Hi all,

and welcome to 5th edition of “Business Wave Investment Club” 🎉🎉🎉

Today we are going to talk about one old dog that can still learn new tricks…

That dog name is…

Why IBM?

Well, IBM is part of S&P 500 index from 1957 but if we go back 10-15 years and see which companies actually drove S&P 500 index to its highs…IBM is not there.

Microsoft, Apple, Meta, Alphabet, Amazon…those are “hot” companies, but IBM has problems catching up with them. Even with all this AI development going on, you don’t really hear about IBM, don’t you?

So, does IBM has a future?

We are here to find that out 😉

If you ❤️ this post

Or if you got here through a friend, and you are still not subscribed 👇

IBM intro

Wow, how to write an intro on such company?

IBM's origins can be traced back to the 1880s, with the founding of several companies that later merged to form the Computing-Tabulating-Recording Company (CTR) in 1911. This company was renamed IBM in 1924 under the leadership of Thomas J. Watson.

Btw, if you want to know more about Thomas J. Watson, you can read it HERE

Did you know 👇

During World War II, IBM collaborated with Harvard University to create the Automatic Sequence Controlled Calculator, also known as the Harvard Mark I, one of the first large-scale, automatic digital computers in the USA.

In 1981, IBM introduced the IBM Personal Computer, commonly known as the IBM PC, which played a significant role in popularizing personal computers. If you thought that AI was brought to light by OpenAI, you are wrong.

In 2011, IBM made headlines with Watson, an artificial intelligence system capable of answering questions posed in natural language. Watson gained fame by winning the game show "Jeopardy!" against human champions.

Currently, IBM operates in more than 175 countries, and is one of the most recognized companies worldwide.

IBM Revenue & Business Model

Ok this one is going to be a big one 😂

Now, we won’t go into too much technical/financial detail, what we want to know is what products and services IBM offers, and how much they earn from it.

If you want to look at the reports yourself, you can find them HERE.What is cool about the IBM Investor Relations page is that they have data such as stock history, investment calculator, and stock charts

Periods that we will look into are 2022 (whole year), and Q3 2023.

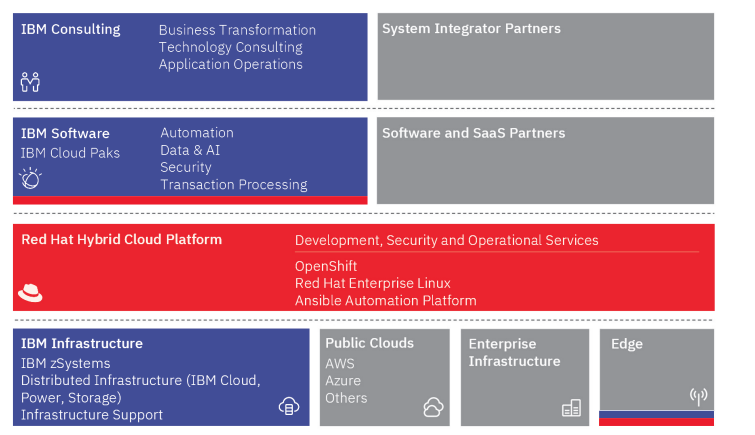

IBM has 3 “revenue” centers

IBM Infrastructure

IBM Consulting

IBM Software

or to put that into the picture 👇

Source: IBM Annual Report 2022

The gray area in the picture is important to understand the IBM business model 💡

IBM relies a lot on its partners to sell & implement their products and services. IBM operates in more than 175 countries and each country has partnerships with companies that are specialized in implementing IBM products.

For instance, one company can specialize in implementing IBM data-related products, another one can specialize in cybersecurity, etc.

Sales can be partner or IBM lead, depending on who has better connections withing the target company. This is nothing unusual because IBM's competitors operate the same way.

What IBM is trying to do differently is to be “open” to competition. Of course, the best possible solution for IBM would be if everything in your company had the IBM logo on it but it’s not realistic. For instance, if you decide to run your whole infrastructure on the AWS cloud, IBM products will work just fine.

A huge part of that strategy was the $34 billion acquisition of Red Shift in 2018.

What bothers me about IBM is the lack of products that will drive their sales up.

The good news is…what they can’t produce, they can buy 😂

Keep reading with a 7-day free trial

Subscribe to Business Wave to keep reading this post and get 7 days of free access to the full post archives.