Hi all,

Nubank published its Q1 2023 report, and the results are pretty much spectacular. Let’s dive in together into this fascinating story!

Btw, if you are new here, consider subscribing to our newsletter, your support means a lot to us!

Let’s talk about Nubank customers

In terms of customers, Nubank finished Q1 with 79,1 million customers, and based on their projections they should reach the 80 million mark by April 2023. Since it’s May they most likely already reached the number or they are close to reaching it.

Now, 80 million customers is a large number, but how does Nubank compare to European and North American fintech?

Not bad 😎

The most famous Nubank competitor is Revolut, and Nubank at this point has 4 times more users even though Revolut is available all over Europe.

On the other hand, Nubank operates only in 3 markets: Brazil, Columbia, and Mexico.

Customer penetration they have there is scary 👇

If Nubank achieves similar results in Mexico and Columbia in terms of customer penetration, you are looking at 150 million customers bank 😬

Are Nubank customers active ones?

A lot of fintechs like to present their numbers favorably. One of the ways to do this is to say that you have XY amount of customers even though the majority of your customers are not active ones or they are using your application only on specific occasions.

Is Nubank the same? Are their customers active?

Based on the data they provided…82% of their customers are active. This is how Nubank defines an active customer

”‘Active Customers’ relates to all customers that have generated revenue over the last 30 calendar days, for a given measurement period.”

And how many of the customers are using Nubank as their primary account?

I would be worried if I was the incumbent bank 😶

Diverse Nubank offering

Over the years Nubank developed a product stack that enables its users to pretty much do everything financial-related inside the Nubank application. From regular cards all up to crypto and insurance…Nubank got you covered 👀

But, how many Nubank products users use on average?

As it turns out, the number is 4 products per active customer! Ask yourself…how many products are you using from your “regular” bank?

It all comes down to…the bottom line 💵

Now that you know how many customers Nubank has, and its product offering…it would be nice to know did they made any money.

Based on Nubank data from Q3 2022 Nubank started reporting Net Income. For Q1 2023, they reported $142 million Net Income.

If their financial metrics continue in the remaining quarters, 2023 will be the first profitable year for Nubank. In 2022 their net loss was over $100 million, but it’s quite possible that in 2023 they will “cover” both 2021 and 2022 losses.

However, with Nubank it’s always about how much growth room they still have even though they are present only in three markets.

Check this out 👇

This data is for Brazil only, but Brazil is by far Nubank biggest market. Nubank is only 9 years old, and already they show better results in key growth metrics than their incumbent banks competition.

How is Nubank making money?

If we want to make things simple we can say that Nubank is earning money from 2 categories:

Interest income

Commission income

Interest income breakdown

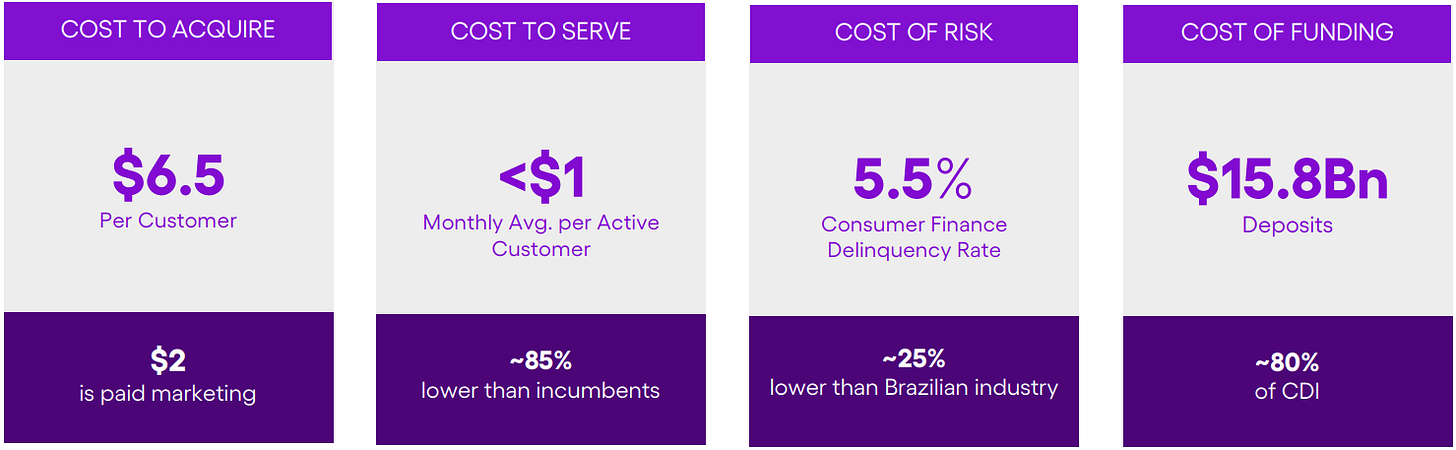

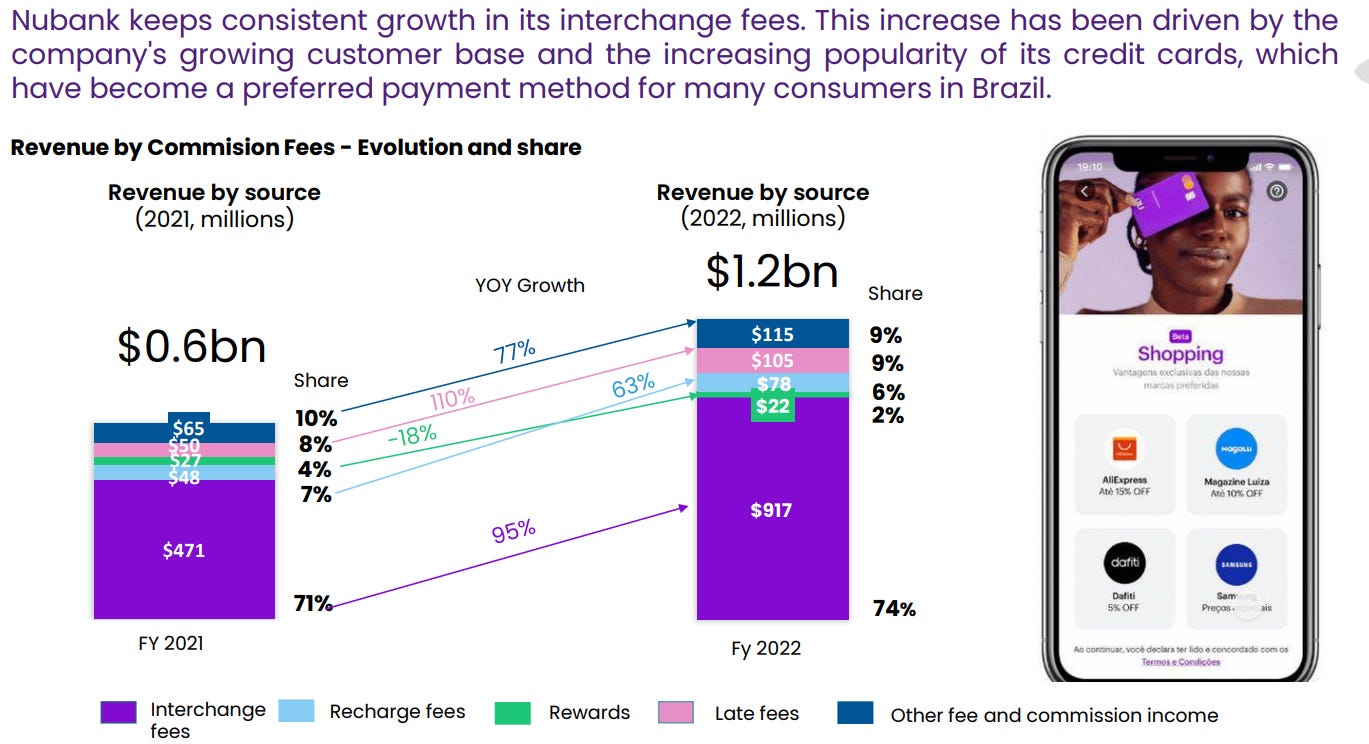

Commission income breakdown

This is it!

In case you loved this Nubank piece, feel free to share it!