🌊The Fintech Wave #44

We are welcoming 52 new members that joined us since last Monday. Although, summer mode🏖️ is still on, last week in fintech/crypto was pretty active.

TLDR: Must read the Twitter thread about the compounding effect in life, career, and relationships - one of the best things I read in a long time. DeFi super app is coming out soon. Marketplace to match financial advisors with clients raises $15M. US Department of Treasury freezes some crypto assets.

If you like this newsletter please share it with friends and encourage them to sign up👇

Fintech Wave graphics

This week analyzed neobanks. Currently, there are 252 neobanks in the world which is a pretty high number. But interestingly, 16 of them went public (6%). Considering the downturn in the current economy, most planned IPOs will be delayed. Mostly, because 99% of neobanks are still not profitable - they rely on VC money and they will have to figure out how to become profitable because it’s getting harder to raise money. Feel free to share this graphic in your posts. If you want to check the list of 252 neobanks, you can find it HERE.

European News and Funding

Decentralized Finance wallet raises €12.5M

Let’s be real - people outside the tech industry won’t touch DeFi. They won’t even touch crypto with the current UX. If the crypto world wants to gain new users it’s time to make it simple to use it. We don’t want to spend 45 minutes setting up the DeFi app to receive yields.

Ultimate Finance is trying to solve the problem by building a super app for DeFi - a mobile app that will offer users to buy crypto or NFTs, and most importantly access to a set of DeFi protocols where you can invest with a few clicks.

The wallet is still not launched (despite raising €4.5M already), but they already have 300.000 people on the waitlist.

Americas News and Funding

Revenue-based financing startup raised $145M debt round

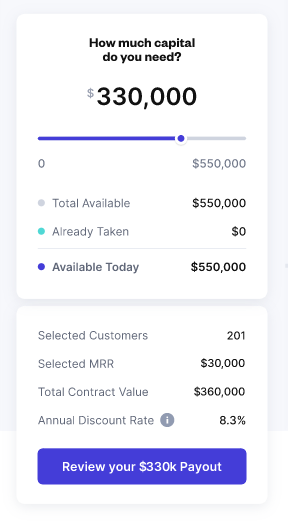

It’s been a few months since we had some revenue-based financing startup raise money. Founderpath just raised money to help bootstrapped companies get financing without giving up their equity.

All SaaS companies can use it to turn MRR (monthly recurring revenue) into upfront cash. Founderpath offers from $10K to $1M within 72h. Same as other services, they connect to requestors’ finances via API and decide how much money the requestor can get.

There are so many revenue-based services active now, it would be interesting to see how they present to investors why they are better than current options on the market. If you saw any of these pitch decks, please let us know.

Wealth management platform💰 raises Series A

New York-based Farther raised $15M at a $50M valuation. Essentially, they built wealth management software and a marketplace to connect financial advisors with clients.

The clients are setting up financial goals, and they are matched with financial advisors. Each advisor can set up their price to manage the client’s funds. Both sides have access to a dashboard to check and make changes to the portfolio directly. To be able to apply as an advisor your need to manage a minimum of $25M.

Crypto ₿ites

US Department of Treasury💵 suspended crypto exchange Tornado Cash

US Officials say that Tornado Cash helped hackers launder >$7 billion since 2019. Tornado Cash is known as a crypto asset mixer. That essentially means it is designed to offer another layer of privacy by mixing someone’s tokens with a pool of other people's tokens in order to make multiple combinations with countless transactions, so it is almost impossible to find the source and destination of crypto assets.

Most people use it as a legit way to protect privacy, but it is obvious how this can be (and is) used for illegal activities.

Circle immediately froze the USDC in those accounts. GitHub suspended contributors to Tornado. Even if you didn’t do anything illegal but you have some assets on the platform, it will be frozen - $437m of assets blocked.

Huge Seed round for crypto infrastructure company

$22.5M Seed round for a one-stop-shop web3 infrastructure company called Fortress Blockchain Technologies based in Las Vegas.

Looking at the services they offer, this is really one-stop shop for everything in web3 - wallets, payments, NFTs, and royalties. Customers can easily connect to Fortress API and build any product to support their crypto/web3 project. Also, super important, they solved all compliance and regulatory requirements, so you can launch your products in a week. Unfortunatelly, there is no pricing on the website.