🌊The Fintech Wave #60

Welcome to the 2nd Fintech Wave edition in 2023. In today’s newsletter, we focused on Real Estate stocks that pay dividends to get you a few investment ideas. Also, we analyzed Netflix's Q4 results. Bitcoin soared above $22.000 which is great news.

Real estate dividend stocks🏠

If you are into real estate you will like this. There are around 100 public companies on the USA market that do business in real estate - from ski resorts to industrial warehouses. The best thing is that all of these stocks pay dividends (some even higher than 7%). Here are some of the examples that you can add to your portfolio - company name, type of real estate business, and dividend yield👇

$LAND Gladstone Land Corporation - acquires farmland that it rents to corporate and independent farmers on a triple-net lease basis - 2.77%

$O Realty Income - acquiring and managing single-unit freestanding commercial properties - 4.51%

$EPR EPR Properties - invests in amusement parks, movie theaters, ski resorts, and other entertainment properties - 8.28%

$GOOD Gladstone Commercial Corporation - investing and owning net leased industrial, commercial and retail real property and making long-term industrial and commercial mortgage loans - 7.23%

$LTC LTC Properties - investing in seniors housing and health care properties - 6.12%

$AGNC AGNC Investment Corp - invest predominately in agency residential mortgage-backed securities on a leveraged basis - 12.7%

$AMT American Tower Corporation - real estate investment trust and an owner and operator of wireless and broadcast communications infrastructure - 2.68%

$PLD Prologis - invests in logistics facilities - 2.59%

$DRL Digital Realty Trust - invests in carrier-neutral data centers and provides colocation and peering services - 4.60%

$SPG Simon Property Group - invests in shopping malls, outlet centers, and community/lifestyle centers - 5.73%

$VICI VICI Properties - specializing in casino properties - 4.71%

$DEA Easterly Government Properties Inc - acquisition, development and management of Class A commercial properties that are leased to United States Government agencies - 6.7%

$STAG Stag Industrial Inc - real estate investment trust focused on the acquisition and operation of single-tenant, industrial properties - 4.20%

*not investment advice, always do your own due diligence

Netflix Q4 results🎥

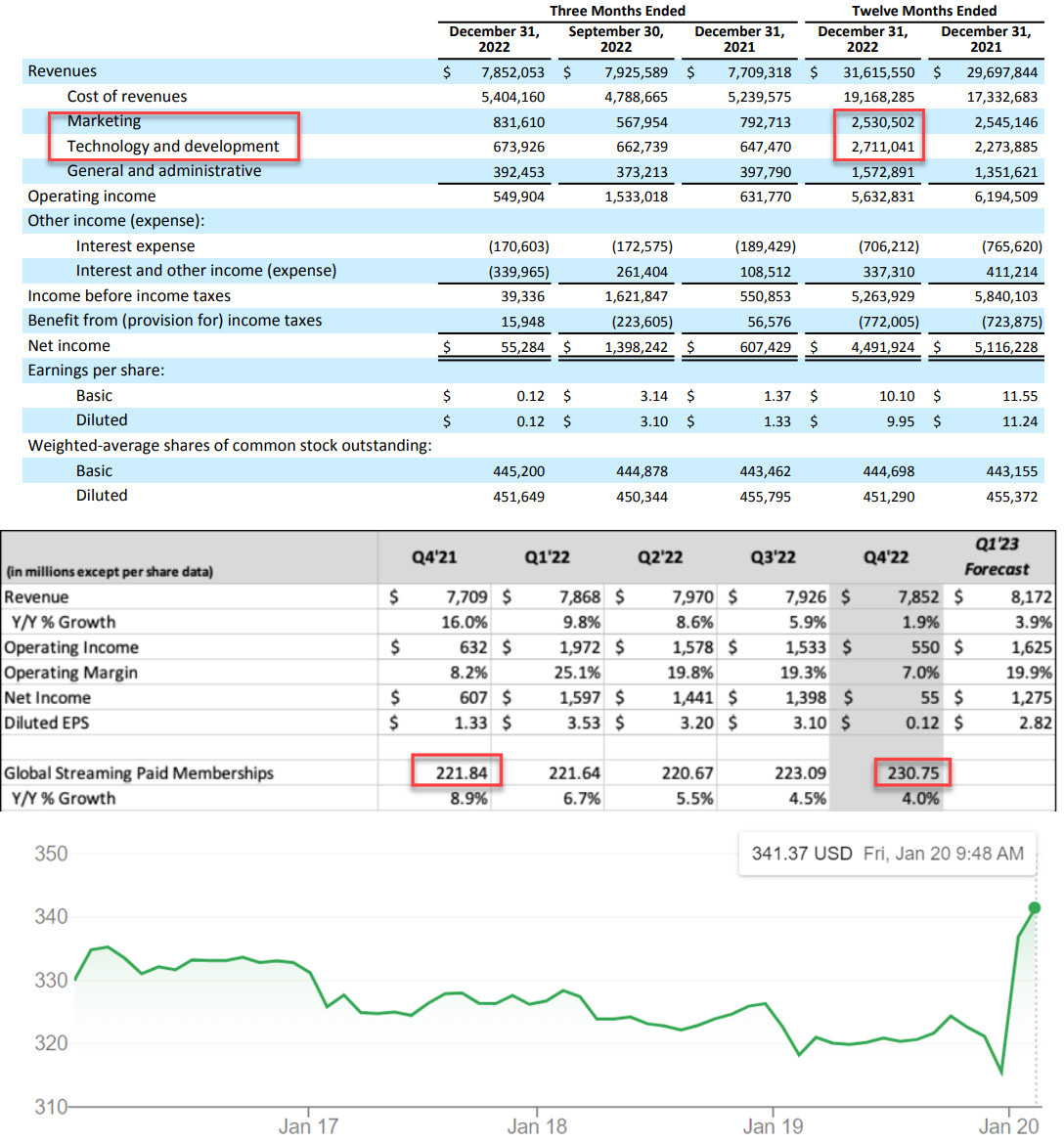

Couple of interesting info from Netflix Q4 results. Last year Netflix spent $2.53B on marketing and added 8.9 million net new subscribers. If we don’t count churn, turns out that Netflix spent $284* per net new subscriber.

That means the new customer has to stay subscribed for 18 months (at $16/month) for Netflix just to return the marketing cost. But, a good thing for Netflix is that lifetime customer value is over $500, so it's still worth spending money marketing.

Also, they spent $2.7B on technology development. Not sure how they were able to spend so much, but the app has had minimal changes in the last few years.

The stock is up 7% after the Q4 results.

*we don't know the churn numbers; with churn, CAC would probably be around $100-150

European News and Funding

Fintech that helps you file tax returns↩️

If you live in Germany, you might like this startup. Zasta just raised €60M in debt to expand its tax filing platform. It’s a great app for users since Zasta automatically pulls data from the tax office and it doesn’t need inputs from users. Zasta has an army of accountants who check refunds and the company keeps 25% of the refund as a fee. I think that is fair since they do all the work. More than 300.000 people already used Zasta.

N26 rolled out crypto trading in 5 countries

One of the European biggest neobanks rolled out crypto trading for users in Germany, Switzerland, Belgium, Portugal, and Ireland. Pretty brave move considering currently the crypto market situation, but it’s good for users to have everything in one app.

Americas News and Funding

App the helps understand movements on the stock market📈

For all stock trades out there, here is one cool app I came across. MarketReader raised a $3.1M Seed round for its market analytics platform. When the stock price goes up (or down) you probably start googling news to see what is going on. But with MarketReader you have these explanations in real-time, so you instantly find out why the prices in changing.

Getting that data quickly and in real-time is super valuable, so I think they have a pretty good market fit. Now, the only thing is, how much does that cost? Unfortunatelly, there is no info about the pricing on their website.

Crypto ₿ites

Bitcoin above $23K

Great news for all of us Bitcoin Hodlers - on Saturday, Bitcoin soared above $23K which is 38% growth in the last month. Let’s hope the trend will continue.

Tweets and Threads of the Week

The worst investor of all time👇

Another crypto bankrptcy👇

Do you agree with this?👇