🌊The Fintech Wave #47

TLDR: You can now get all investment data for free. The fine art marketplace raises money. Corporate spend management startups are still popular among investors. Apple Pay. still didn’t overtake Mastercard in payment processing.

If you like this newsletter please share it with friends and encourage them to sign up👇

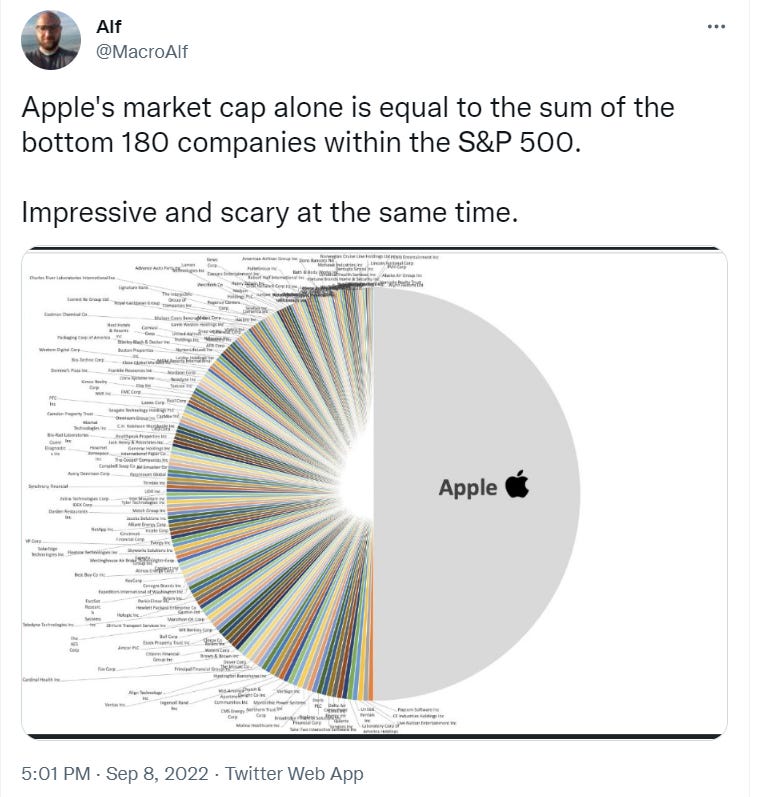

We all know that Apple is the most valuable company and it has a market cap of $2.5 Trillion dollars, but it is hard to visualize that. I came across cool graphics that show that Apple's market cap is equal to the market cap of 180 companies from the S&P 500 list. And these are not small companies, each one of them has thousands of employees.

Now you can get the same data as investment professionals, but for free🍾

You probably heard about Bloomberg Terminal. It is a popular hardware and software system that allows investors access to real-time market data, investing analytics, and proprietary trading platforms. There is only one “problem” - price. They recently increased the price from $24.000 to $30.000 per year for a single terminal.

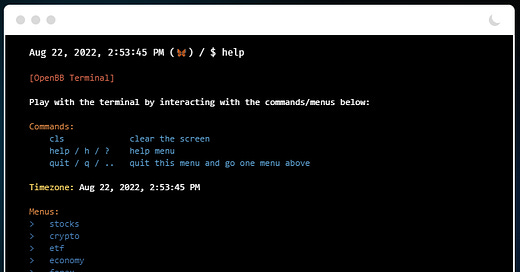

But, there is a way to get 90% of that data for free, thanks to Open BB - a free and open-source platform for investment research. If you are a data nerd or you or a small investor, this will be your new go-to place to get investment data. This is how you can use it👇

Go to OpenBB website https://openbb.co/products/terminal

Install the app for your OS

It might take you some time to get used to the interface but now you have the access to

You can find in-depth information about the following:

Stocks

Crypto

ETFs

FX market

Economic data

Mutual Funds

Also, you can get data for due diligence for each stock/etf/crypto - analyst ratings, price targets, SEC filing, list of customers/suppliers, etc.

It might take you some time to get used to the interface, but once you are settled you have access to an almost unlimited set of data.

European News and Funding

Revolut is having audit problems

The most popular European fintech used by 20M people, Revolut, is facing some problems with regulators. Apparently, there was a “material misstatement” in the financial statements, probably due to crypto reporting which accounts for up to 10% of its revenue.

Looks like Revolut will have to improve their back office.

CRM focused on the Investment Industry📈

Truth is, the almost complete financial industry is still depending on MS Excel. Like it or not that is true. PE and VC funds still track everything in Excel, just because it has been here forever and everybody is used to it.

Edda wants to change that with great design and automation. For example, investors are getting deal flow from many sources: email, Twitter, etc. and they have to manually enter that into Excel. Edda software will automate that. The product design looks really good, especially the visualization. Unfortunately, there is no pricing on the website.

Americas News and Funding

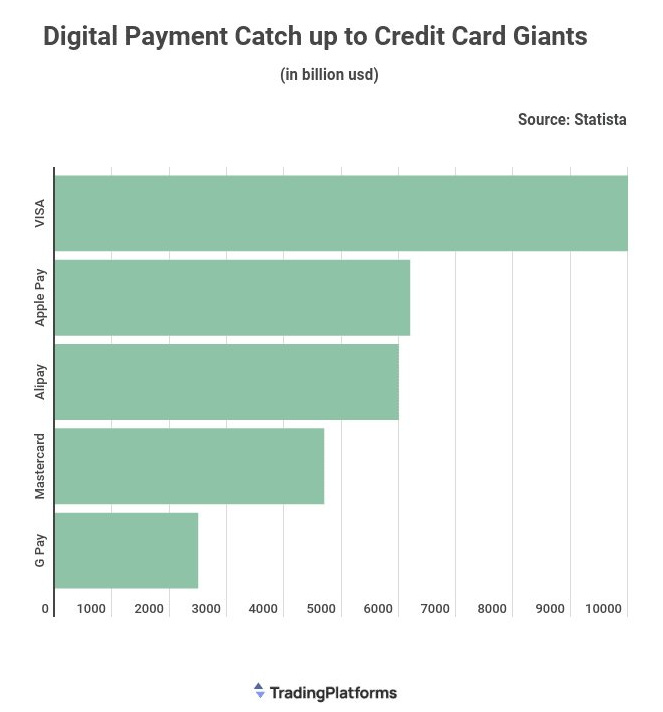

Somebody wrote that Apple Pay surpasses Mastercard💳in payment processing, but it is not entirely true (yet)

Last week Apple insider post an article that Apple Pay suppressed Mastercard in payment processing. Their graph soon spread over Twitter, but it is incorrect.

The reason this is incorrect is that Apple Pay sits on top of Mastercard, Visa and other processing networks. Even if you pay with Apple Pay, in the background Visa or Mastercard are processing the transaction. Apple is doing some of its financing/processing with the Apple Pay Later product but that is still early.

This doesn’t mean that Visa or Mastercard shouldn’t be worried in the long term, but at least for now, they will keep being leaders in payment processing.

One more spend management software raised money💰

Mesh Payments raises $60M to help other companies with spend management.

In the last 2 years spend management become one of the most crowded places in the startup world. Billions were invested and investors’ FOMO (fear of missing out) is real. Mesh Payments competition includes Brex, Ramp, etc. If you want to learn more about the space, a few months ago we wrote an article about it.

As all other companies in this space, Mesh Payments offers credit cards, expense management software, real-time reporting, etc. Also, it is possible to integrate it with accounting software such as Quickbooks. What makes them different from the competition is that users are able to create unlimited virtual cards, free of charge which is pretty cool. That way you can create 1 virtual card for each software you pay for and it makes it easier to track expenses.

The company has over 1000 customers and could soon reach $1B of processed transactions. The good thing for these companies is that market is almost unlimited - corporate spending is a $100 TRILLION market.

Crypto ₿ites

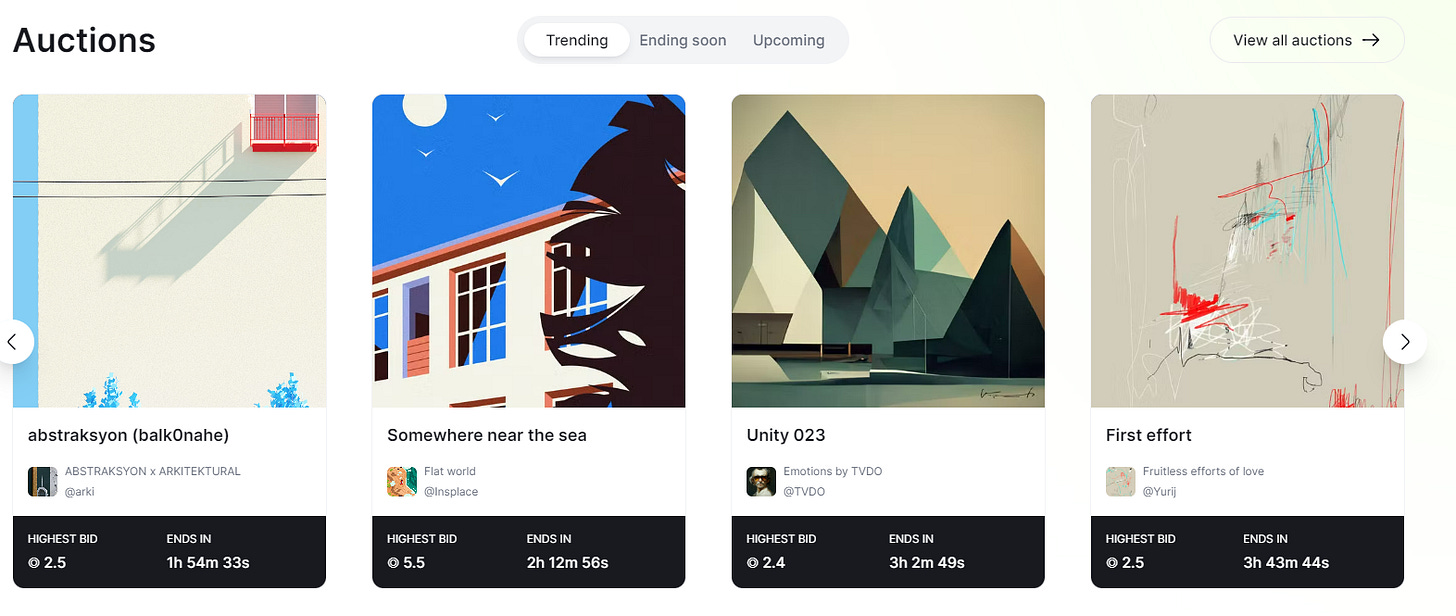

Fine art🖼️ marketplace raises $3.2M

Exchange Art just raised a seed round for its Solana-based NFT marketplace.

Because it’s based on the Solana blockchain, fees are costs are much lower than on Ethereum-based marketplaces. As we were talking for the last year, we believe that marketplaces on Solana make the most sense because it keeps the fees low (you can mint NFT for a few dollars or less). Exchange Art website design is beautiful and it is so easy to get around like you are in a real gallery.

Artists can list their artworks to a global audience and Exchange Art charges just 2.5% per sale. On the other side, collectors are able to verify the token ownership on-chain. So far, they have paid more than $11M to artists.

A few days ago, it was reported that OpenSea's (biggest NFT marketplace) trading volume is down 99%, which shows a huge slowdown of the market (also due to high gas fees because its based on Ethereum), but I talked to Exchange Art CEO, Alex Fleseriu, and he says that they saw trading at almost 6x more volume than OpenSea, in the last 30 days.

Tweets and Threads of the Week