🌊The Fintech Wave #51

TLDR: Visa had a great Q4. Facebook stock is trading below $100. BTC is finally about $20K. Now it is possible to invest in pre-IPO companies with synthetic products. Financial wellness app from Denmark raised €3.2M.

If you like this newsletter please share it with friends and encourage them to sign up👇

Comment about Twitter

The whole week was about Musk’s acquisition of Twitter and how he is going to lay off most of the people. The CEO and CFO were laid off immediately. Whatever anybody thinks about the ex-CEO of Twitter, Parag Agrawal created enormous value for shareholders.

- he managed to secure a deal for $54.2 per share, only 30% down from Twitter’s ATH of $77.6 from a year ago

- Twitter stock is up 25% this year, while all other social media stocks are down at least 70% (FB 70% down, Snap 86% down)

- he didn't want to negotiate a lower price with Musk

- looking at the other tech stocks, Twitter would have been trading below $10 per share without this successful buyout

And he walks out with $42M for himself. Job well done. On the other hand, Twitter now takes on an extra $13 billion of debt at a 7.75% interest rate. Annual interest payments of $1 billion could exceed Twitter's cash flow. Management doesn't have too much time to figure out how to increase revenue.

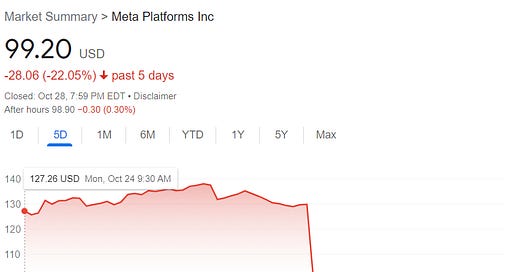

Facebook Q3 results

Although, it is not a fintech company we still need to comment on this. The stock lost more than 70% of its value this year and it is continuing to fall. After the Q3 results, the stock went down below $100.

Facebook net income is down -49% YoY but headcount is up +28% YoY. They added 19.000 employees. This looks like zero cost control and for the next year, they project that expenses will be above $100B!!!

The operating margin is now only 20% (down from 36%), but the company will continue heavy investment into the metaverse. Meta has repurchased $42B of stock in the past 12 months at an average price of $300. It is now trading below $100/share.

I’m sure that Facebook will turn this around because Zuckerberg is one of the best company operators in the world, but the current situation doesn’t look good. There will be huge cost cuts soon.

European News and Funding

Financial wellness app from Denmark raised €3.2M

All Gravy is a finance app that wants to help employers in the hospitality industry retain employees. It allows employees to: instantly access their salary, budget and save for goals and see exactly what they'll be paid after tax.

This might app can help a bit with employee retention, but to be honest, I don’t think we need an app for that because the solution is simple: if you give higher salary people won’t leave.

Americas News and Funding

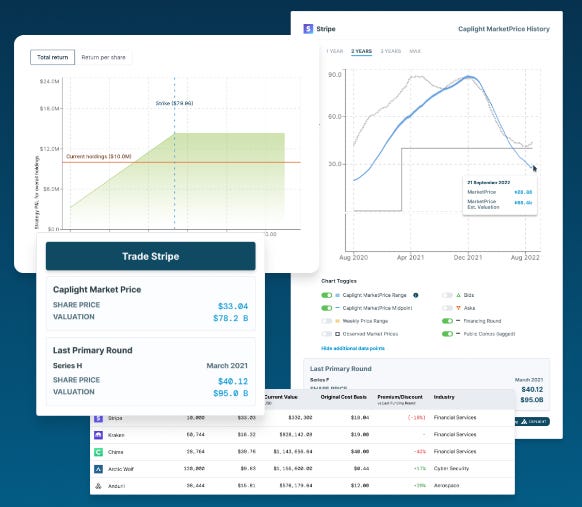

Deutsche Borse invested in a trading startup📈

This is one of the most exciting fintechs we have come across in the last few months. Caplight Technologies offers a unique solution for trading pre-IPO companies. It is extremely hard to buy shares/equity of private companies (if you are not a direct investor) and Caplight is solving this.

This means that investors can buy shares of private companies such as Stripe or Airtabble. Institutional investors can long and short private company positions with synthetic derivatives (you don’t actually buy the share, you buy synthetic products that represent the share price.

There is over $3.8 trillion in value across venture capital-backed private companies, and this could be unlocked with this app. This company is the future🦄

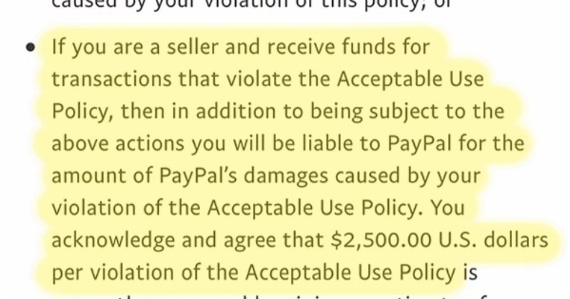

Be careful, PayPal returned a $2500 penalty

PayPal quietly inserted this policy again in their terms of service. If they don’t agree with what you say on social media they can take $2500 from your account and you cannot do anything about it. The hashtag #DeletePayPal quickly became popular on Twitter.

This is such a strange move by PayPal, considering the hit fintech companies are getting with these higher interest rates. Users will just go to some other payment providers.

Visa published Q4 results🚀

Payment processing is one of the most profitable businesses on Earth. Visa Q4 results are out. It is amazing how much revenue Visa can make by taking 1-3% of every purchase.

Q4 revenue $7.8B (19% increase)

Free Cash Flow $5.6B (72% FCF margin)

Net Income $3.9B

Payments volume 10% increase

Most importantly for shareholders, the board of directors increased Visa's quarterly cash dividend by 20% to $0.45 per share. If you have time, you can read the whole report here.

Crypto ₿ites

Bitcoin is finally above $20K, which is the best price in the last 3 weeks, but there is still a long way to last year's value. We will probably wait years.

Tweets and Threads of the Week

If you buy stocks right after the IPO, your investment is probably down👇

It will take years for companies to recover👇

About Chamath’s SPAC (most of them lost 90% of their value since IPO)👇

Musk in Twitter’s HQ