Hi all,

and welcome to the 3rd edition of “Business Wave Investment Club” 🎉

Today, let's talk about something really important in investing: choosing some less flashy stocks for your portfolio.

It's great to snag shares of big names like Amazon, Microsoft, or Tesla when they're cheap and watch them jump 100% or more in a year.

But what if you buy high and the value drops?

A lot of investors, especially the smaller ones, miss out on many good stocks because they don't do enough research.

But you're in luck! Being part of the "Business Wave Investment Club" means you won't make that mistake 😉

Just a heads-up, next week will be our last "Business Wave Investment Club" post for our free subscribers.

So, if you're liking what you see, consider joining as a paid subscriber. It's just $8 a month 👇

Also, if you like this post, you can share it here 👇

But now, let’s dive into “not sexy” stocks!

What are “not sexy” stocks?

This depends on your individual preferences but for us “not sexy” stocks can be found in “old industries” or industries where there are few structural changes, stocks of companies that have been on the market for 50+ years, or companies that are year after year paying dividends.

We are talking here about companies in industries such as telecommunication, energy, FMCG, banking, and so on.

This is a great example 👇

ExxonMobil has been parsing out payments to its shareholders since 1882, meaning its streak of consecutive dividends stands at 140 years.

ExxonMobil operates in an industry that is the backbone of the whole world, and it’s paying dividends every year.

You can’t expect it to grow 100%+ in one year but on the other hand, even if the stock loses its value due to some “out of the box” world event it will come back up 👇

Due to the Covid-19 crisis, the stock went down to $36.95, and today’s price is $102.34.

Speaking of Exxon Mobil, if you are looking for stocks that are paying out dividends, you should read this article

But, anyhow…you get the picture of what “not sexy” means to us when we are talking about investing and stocks.

In today’s edition of the newsletter, we are going to focus on stocks that are investing in real estate.

Why real estate?

Real estate is somewhat of a boring industry (everybody has to sleep/work somewhere), and yet it has its ups and downs which correlate with the overall global economy health.

This makes it a good investment opportunity if you are patient and looking to earn money in a mid-term period.

Unlike the previous two “Business Wave Investment Club” editions today, we won’t be focusing on the analysis of one stock but instead, we’ll be analyzing two stocks!

Of course, we won’t go “deep, deep dive” into each stock because the newsletter would be so long that even my wife wouldn’t read it till the end but you will still find plenty of information in it 😉

So, are you ready?

Easterly Government Properties Inc (NYSE: DEA)

Easterly Government Properties Inc (NYSE: DEA) is a real estate investment trust (REIT) focused on the acquisition, development, and management of Class A commercial properties that are leased to U.S. Government agencies. Founded in 2015 and headquartered in Washington, D.C., Easterly Government Properties has established itself as a key player in the niche market of government-leased properties.

The company's portfolio predominantly includes properties that are leased to various government entities, ensuring a stable and predictable income stream, given the creditworthiness of the U.S. Government.

Easterly’s business strategy is underpinned by a focus on long-term leases, which provides financial stability and reduces the volatility often associated with commercial real estate. The company also capitalizes on the specialized nature of many government buildings, which can create barriers to entry for potential competitors.

Past stock performance

YTD perfomance 📉

As you can see, we can’t say that the stock has been performing 😅

For the quarter ended September 2023, Easterly Government Properties (DEA) reported revenue of $72.01 million, down 4% over the same period last year. EPS came in at $0.29, compared to $0.01 in the year-ago quarter.

Source: macrotrends.net

2023 is the first year where Easterly Government Properties is not showing quarterly revenue growth which explains this year's drop in the price.

However, does all of this mean that this is a bad stock? 🤔

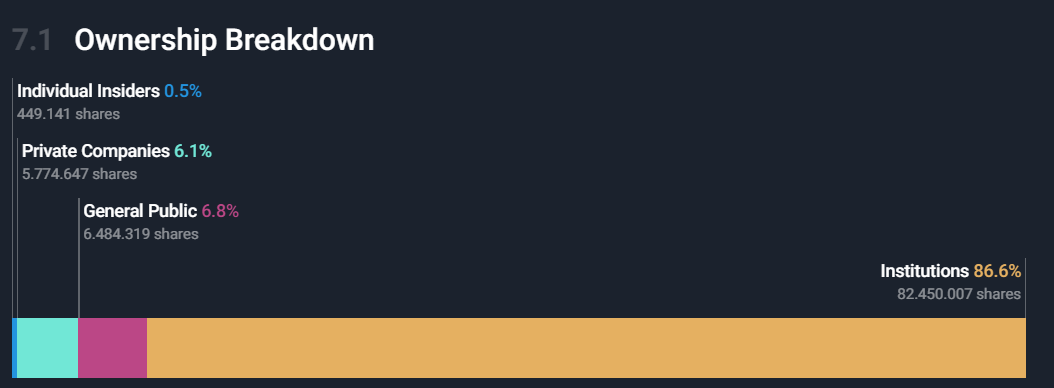

Ownership structure

Source: Simply Wall St

Source: Simply Wall St

BlackRock is one of the largest (if not the largest) investment funds in the world so it’s always nice to see their name on the ownership list. The company is owned predominately by institutions, and there must been a good reason for it…

Can you guess the reason? 😄

Stock metrics

Just a small disclaimer here - always take any kind of stock metric with a “pinch of salt”. Stock metrics are calculated but stock price depends on other people’s decisions which are not always logical or “calculated”.

Let’s take a look at metrics together 👇

Source: Simply Wall St

Earnings and Revenue numbers you see in the picture are from the latest Q3 2023 report.

$30 million earned on $298 million of revenue is a good result for this type of company but the main “driver” for buying this stock is the dividend payout.

Easterly Government Properties pay out dividends to their shareholders every quarter, and for Q3 2023 they will pay out $0.27 per share.

This means that every year they pay their shareholders more than $1 in dividends which is great for a stock that goes for $11.68 😉

Due to their business model, their cash flow should be stable (office leases to the government are long-term deals) so buying this stock makes sense.

The one thing that worries us is the Debt/Equity ratio.

Debt/Equity ratio explanation you can find HERE

Since the company is paying out almost all of their profits as a dividend this doesn’t leave them any room for buying new properties with cash. In the era of “cheap money” this is not the problem when the interest rates are low but when that is not the case…

With the higher price of borrowing money, the company won’t have too much room for future growth so they will have to lower their dividend payments or stop divident payout (worse case scenario) which will affect the stock price.

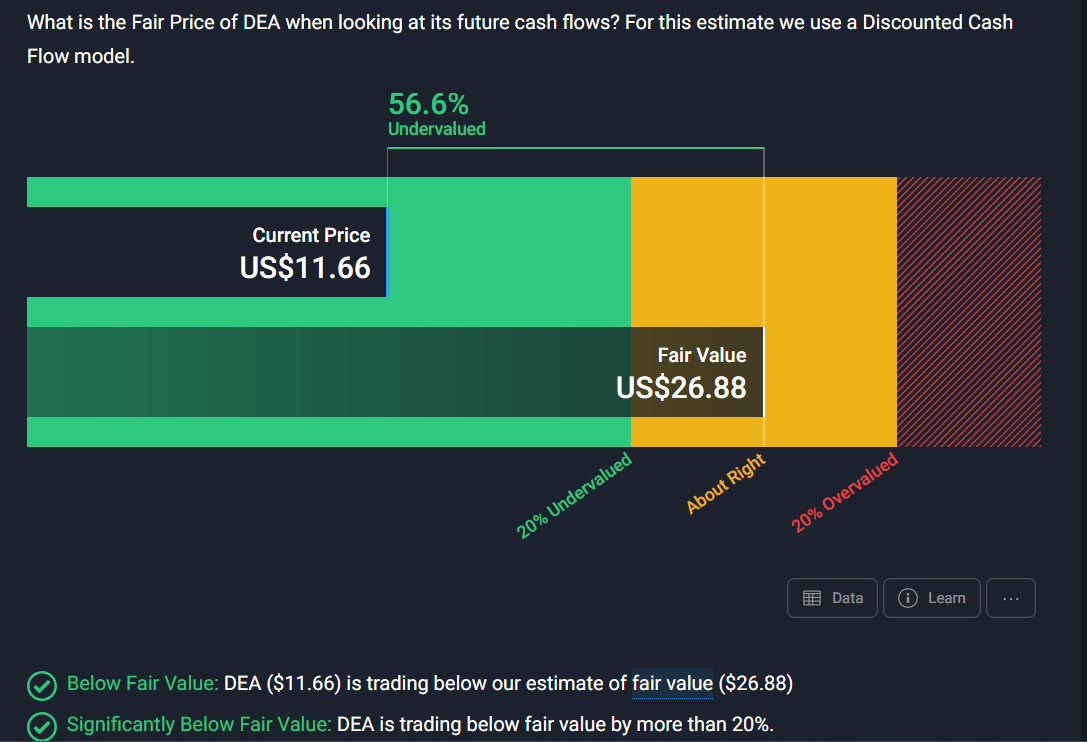

At the moment, the current price still looks good 👇

Source: Simply Wall St

LTC Properties Inc (NYSE: LTC)

LTC Properties, Inc. (NYSE: $LTC) is a real estate investment trust (REIT) specializing in senior housing and health care properties. Founded in 1992 and based in Westlake Village, California, LTC Properties primarily focuses on investing in long-term care and other health care-related facilities through mortgage loans, property lease transactions, and other investments.

The company's portfolio includes a range of properties such as skilled nursing facilities (SNFs), assisted living facilities (ALFs), independent living facilities, and memory care facilities. These properties are typically leased to experienced operators in the health care industry. LTC Properties' investment strategy is centered on capitalizing on the growing demand for senior care and health care services, particularly given the aging population in the United States.

LTC Properties operates on a business model that generates income from rental payments and interest from mortgage loans extended to facility operators. This model allows the company to benefit from the stable and predictable cash flows that are characteristic of the health care real estate sector.

Past stock performance

YTD performance 📉

All-time stock performance is more than decent but YTD performance was not “stellar”.

According to LTC Properties's latest financial reports, the company's Q3 2023 revenue is $0.19 B. In 2022 the company made a revenue of $0.17 B an increase over the year 2021 revenue that was of $0.15 B.

Source: macrotrends.net

LTC Properties do have a history of not showing quarterly revenue growth but 2020 and 2021 were special years in many ways…

Ownership structure

Source: Simply Wall St

Source: Simply Wall St

Big investment management funds like real estate investment trust (REIT) stocks because they pay out dividends every year which creates stable cash flow for their clients. However, there is a difference in ownership structure when compared to Easterly Government Properties.

General Public owns almost 29% of LTC Properties while that percentage is less than 7% in Easterly Government Properties.

Stock metrics

Source: Simply Wall St

Earnings and Revenue numbers you see in the picture are from the latest Q3 2023 report.

When compared to the previous stock, LTC Properties has a higher Net Profit Margin and EPS number but…The debt/Equity ratio is also higher 😤

With the current money “climate”, we don’t prefer companies that have a high Debt/Equity ratio but certain industries operate that way, and companies in those industries will always have a high Debt/Equity ratio.

This is the case here but we would still love to see the Debt/Equity ratio around 80%.

However…

Dividend payments are regular 💵💵💵

LTC Properties Inc. announced that it had declared a monthly cash dividend on its common stock for the fourth quarter of 2023. The Company declared a monthly cash dividend of $0.19 per common share per month for the months of October, November and December 2023, payable on October 31, November 30 and December 29, 2023, respectively, to stockholders of record on October 23, November 22 and December 21, 2023, respectively.

So, that is $0.19 per month in the Q4 2023 which makes it $0.57 for the whole Q4.

If you buy this stock by December 19th you can still “catch” dividend payout for December.

Looking long term the demand for senior housing and health care properties in the USA will grow so LTC Properties, and by some metrics, the current stock price is more than fair 👇

Source: Simply Wall St

Final Thoughts

So, there you have it!

Two stocks in a “boring” industry that are paying dividends regularly. Both companies have a sound business model and looking long term their business future is bright.

Sure, their stocks are not as exciting as tech ones but even if you “miss” the opportunity and buy their stocks on a “higher end”, regular dividend payments should offset some of the lost value in case the stock price goes down. After some time the stock price will recover (remember, both companies have a sound business model) and you will be in a good position again.

DISCLAIMER

Our content is intended to be used and must be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances.