Hi all,

and welcome to our Monday weekly fintech and crypto recap.

If you like this newsletter please share it with friends and encourage them to sign up👇

Let’s dive in

RIP Crypto

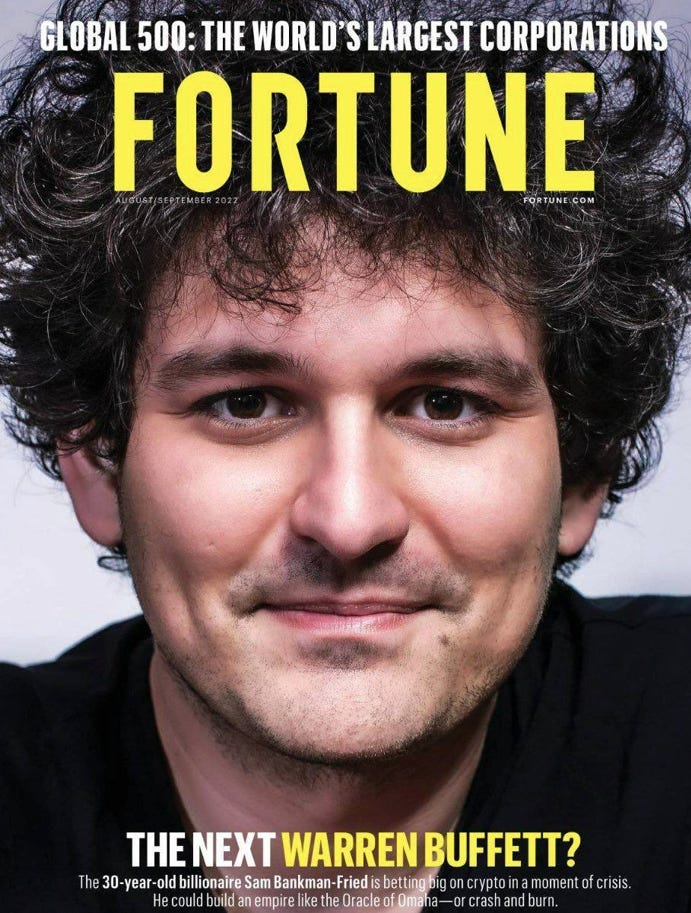

It was the most dramatic week in the crypto world ever. One of the world's largest crypto exchanges, FTX Group is bankrupt. Company’s CEO Sam Bankman-Fried (aka SBF on Twitter) created one of the biggest scams in modern history. Just a few months ago he was: the hero that planned to give up all his fortune to save the world, the new Warren Buffet, etc. Some journalists even said he could buy Goldman Sachs or JP Morgan. Turns out, he is the fastest person ever then went from $16B net worth to 0 in less than 2 days.

There are so many explanations of what exactly happened but long story short:

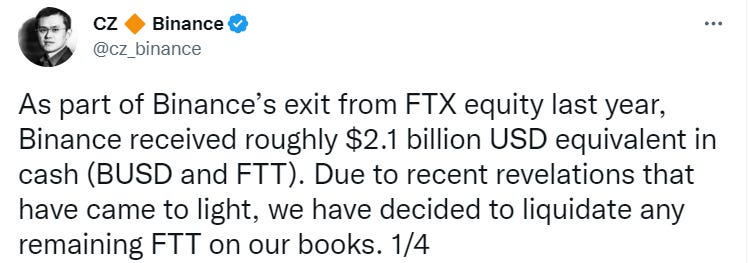

Everything started with a CZ Tweet (CZ is the CEO of Binance - the world's largest crypto exchange).

Turns out he was correct. SBF created an FTT coin out of thin air, with zero utility and use case, artificially pumped the price, and then used that coin to borrow money (and crypto) against it.

SBF called CZ and asked if Binance would acquire FTX. CZ entered into a non-binding agreement to buy FTX but after 1 day of looking at the financials books, he announced there will no acquisitions. As everybody expected, CZ never planned to buy FTX, he just wanted SBF to admit that FTX is insolvent.

On Saturday morning it was announced that FTX has been hacked and that all money is lost. Customers lost at least $9B. SBF is hiding somewhere in the Bahamas.

The biggest problem is crypto is not regulated and probably there will be zero consequences for SBF and his team.

Wanna hear an even crazier thing - VC fund Sequoia invested $213m in FTX, driving its valuation to $32B. SBF cashes out, steals client funds, and invests $500M back in Sequoia. This kind of scam doesn’t even have a name, it is something like Double-Ponzi and nobody is in prison yet. Other investors include Tiger Global, Paradigm, Softbank, BlackRock, etc.

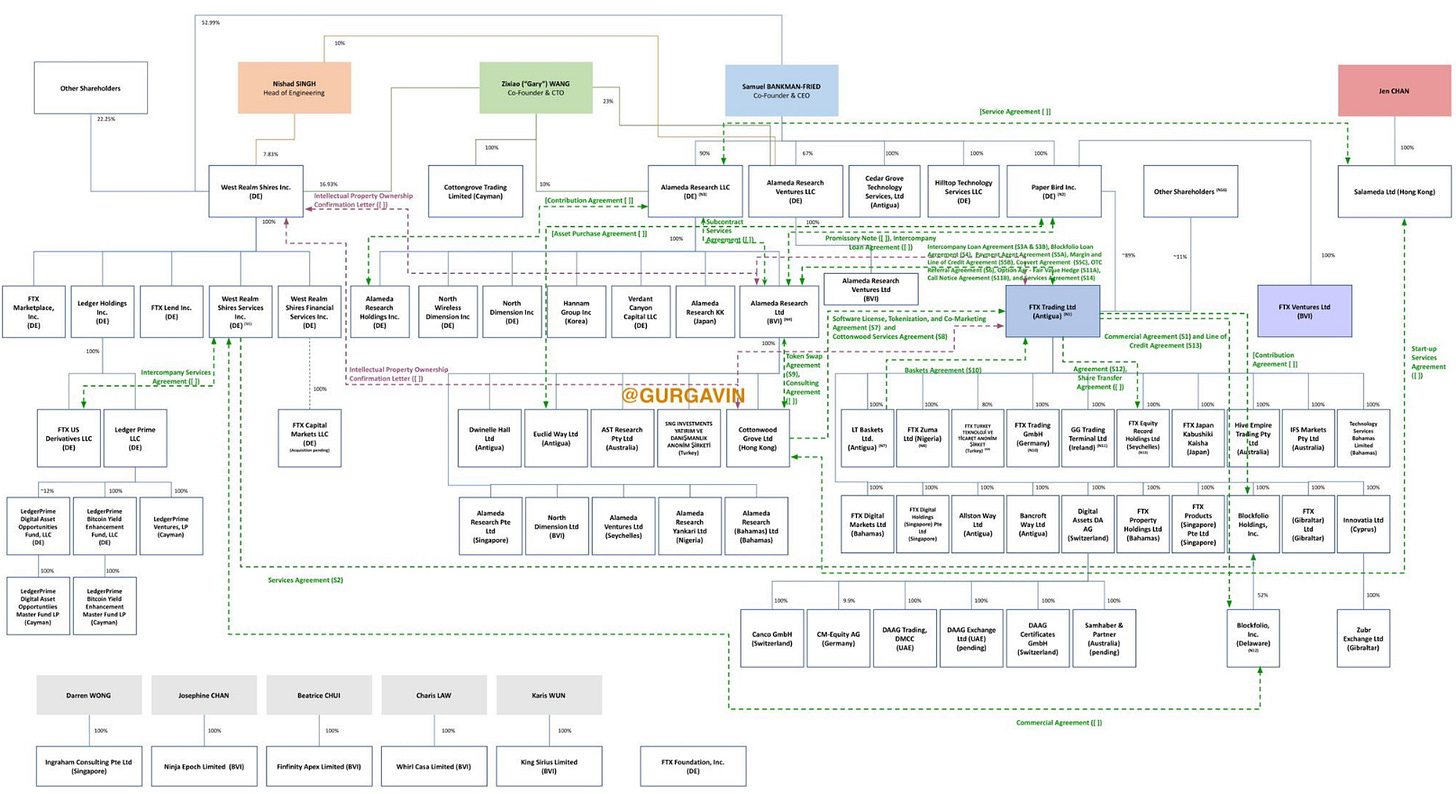

Ontario Pension Fund invested hundreds of millions into FTX. Future pensions are at risk. All of these just tell us there was zero due diligence. This is what the organizational structure of FTX Group looked like😂

European News and Funding

Payment solution for brick and mortar business🧱

I always like to see fintech solutions for physical retail, because I think it is important to reduce the costs and complexity of payments for small and medium businesses. KodaPay is one of these solutions.

KodyPay created an all-in-one iOS/Android app for tablets or physical card machines that allow businesses to accept both physical card payments & online ordering at once. Also, a pretty cool thing is that businesses can also accept an expanding range of non-card payment types with KodyPay. Think about e-wallets, buy-now-pay-later, open banking, and cryptocurrency, with automated payment reconciliation across all payment service providers.

The company has more than 500 businesses signed up in the UK.

Americas News and Funding

Payment💳 solution for freelancers

Miami-based startup that was part of Y Combinator batch raised a $5M seed round. Ping allows freelancers to get paid globally in their local currency, wherever they are, both in fiat and crypto (although not sure anybody will choose the crypto option after this week)

With more and more people working remotely for foreign companies this is a much-needed solution. Customers can even open US accounts from anywhere in the world, send invoices for their work and receive payments in USD. Now, the only question to which we couldn't find the answer is how this will be taxable. If you going to use this app make sure to check that.

Crypto ₿ites

Poland crypto startup raised $70M Series B

Despite crypto winter, Ramp managed to raise a new round of funding. It has the same name as a US-based startup for corporate spend management, so don’t confuse these two fintechs.

Ramp offers a full-stack infrastructure that enables its clients to embed crypto payments infrastructure into their existing apps/stores/gaming platforms so that users can buy crypto assets without needing to jump to other apps. This is a great infrastructure solution and it looks simple to integrate with any business. For businesses, this opens a new channel to attract customers that like to pay for something in crypto, so it is a win-win situation.

The company published that transaction volumes in 2022 have increased by almost 240% compared to the same period in 2021. We can only wish them good luck in this crazy crypto market.

Bitcoin below $17K📉

Bitcoin falls to new lows after this drama with FTX. At exactly this time last year bitcoin was at $69.000. These were good old times, that we won’t see in crypto any time soon😊

Tweets and Threads of the Week

If you are looking for an investment 👇

This sums up everything about FTX👇

This is a nice lifetime value👇

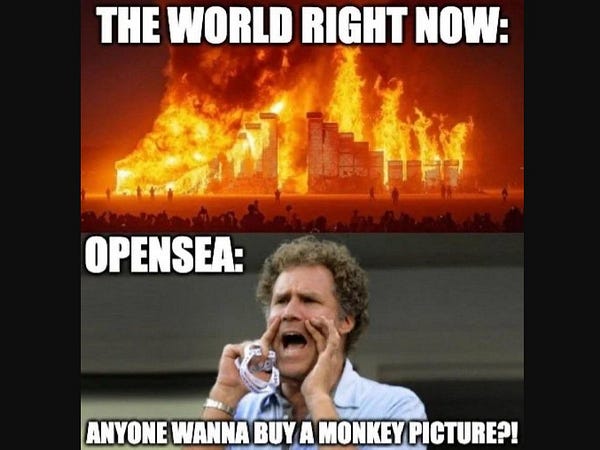

Pretty much correct description of the NFT market👇