🌊The Fintech Wave #40

Hi all, we are back after the short summer break. Great week for European fintechs, 8 of them raised money this week. German Insurtech startup wefox raised $400M A bit slower in the USA. In the crypto world - mostly bad news - bear market, a lot of exchanges are suspending withdraws, users cannot get their coins, and a lot of layoffs.

TLDR: EU fintech startups raised more than $1B this week. BNPL Klarna raises $800M but at a much lower valuation. A new platform that lets you invest in real estate as easily as in stocks. Crypto bank, Celsius bankrupt, owning customers $4.7B. NFT marketplace OpenSea lay off 20% of its workforce.

If you like this newsletter please share it with friends and encourage them to sign up👇

Europe News and Funding

Buckaroo acquired🤝SEPAY

With this new acquisition, Buckaroo will become one of the leading online payment systems in the Benelux region. SEPAY will bring additional 13,500 customers with a strong footprint in the retail industry. SEPAY is a profitable business, with a revenue model that is primarily subscription and transaction-based with flexible solutions, such as leasing, buying, or renting PoS (Point-of-sale) devices to SME (small and medium enterprises) clients. The combined group will serve 27,000 customers and process c. €10bn in transaction volume.

The European version of RobinHood📈 raises $25M

London-based Lightyear wants to become RobinHood app for Europe offering commission-free trading.

What makes it different from its competitors is the offering of multi-currency accounts which helps bridge the FX rates between EUR and (mostly) USD. Since trading is free they make money from FX conversions - a 0.35% conversion fee that's taken from the pre-conversion amount. I hope they don’t sell your data to hedge funds like Robinhood. The app is available in 19 EU countries.

Klarna raised a new round at 1/7 valuation of the previous round😲

Huge correction in the private market. Buy Now Pay Later giant Klarna raised a new round (around $800M) at a $6.5B valuation. Last year they raised a round at a $45B valuation led by Softbank.

Interesting things about Klarna:

The company is profitable for the last 14 years

150M users

Available in 20 markets

Other European fintechs that raised money this week👇

Kadmos - €29M, Series A

Open Credits - €11M, Series A

wefox - $400M, Series D

Morpho Labs - $18M, Series A

Quartr - $7.1M, Seed

RIDE Capital - €3M, Seed

Americas News and Funding

Investment platform for vacation properties🏠 raises $5M Seed round

Miami-based startup Here is making investments in rental properties easy as investing in stocks. The money is raised from Fiat Ventures, Liquid 2 Ventures, Mucker Capital, Basecamp Ventures, and others.

They are trying to provide the holly grail of investing: stable passive income. Starting from $100, investors can buy shares of the property. Here is doing day-to-day operations such as property management and bookings, while investors just collect % of net income. Also, each property is held in an LLC and covered with property insurance that shields investors from personal liability.

This is a pretty new asset class and on paper, everything looks great, but we will need a few years to really see the returns on investment. There are a lot of stakeholders involved in the process: investors, Here, and property management, so everybody needs to get their share of the pie. Personally, it is one of my favorite fintech/proptech ideas and I hope they succeed.

Crypto ₿ites

Make sure to transfer your coins from exchanges to your wallet

Due to bear market and losses, a lot of exchanges are not allowing users to withdraw their coins (for example Celsius Network). The best thing you can do now is to move your assets into wallets (like Metamask, Phantom, etc). Even better if you have cold storage, move it there and store it in a safe place.

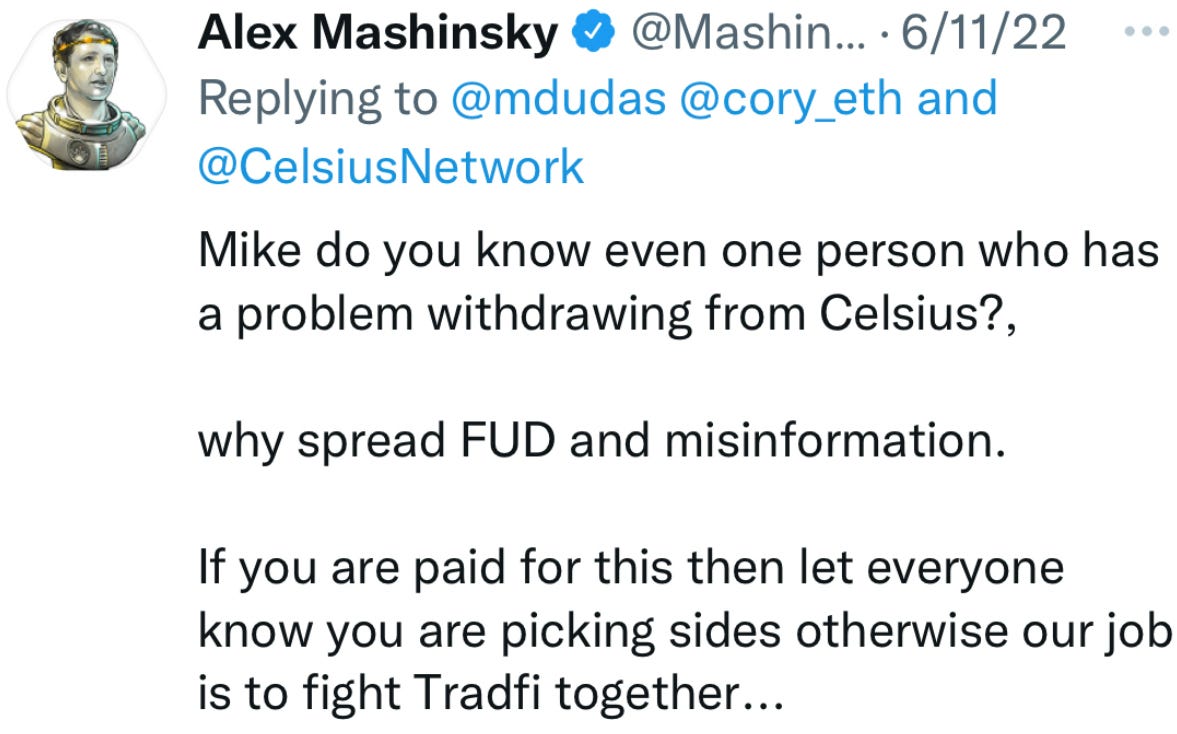

Celsius Network declares bankruptcy

After they suspended crypto withdraws, it was just a matter of time before this would happen. Millions of customers will lose all of their cryptos. The company has only $176M of cash, while obligations to the customers are $4.7B. Just a month ago Celsius's CEO was telling people on Twitter that everything is fine and withdraws are working.

Just to remember, Celsius was offering a 17% yield on staked crypto. As long as it was working nobody asked how is that possible. Now we know. It was all a Ponzi scheme.

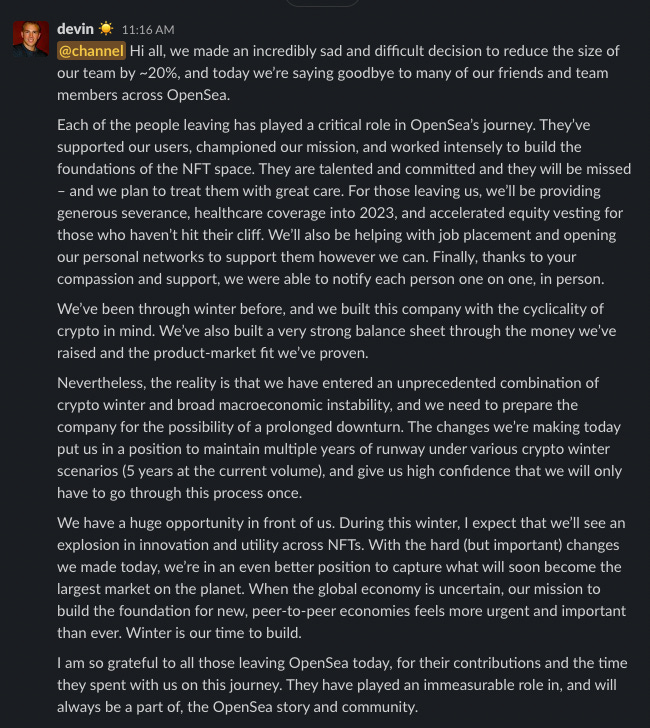

OpenSea🖼️ lay off 20% of its workforce

The CEO of the largest NFT marketplace (valued at $13.3B), just announced that it will have to let go of around 20% of its people due to the bear market. Trading volume on OpenSea is down 95% compared to last year, so this decision isn’t a surprise. Below is the email sent to employees👇

Tweets and Threads of the Week