🌊The Fintech Wave #42

TLDR: Make money by selling your data. Investing in lawsuits - coming soon. We are introducing Fintech Wave Graphs. A social investing app from Europe raised $40M. Real estate investing apps are becoming popular in the USA. One more crypto exchange is close to bankruptcy.

If you like this newsletter please share it with friends and encourage them to sign up👇

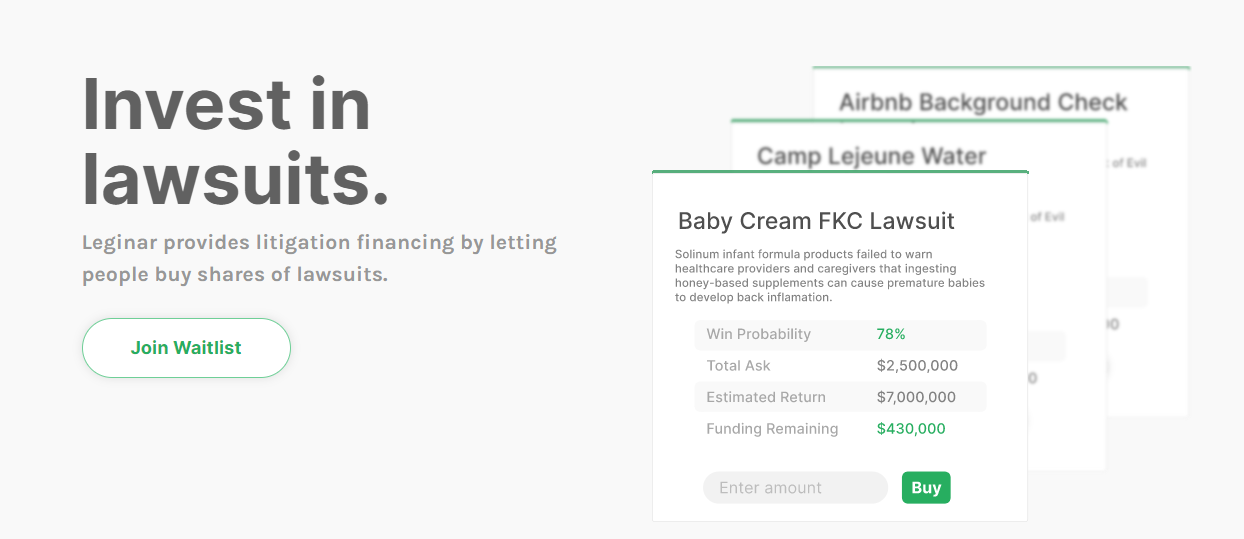

Now you can invest in lawsuits. Yes, you read that right.

Last week, I was doing some research about alternative investments I came across this unusual idea. A startup called Leginar is building an app that will allow you to buy shares in the lawsuit, starting from $10. In case your lawsuit wins, you get a part of the proceedings. They promise up to 30% return on investment.

Currently, the app is still not launched, only the waitlist is open. Not sure if the concept will ever be live, but it’s definitely interesting.

Introducing Fintech Wave graphics

Everybody loves graphs and graphics, so we will try to create at least one new interesting graphic per week. Feel free to use it and share the graphic for your posts. This week we analyzed % of cash payments in some European countries. We excluded Scandivanian countries because cash payments account for only 3-5% of total payments (almost cashless societies).

Europe News and Funding

$40M for social investing app

The app is focused on first-time investors where they can exchange investing ideas with friends and follow their investments in real-time. IMHO the best feature is that it is possible to buy fractional shares - just a % of 1 share - so users can start investing with $1, which makes investing accessible to everyone and remove any barriers. So far the app is used by 150.000 people.

Americas News and Funding

Exchange your data📊 for money

Pogo raised $14.8M Series A to allow users to exchange data for money. Since we already giving our data everywhere, why not make some money from it? It’s a great idea and based on reviews, this could be a new unicorn in a few years.

This is how it works - after you download the app, it connects to your data and your debit/credit card so it can track your purchases. For example, whenever you buy something online, the app takes info about the purchase and sells it (.

You are getting points every time you use a card - 2 to 4 points per purchase. Each point is $0.01 in value. Users will need at least $3 in rewards, which equals 3,000 points, to cash out via PayPal or Venmo. This app will not make you rich, but you can still make a few bucks.

Buyers of data are mostly consumer fintech companies that use data for all kinds of analysis and projections. The app has 20K reviews and an impressive score of 4.9/5. Currently only available for US market.

Apps for investing in real estate are on 🔥🔥

Nada, a real estate investing app, raised $8.1M. Week earlier similar app called HERE also raised funding.

This is so far the most advanced real estate investing app; maybe even too complicated for beginners. I will explain later why. Once you open an account you even get a debit card that collects points on each purchase so that users can later these points use toward investing in real estate.

$250 is the minimum to start investing in this app. Here is the catch - you have to invest in their own investing product called “Cityfunds” - an index-like fund that provides targeted exposure to a single city’s residential real estate market. This allows you to target specific high-growth cities such as Miami, Austin, etc. “Cityfunds” only invest in single-family residential real estate

What about returns? Nada we expect to generate annual internal rates of return “IRR” of between 12% and 16% over a 7-year period.

It is a really advanced options platform for real estate, and it will be interesting to follow the returns after a few years.

Crypto ₿ites

One more crypto exchange suspended withdraws📉

Crypto exchange, Babel Finance lost $280M of customers' money on trading and stopped the withdrawals due to liquidity problems. Now they plan to convert debt into equity, so every customer will get some equity although probably most of them would like to just withdraw funds.

Ironically, their website description says that they have your best interest in mind😂

Tweets and Threads of the Week