🌊The Fintech Wave #43

We are welcoming 76 new subscribers since last Monday. In the EU almost nothing this week in the fintech world, looks like everybody are on vacation☀️, but in the USA is a different story. If you are looking to connect with investors check the Tweet at the end of the email, there are over 200 contacts in the thread.

TLDR: Check how you can invest in athletes and get part of their future pay. Robin Hood lay off more people. Neobank in NYC raises $30M. Coinbase is partnering with Blackrock. Solana wallets hacked.

If you like this newsletter please share it with friends and encourage them to sign up👇

Fintech Wave graphics

From funding to IPO. We did some research about how long it takes for fintech companies to go public. 20 years ago Pay Pal went public after only 3 years. SoFi and Wise took a more conservative approach so it took them more than 10 years. Feel free to use the graphics for your posts on social media.

Europe News and Funding

Angel invests in young athletes🏃

I came across a pretty cool app for alternative investments - Moonshot - an app that let you invest in athletes.

The idea is to match promising athletes with people who would invest in their careers and later receive part of their earnings. Any athlete can reach out to Moonshot and the pickup which athlete will be able to raise funds via their app. To ensure future paybacks, athletes and backers are signing the contract. Athletes can ask for up to $300K.

Pretty cool idea and I hope it will gain some traction. The company got funding from Y Combinator.

Americas News and Funding

This is why we need fintechs to build more lending products

When you apply for a loan/mortgage/credit card your financial institution contacts one of these 3 bureaus to check your credit score and based on that they approve (or not approve) your application. Also, the interest rates will depend on credit score.

WSJ reported that Equifax provided the wrong credit scores of the customers.

In short, that means that customers didn’t get their applications approved, or if they were approved, interest rates were higher than what they should be. This is literally billion dollars mistake, for which nobody will be responsible. Luckily, there are a couple of startups that are building alternative risk models for lending (such as Upstart) which the current system in the USA desperately need.

Neobank💳 focused on small businesses raised $30.4M

For banking, they offer checking account, with unlimited 1% cash back and up to 1.00% APY, no monthly fee, and unlimited transactions. Pretty good offer for startups.

Also, they support SMB (small and medium business) lending for commercial real estate. Interestingly, they have special lending offers if you are planning to buy a yacht for up to $10M. Not sure many small businesses will use this option, but good to have it.

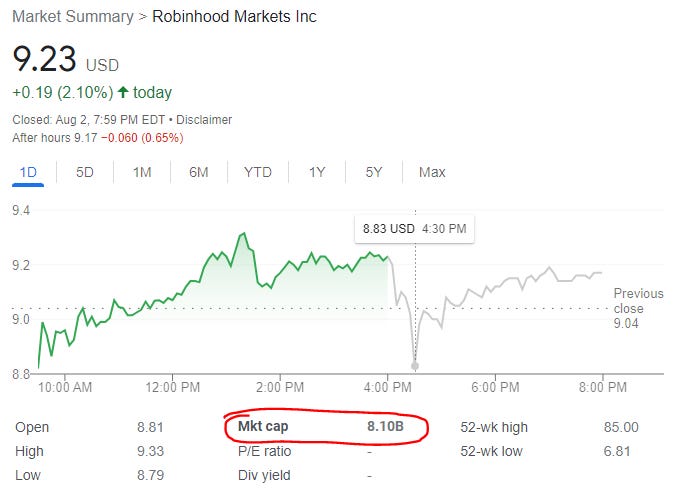

Robinhood lay off 23% of its workforce

A couple of months ago they cut 9% of the jobs and now 23% after Q2 reports came out. Revenue is lower than expected, and the number of monthly active users decreased for the 4th quarter in a row so it doesn’t look good for Robinhood. Shares went down a few % after the report was out.

Also, an interesting thing - the company has a market cap of $8.1B, of which $6B is cash, so the Net Present Value of the company is “only” $2.1B, which makes it a good target for acquisition.

Crypto ₿ites

Solana wallets hacked

One of the most popular blockchain networks, Solana, has been hacked on Wednesday. Around $5M has been stolen from around 8.000 wallets including Phantom (no1 wallet for Solana). Once again, looks like the only way to securely store your crypto is to buy a hard wallet and keep coins offline.

Coinbase partnering with BlackRock🤝

Big news from the crypto world today. Coinbase announced that they're partnering with BlackRock, the largest asset manager in the world ($10 Trillion under assets).

With this partnership, institutional clients of Aladdin (BlackRock's investment management platform) now have direct access to crypto trading, custody, and prime brokerage through integration with Coinbase Prime.

Coinbase shares jumped 30% on the news.

Tweets and Threads of the Week