Real Estate🏠investing apps

We are super excited about this deep dive. There is a fintech trend that allows you to invest in real estate the same way you invest in the stock, which is a super interesting concept, we did some research to figure out how it works. Take 10min of your time to learn about this. Let’s goooo➡️

INTRO

Most of the world's millionaires made money in real estate. “90% of all millionaires become so through owning real estate.” This famous quote from Andrew Carnegie, one of the wealthiest entrepreneurs of all time, is just as relevant today as it was more than a century ago.

In almost all cases, traditional investing in real estate requires heavy upfront capital and because of that, it is out of reach for most people. With the advancement of financial technology, some startups are working to democratize access to real estate investing in the same way that Robinhood brings stock investing to millions of people by removing most of the fees associated with trading and holding investment accounts.

The Holy Grail of investing is receiving passive income. When you combine that with real estate as an underlying business, the idea is very powerful.

We are still pretty early, so it will take years to see if offered business models actually make sense both for startups and investors in terms of profitability. But for now, we did deep dive into current offers on the market

As expected, this trend started in the USA, but there are a few startups in Europe that are also working on this. So, let's deep dive into the business models and risks and in the end, we will do a quick overview of that app that you can use to invest in real estate.

So how it works⚙️?

The main idea is to offer an investment in real estate with the same ease as investing in stocks - open an account, transfer money, and start investing with a couple of dollars (yes it’s possible).

Instead of tens of thousands required to get into real estate, investors can now get into real estate with $100. Sounds too good to be true, but the business model actually makes sense.

A startup (or app) buys the real estate (house, condo, etc.) via bank financing (usually 30 yrs mortgage)

Then, they form LLCs for every real estate and create shares, so ownership can be split among more parties - there can be hundreds of co-owners.

Customers can buy shares (usually in $100 increments) and own % of the property.

These companies then rent the property to start marking cash flow. Some apps specialize in long-term renting, while others are looking to utilize Airbnb for short-term rental.

Idea is that rent is covering the mortgage, interests, property management, and app fees. Everything that is left from the cash flow is going to investors as passive income. And you can start with $100. Sounds like the best deal ever. And it could be if everything works as planned.

Also, the good thing is that you can always sell these shares if you no longer want to own them.

How do the apps make money💰?

Management fees - they charge % of the monthly rent for managing the property (tenant screening, admin, renovations, etc.)

Acquisition fee - a few % of the property purchase price to cover admin work when acquiring property - property search, underwriting, closing, and reporting. For example, if a property cost $100K; the app will put it on market for $106K to cover the costs.

Risks⚠️

Of course, nothing comes without risks. There are 2 main assumptions that need to happen in order for this model to work for investors and for the app

Real estate prices will continue to rise in the mid and long term

Rent prices will also continue to rise (both for short-term and long-term rental)

I think it fair to agree that these 2 assumptions have a pretty good chance to be true. Historically this was true if you zoom out 100 years back. In the short term, prices can go down, but it is expected to grow in the mid to long term.

But the problem in a short term is if the house prices continue to fall for a year or two, and demand for short-term rentals plunges, the question is can these startups survive that? Probably they could but that means that you as an investor won’t see much of a return because there will be nothing left from the rent after mortgage/ property management and insurance is paid.

In the long term, real estate prices in the USA and in most of the EU are only going up. Also, after Covid is over, demand for short-term rental is growing (Airbnb recently posted a record quarter both in bookings and revenue).

House prices briefly went dont for free years after the global crisis in 2007 but, when you zoom out, in general, they are just going up.

We came across 3 apps for the USA market and 2 apps for the EU market.

LANDA (USA)

Landa is probably the most affordable of all of these options. You can start with as little as $5; they split properties into 10.000 or 100.000 shares to make it affordable for anybody to invest.

It works pretty simply - they list the properties in which you can invest and you buy as many shares as you want. After they rent the property, you receive dividends based on the amounts of shares you own.

LANDA pays monthly dividends.

The issue I see here is that, if you can invest $5 in the property, there can be literally thousands of co-owners. Imagine the administration where you need to follow all these co-owners of a single property - hope the company has some good automation tools in place, to keep these costs low.

The company is pretty transparent and in its “Help” section so you can find answers to any question you might have. As I can see from the website, they are mostly buying houses in Georgia.

If you want to sell your shares and liquidate your investment, you can also do it via LANDA marketplace at any price you set up, but it could be hard to sell since this is no stock exchange with millions of potential buyers.

The app is used by 30.000 investors.

NADA (USA)

https://www.nada.co/

Nada is a bit more complicated app in terms of how it works because as a customer you are not buying shares in the property. Instead, you are buying shares in the index-like fund that represents the housing market in a single city where the NADA app invests.

They called this index Cityfunds. So, Cityfunds is buying single-family houses and renting them. If the home value goes up and they collect monthly rent, the index should go up. If you own the Cityfunds index you are entitled to receive dividends distribution (which starts in 2023).

Currently, when you buy the Cityfunds index, you cannot sell it because NADA still doesn’t have a secondary market for it (at the moment of writing this). As you can see targeted returns are extremely good - up to 15% IRR.

The minimum amount to start investing via NADA is $250 and the startup is focused on buying homes in high-growth areas such as Austin, Dallas, Miami, and Tampa.

Also, if you are a homeowner you can sell equity in your home to NADA and get cash which you can spend however you want. NADA is betting here that the home value will go up over time and their equity will be worth more.

To be honest, we like Landa's business model more, because it is more simple and more straightforward for the average investor. It is great to see all the use cases that NADA offers, but it might be overkill with so many options and features. I would rather have direct shares of the property than own an index fund.

HERE (USA)

HERE is different than the 2 previous apps because it is focused on buying properties for short-term rental (mostly via Airbnb). They offer customers the ability to earn passive income from the highest-yielding asset class in real estate with vacation rentals.

Why did they decide to buy properties just for a short-term rental? Based on their research vacation properties generate 160% more revenue than long-term rentals.

In terms of how it works, it is similar to Landa. Each property is owned by an LLC, which is divided into thousands of shares, so you can start investing from $100.

HERE is taking care of everything - booking the property, cleaning, insurance, etc and investors are receiving a passive income after all expenses are paid for the property.

The app makes money in 2 ways:

Asset Management Fee - HERE collects a quarterly asset management fee of 0.25% based on the total asset value of each property on the platform. The fee is paid out of the income from the property each quarter. This fee covers services such as asset management, automated payout distributions, and investor relations.

Property Management Fee - property management fee of 25% based on the gross revenue that a property generates over the lifetime of a property’s operations. This fee is paid out of the income from the property each month. This fee covers services such as property cleaning scheduling, guest relations, maintenance, repair management, and booking management, among other responsibilities.

Property management fees seem a bit high, but at least there are no hidden fees.

Also, they have a huge FAQ section, where they answered all questions investors might have.

BRXS APP (EU)

Amsterdam-based BRXS app allows users to in long-term rental properties. With BRXS you can invest in rental properties from €100. Investors will receive quarterly interest payments from rental income and benefit from appreciation (if prices of real estate go up).

So far, BRXS is offering properties in the Netherlands market which is great, because this is a strong rental market. The app is pretty good because you can check potential earnings on each property they offer and find what works best for you.

The good thing is if you want to sell your shares BRXS will buy them from you.

BRXS makes money with 3 revenue streams:

Transaction fees: 1% if you are selling your investment

Offering fees: these can vary from property to property to cover costs for property search, acquisition, etc.

Management fees: 6-8% of gross rent, which is automatically deducted before distributing profit to investors.

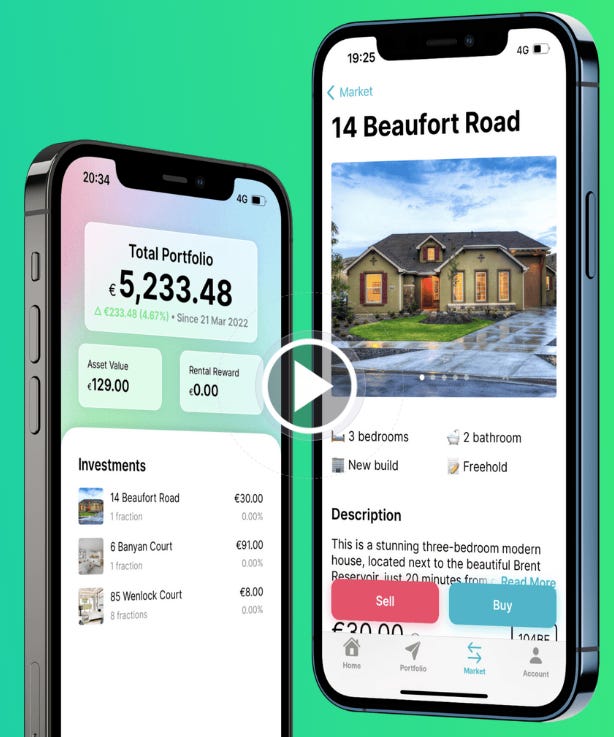

Proptee (USA, EU, UK)

Proptee is combining blockchain and investing in real estate. It allows people to invest in real estate starting at only $1. So, how that works?

Proptee buys properties in the USA, EU, and UK and creates virtual tokens that represent these properties. Every week Proptee lists a new property for which you can buy tokens. Each property is fractionalized into either 10,000 or 100,000 fungible tokens.

Another thing is that Proptee doesn’t specialize in specific properties - they buy both residential and commercial properties. Also, they do long-term rentals and short-term rentals. I like better when the startups are concentrated on one niche market.

The app states that investors can earn up to 25% APY, which is ridiculous IMHO. You can see the crypto hype here.

How Proptee makes money?

The startup is charging 0.5% buying and selling fractions (the first €1,000 of investment is without fee).

Also, they charge 10% of the monthly rent for admin and property management costs.

This is a pretty innovative concept of putting real estate onto the blockchain, but I just wouldn’t be confident investing via this app. Too much risk if something goes south.

If you like this, please share the newsletter with your friends.

This is not investment advice. Do your own due diligence.