🌊The Business Wave #68

TLDR: Google stock is up 10%. Energy drink stock you should pay attention. Nuclear fusion reactor to power AI. Fintech that manages employee pensions raised $95M. Zuckerberg just won his first Jiu-Jitsu Tournament🥋. LendBuzz secured new credit facility.

Investing

Billionaire lost $10B after short-seller published report

Short-seller Hindenburg Research published a new report. This time it's about Icahn Enterprises, owned by famous investor Carl Icahn. The stock is down 35%. Since he owns 85% of the company, he lost more than $10B within 24 hours. Hindenburg accuses Ichan that he is running a Ponzi scheme - using money taken in from new investors to pay out dividends to old investors.

Who is Carl Icahn? He is the most famous “corporate raider” - he buys a large number of shares in a corporation whose assets appear to be undervalued (mostly via hostile takeovers). You can find the report here.

Some years ago, he also tried to take over Dell from Michael Dell, but (Michael wrote this in detail in his book “Play Nice But Win”)

The best way to increase stock price

Google stock is up more than 10% after its CEO mentioned AI around 100 times in a recent presentation. More CEO will probably follow

Energy drink stock⚡you should pay attention

I don’t follow the food and beverage industry a lot, but Celsius stock is the one I’m bullish on. Celsius is the fifth most popular energy drink in the USA market. The company is crushing sales QoQ. Also, the global energy drink market has already surpassed growing at 9-10% per year.

Last year the company signed a $550M contract with Pepsico - a long-term distribution agreement for Celsius that gives the Pepsi owner an 8.5% stake in the company and a director’s seat on its board.

Q1 results beat all the estimates👇

Revenue $259.9M (up 95% YoY) vs estimates of $219.6M

Gross profit of $114M (up 111% YoY)

Net income of $34.4M (vs estimates of $16.8M)

IMHO, it is by far the best energy drink I ever tried.

Technology

Nuclear fusion reactor🔋to power AI

Helion Energy is one of the most promising nuclear fusion startups. Nuclear fusion, or “the Holy Grail of energy”, is a potentially limitless source of clean energy that scientists have been chasing for more than 50 years. Helion already raised more than $2.2B from investors like Sam Altman (OpenAI co-founder) and now it signed an agreement with Microsoft that will purchase electricity from a nuclear fusion generator.

Since Microsoft is an investor in OpenAI, it could be entirely possible that AI models will be powered with unlimited clean energy. Also, Helion committed, that they will target power generation for Microsoft of at least 50 megawatts or will pay financial penalties. If they succeed this is huge for humanity.

Twitter will become the poster child for other software companies

Twitter is now operating with only 10% of the workforce before the acquisition, but it's shipping more products than ever: encrypted DMs, voice and video chat, etc. Still waiting to fix the bookmarks to make it searchable and that's pretty much it. This is just proof that many SaaS companies are overstaffed.

Zuckerberg just won his first Jiu-Jitsu Tournament🥋

One of the best entrepreneurs of our times just won his first martial arts tournament. Meta stock is up 87% since the start of the year. Huge win energy, I wouldn’t bet against him and Meta.

Startup News and Funding

More debt for LendBuzz💰

Boston-based fintech company announced that it closed a $125 million credit facility with Royal Bank of Canada. We already wrote about LendBuzz - the company is using AI to help consumers obtain access to credit when purchasing a vehicle.

Lendbuzz can assess the creditworthiness of consumers with limited credit history—a group underserved by traditional banks (which is more than 50M people in the USA). Interest rates for their loans start at 5.4% which is not bad. I expected much more.

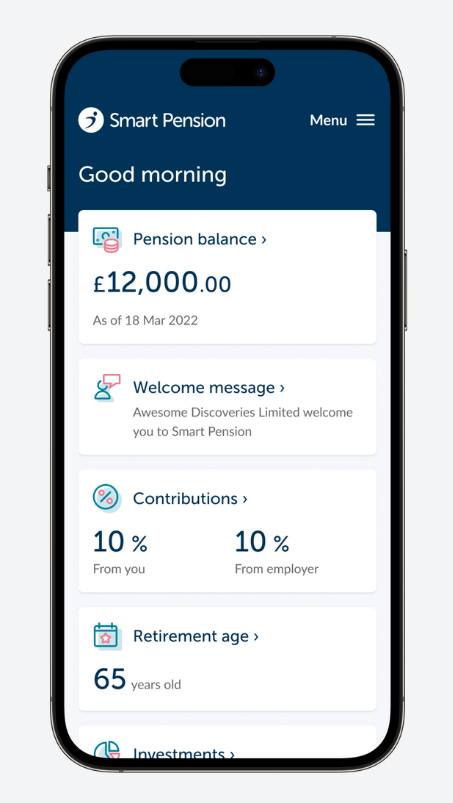

$95M for employee pension management software

Londong-based company Smart raised Series E to improve its global savings and investments technology platform provider. The company was launched in 2014 by when the UK rolled out mandatory workplace pension auto-enrolment. It is a great example of a good launch timing.

This is especially important for EU customers - where your government automatically deducts money for pensions and most of the people have no idea how much they saved or what their future pension could/should be.

Smart already has over £5.5 billion in Assets Under Management (AUM). Smart Pension, serving more than one million savers and 70,000 employers.

Tweets of the week

I think he might be right👇

The largest companies in the world👇

This makes you wonder👇

Discussion on Twitter about networking events. I kinda agree with the below. Never saw value in these events👇