🌊The Fintech Wave #61

TLDR: check some of the Q4 results. BNPL startup raised $100M. New social investing app from Swiss. Credit cards for influencers and their fans. If you ever wonder about gas station economics, check the Tweet at the end.

Q4 and FY22 results📈

A lot of companies published quarterly results last week, so we are bringing you the summary for some of them to give you a couple of ideas for investments.

Intel is in huge problems😔

It is sad to see a legendary American company performing so badly. As I understand, the problem is that Intel chooses to develop chips on an architecture that a lot of people think is not good to compete with AMD and TSMC.

Revenue $14B ( down 32% YoY)

Gross Margin 39.2% (down 14.5% YoY)

Net loss $0.7B (down 114% YoY)

The stock is down more than 7% after the results. Somebody needs to turn this ship around otherwise semiconductor productions are not returning home anytime soon.

Buzzfeed stock is up 160%🚀

Buzzfeed announced it would replace some of its writers with ChatGPT. The stock is up 160% after the announcement.

Boeing has a pretty Q4 results✈

Boeing (and other aerospace companies) are still recovering from Covid. There were a lot of canceled airplane orders, but it looks like production is ramping up.

Revenue $19.9B (35% increase YoY)

Net loss ($663M)

152 commercial airplanes delivered (54% increase YoY)

The stock lost less than 1% after the results

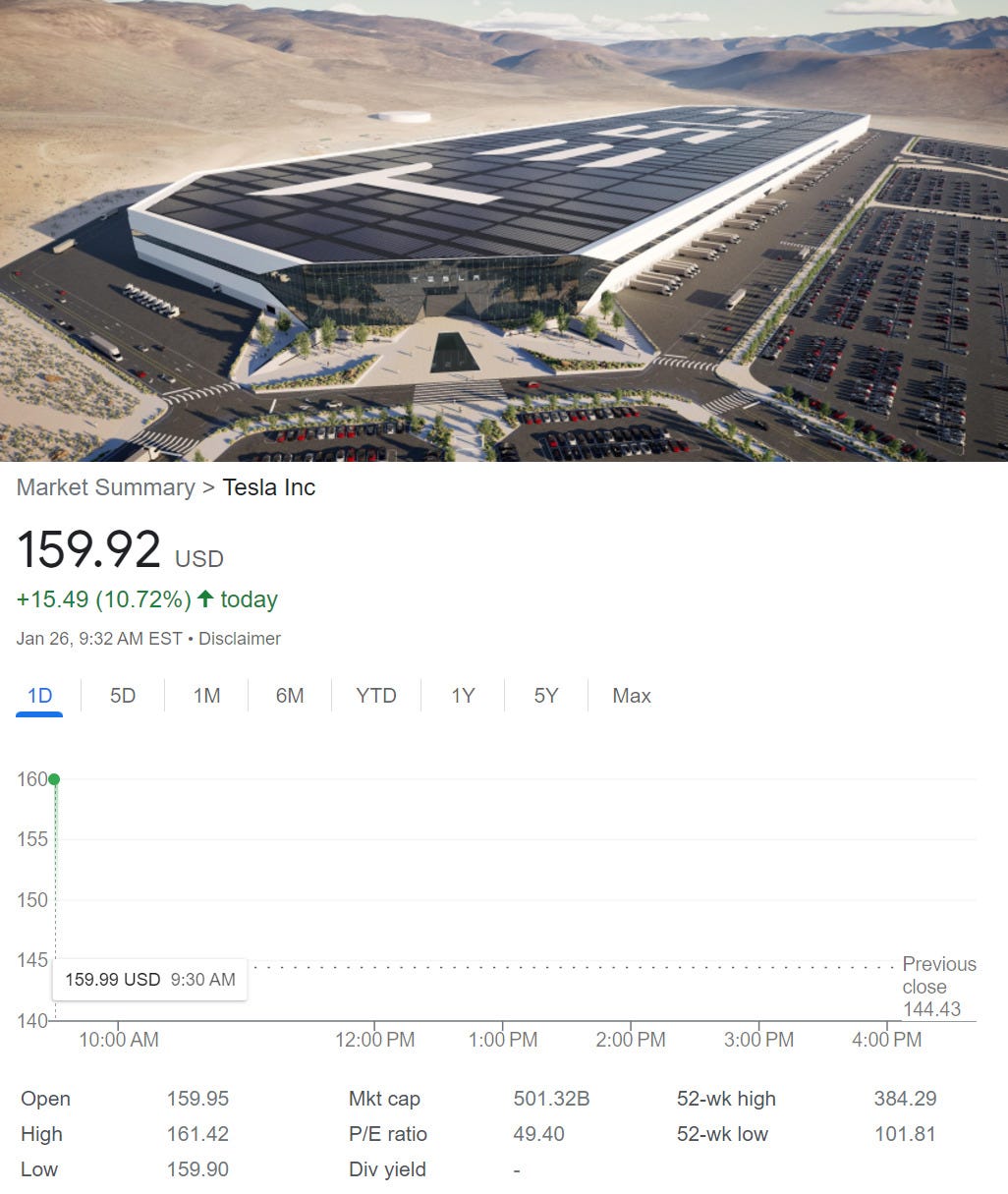

Tesla has the final results for FY22🚗

Revenue $81B (51% growth YoY)

Automotive Gross Margin 28.5%

Net income $13.6B

1,369,611 cars produced

Tesla now has 4678 supercharging stations worldwide

The stock rose more than 10% right after the market opening

European News and Funding

The social network for investors

Zurich-based app yeekatee raises $1.9M to develop the educational social network targeting investors. The idea is not new, because there is already tens of social investing app. Customers will connect their brokerage account with yeekatee app and will be able to share their portfolios with other users, get new investment ideas and learn. The app is still in development, but you can signup for a waitlist.

BNPL startup raises $100M in equity and debt

London-based Buy Now Pay Later startup Tranch just announced $100M of fresh capital to fuel the growth. The app is now available for UK and USA markets. This is how it works: after business connects a bank account on the tranch platform, tranch provides the business with a commitment-free credit line of up to $250,000. The business can upload any invoice and - once it has been approved - tranch pay your supplier directly. You pay us back over 3-12 months.

Would be interesting to see how much of this $100M is actually equity. Probably 5-10% and everything else is debt. An interesting comment on Twitter about this announcement👇

Americas News and Funding

Credit cards for influencers and their fans💳

Zurp raised $5M pre-seed to launch a credit card that will build relationships between fans and influencers. It’s a pretty interesting concept, considering how much people spend time watching and listening to influencers.

It works like this: “Creators who participate in the Zurp credit card program will each have their own card that their fans can sign up for and will receive a percentage of the purchases made with each card from the merchant. Once fans receive their cards, they will start earning points each time it’s used, which they can then redeem towards exclusive experiences with their chosen creator.”

Of course, people will consume content, while influencers make money from that. The app is not launched yet.

Financial crime monitoring software👮

Anti-money laundering (AML) startup Sandbar, raised $4.8M in Seed investment. More than 45 angel investors participated in this round (people from Stripe, Ramp, Plaid, etc.) Every fintech company does need AML technology so the market is there.

Financial frauds are getting more and more sophisticated and Sandbar’s platform is helping fintech companies to monitor all financial transactions, flag suspicious activity and manage cases. The platform can cover any B2B or B2C company that works with money. I’m really curious about how much this solution costs, but there is no pricing on the website.

Tweets and Threads of the Week

If you are interested in to Gas Station business this thread has some great insights👇

Priorities👇

Indeed, Visa and credit card issuing is such a great business👇