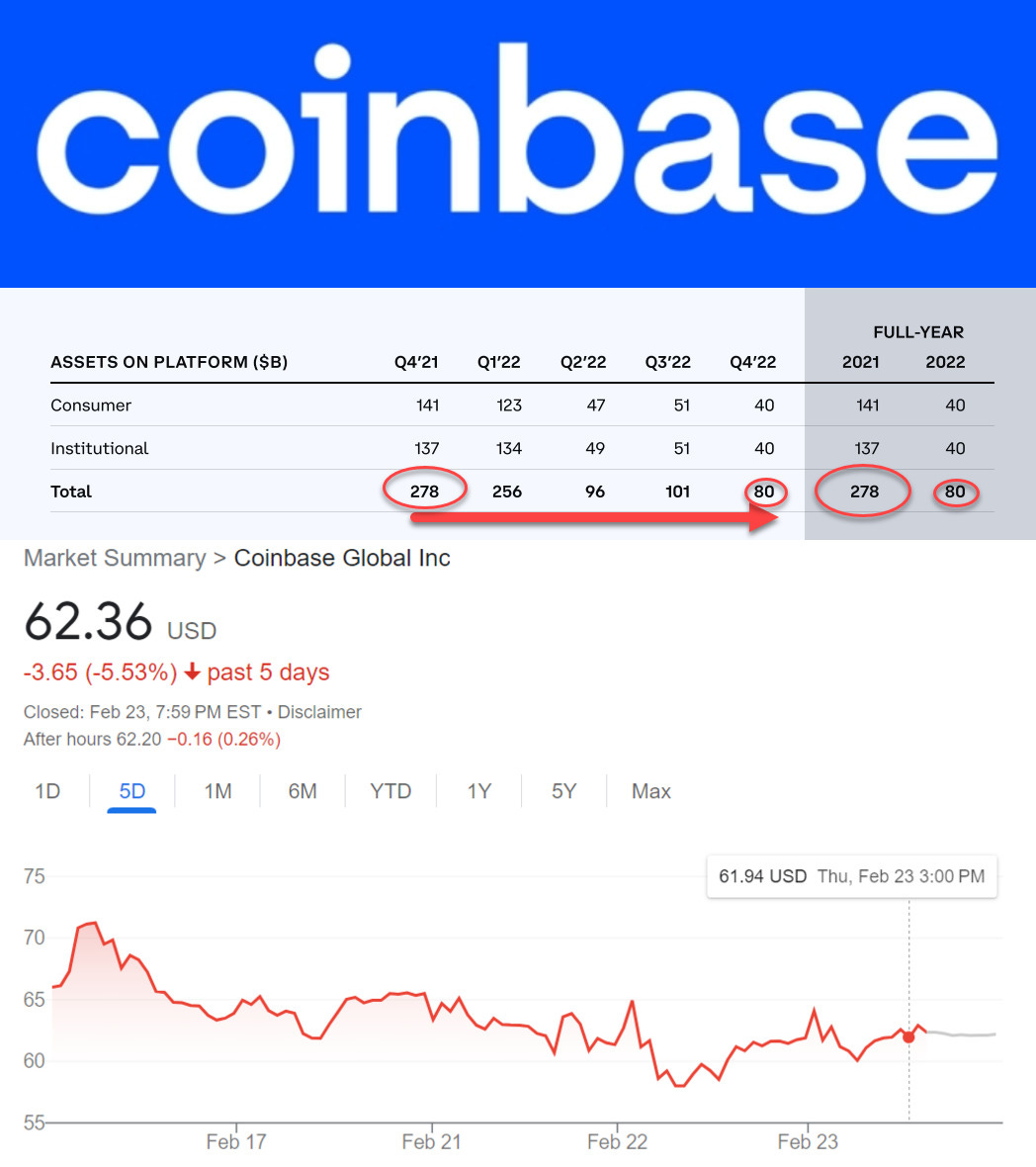

Coinbase has a very bad FY22📉

Coinbase reports massive losses - $555M just in Q4 and $2.6B for FY22. Management under assets (AUM) is down 71% YoY. It went from $278B to $80B. After a lot of crypto exchanges went bankrupt people started pulling the asset to a private wallet. As you can see Coinbase suffered pretty hard from this.

The company ended Q4 revenue at $604.9M which is a 76% decline from the same period last year ($2.49B of revenue).

Full FY22 revenue is down more than 50% compared to FY21 ($3.1B vs 7.3B)

The stock is down 5% this week and it's currently trading around $62. I remembered right after the IPO people were buying at $340/stock. It is hard to imagine that it will ever return close to that amount.

Q4 net loss was $557 million. Full-year 2022 net loss was $2.6 billion and included $694 million.

Teladoc has made some positive progress

TDOC 0.00%↑ , the most popular virtual health app, posted solid Q4 results but the stock still declined a few %, because analysts expected better results.

Q4 Revenue grew 15% compared to the year before ($637M vs $554M).

Net loss is at ($3.8B; yes billions) because of goodwill impairment charges and stock-based compensation expenses.

EBITDA is also up, 22% ($94M vs $77M)

The biggest issue is customer base growth. Less than 2% growth Q over Q for the last few quarters. The company has its prime during Covid, but now they just cannot find areas to grow.

European News and Funding

Finance tools for SMEs

German-based Finway raised €9.2 million in series A led by Capital 49. Finway is an all-in-one solution for expense management - invoicing, accounting, spending, travel expense management, and corporate credit cards.

Looking at the website, UX seems very good and easy to use. The pricing is based on the number of processed invoices per month and it starts from €169 for 100 invoices. Currently, 400 customers are on board.

Americas News and Funding

Banks on wheels🚌

Came across an interesting article on CNBC. In order to get more customers banks are testing “banking on wheels” - vans and buses are turned into mobile bank branches that can be parked in any neighborhood.

The plan is to go into an underbanked neighborhood and offer most of the services of a traditional bank like opening a savings or checking account, securing loans, and providing financial advice. You can find the article here.

Fintech that helps friends buy homes together🏠

A lot of fintech startups are trying to make homeownership more affordable. I don’t think they can solve the problem because we just have a supply problem in the USA, but it’s always interesting to see new ideas that people come up with.

This time it’s called Nestment and the startup just raised $3.5M pre-seed. The startup allows you to buy a property with your friends. The idea is that friends can chip on, buy a house and then rent it in order to increase their wealth. Nestment helps friends to form an LLC that will own the property and everybody owns the shares (that can also be sold). Also, their app tracks the Profit and Loss account on the property. It’s a cool idea but we will see if it can gain meaningful traction.

Crypto Bites

Bitcoin lost 3% of its value on Friday

On Friday (Feb 24) Bitcoin fell down more than 3%. Not sure what the reason is, but I think it could be connected with Coinbase's financial results. People probably just sold some of the BTC and take the USD out from the Coinbase app.

Bank decided to hold some of its reserves in USDC coin

Citizen Trust Banks partnered with Circle (IMHO the best crypto company) to hold some of its deposits in USDC coin (Circle is the issuer of USDC coin) - $65 million in USDC cash reserves. A pretty significant move for USDC adoption. More details are here.

In case you are asking what is USDC here is the answer - USDC is a digital dollar, also known as a stablecoin, that’s available 24/7 and moves at internet speed. Every digital dollar of USDC can always be exchanged 1:1 for cash.

Tweets and Threads of the Week

Lux Capital's letter to its Limited Partners is always a great thing to read👇

Cannot agree more👇

In case you want to start selling something over Amazon, this could be useful👇

It’s not finance related but, take a look inside the Amazon Fulfillment center👇