Hi everybody, instead of fintech news, this week you will find out How to Launch an Online Bank. If you are into fintech, at least once you had to have an idea how it would be cool to launch your own online bank. After you read this newsletter, you will know how to do it. Take 15-20 minutes of your time and let’s deep dive into it.

I wanted to write about this subject for a long time. Almost every day we are witnessing a launch of a new online bank or investing app. I was curious to find out what does it take to launch an online bank or investing app, so I spend a lot of time researching. Surprisingly, there is almost no useful information online, which is strange considering how much popular are online banks.

Obviously, to launch an online bank you need to figure out your target audience and built a nice app with a cool-looking debit card. Also, it’s crucial to understand how online banks make money. But the biggest challenge is the infrastructure in the backend that actually powers your fintech startup - regulatory licenses to operate, FDIC compliance, KYC, banking accounts, debit/credit card issuing, etc.

This is the part where the whole ecosystem lacks knowledge. Or at least, that knowledge is not shared with outsiders. I think this is keeping a lot of people outside the fintech industry. If you are not deep into the industry, it is very hard to find out what you actually need to launch a consumer fintech startup. Not even to mention trying to find out how much it will cost you. A lot of infrastructure providers won’t even agree to have a call with you unless somebody recommends you. It is probably one of the most exclusive industries out there. That is the main reason for this research. I want to bring some light on it, and hopefully help everyone who is thinking about launching a consumer fintech startup.

First, you will find out how to find your target market and customers; we will go through a few successful examples. Second, understand how you will make money. Third, we will deep dive into infrastructure - licenses, KYC, banking partner, and card issuing.

I expect at least 10 new online banks after this article is published😊

Everything in this article is just for information purposes, and make sure you do your own due diligence.

Differentiation - find your niche🎯

As we already mentioned, competition is really fierce in consumer fintech, so you need to make sure you differentiate from the other online banks on the market. That is also pretty hard since in the beginning, every online bank offers the same: free checking account, mobile app, and debit card. So, the best way is to focus on a particular niche that has a lot of underserved potential customers. Some of the most popular examples: teens, freelancers, immigrants, etc. Also, you can focus on age, gender, location, or demographic.

Once you find the target market for your online bank you need to create a distribution channel to reach your customers. This is where it gets tricky. Here are a few successful and creative examples:

Stretch (example 1) - an online bank focused on people who were recently released from prison (a pretty interesting niche, I have to admit).

Stretch offers free checking accounts and Mastercard debit cards. How they will reach their target audience? The startup builds an online job board with employers who accept conviction history. This is a great example of how to build a distribution channel for your product. People will come to look for a job and some of them will open an account with Stretch.

Majority (example 2) - mobile banking for immigrants. Basic service is the same as any other online bank - free account, app, and Visa debit card.

Apart from basic services, Majority is building a membership plan with services that are useful for immigrants. Membership costs $5 per month and offers some great perks to immigrants: no-fee money transfer abroad (great for immigrants who are sending money back home to family), unlimited free calls to landlines and mobile phones, and customer support in multiple languages.

Use this framework to grow customer base:

Focus on specific customers/niche

Build distribution channel to reach the customers

Offer some benefits that are not usually within traditional banks

Let’s say you want to build an online bank for freelancers. Since more and more people are moving into freelancing work, your market is big enough.

For the distribution channel, you can create a website or a knowledge base that will be useful for freelancers (how to file tax, how to find health insurance, etc). Also, you could create a freelance job board. This will attract potential customers.

Now you need to figure out some benefits along with a banking account - maybe help with tax filing, or discounts on health insurance, etc. The best is to talk to a few freelancers to see what they would like from their bank.

This is a super important step, don’t skip it until you have a good plan. Spend as much time as you need to figure out how to reach customers. Now, let’s check the infrastructure requirements.

How do online banks earn money?

There are 4 main ways to earn money as an online bank.

The most important revenue stream is fees from debit/credit cards. When customers use a debit/credit card, Visa and Mastercard charge a fee to the merchant. An online bank receives a percentage of this fee, known as interchange.

The second is interest from deposits. Customers deposit money on bank accounts, so online banks will also earn a small amount of interest on deposits.

The third way is to create premium features and charge monthly membership. Usually, neobanks charge it between $5 and $10 per month. Some of the features offered with premium memberships are metal debit/credit cards, unlimited ATM withdraws, discounts for online stores, travel insurance at a cheaper price, etc. If you have good offers for $5/per month you can count that 5 to 10% of users will upgrade to your premium service.

For $5/per month, Majority offers this👇

For $4.99/per month, Greenwood offers this👇

The hardest way (and most profitable) is to offer lending services such as car loans, credit cards, etc. Usually, that comes a few years after the launch. Because the customer base needs to be big enough and because it is very expensive to finance the lending products (both in terms of capital and regulatory approvals).

Worth mentioning, only a few online banks are actually profitable. Most of them are putting growth before profitability. This is mostly sponsored by VC money. One of the largest online banks, Nu Bank, reach profitability after 8 years. The largest German online bank, N26, is still not profitable.

Banking infrastructure⚙️

Launching an online bank is complicated. Since you operate with other people's money, you can expect that regulations are pretty strict. There are 4 main topics to cover here.

Licenses

Banking Partner

Card Issuing

KYC

Licenses

When you start searching for regulatory approvals you need, most likely the first thing you will see is Money Transmitter Licence. And when you read how much money and time you need to get it, you will probably give up on your fintech idea. But is just because there is not enough information about all the options you have, so keep reading👇

The USA requires every business dealing with money to obtain regulatory licenses. Facilitating the movement of money from one person to other, or one business to the next may mean you are operating a money service business or MSB. When that’s the case, you may need a Money Transmitter License.

Each state in the USA requires its MTL license, which means you need 50 different licenses if you plan to cover the whole USA. The only state that doesn’t require MTL is Montana, so you can launch your bank in Montana right away :)

Luckily, there are two options, and we will discuss both.

Apply for MTLs on your own

Doing business through a partner institution

1. Apply for MTLs on your own.

TLDR: it is a very expensive (up to $2M) and long process (it takes about 2 years to get licenses in all states). Currently, the hardest states to get licenses are NY and California. It can take up to 2 years to get it. Every state has different requirements and timelines. In terms of expenses there are a couple of different costs associated with MTL:

MTL application fee: depending on the state, it varies from a few hundred dollars to a few thousand dollars. The total application fee cost for all states is around $60K.

Annual License Fee: when you get a license, you need to pay an annual fee to maintain the license. Annual fees are usually a few hundred USD per year.

Investigation fee: some states require investigation after you apply for MTL and this can cost between $50 to $1000.

Net Worth requirement: since you work with the money, the state wants to get as much security as possible and one of the requirements is net worth. For example, Arizona is require $500.000 of net worth. Alabama is asking for $5.000.

Surety Bond: surety bonds protect consumers and government entities from fraud and malpractice. When a principal breaks a bond's terms, the harmed party can make a claim on the bond to recover losses. For example, in Colorado, Surety Bond for MTL is $1M.

Below is the summary of requirements per state:

Since applications can be complicated, a lot of companies are hiring attorneys specialized in obtaining MTLs, which of course increases the costs. From the conversations I had with experts, looks like the total cost to be fully licensed in the USA is around $2M (application fees, investigation fees, surety bonds, attorney).

For more information check this article.

2. Doing business through a partner institution

There is a 100% chance that you will want to use this option for your fintech startup. Using a partner which already has all the licenses means you can launch quickly and with much lower costs.

Simplified, it works like this: in the fintech backend, its all partner’s infrastructure is connected to your app via API. Your fintech startup is not touching the money or accounts. Customers just use your app and UX to open an account, send/receive money, request debit cards, etc., but behind the scenes, it is all done via partner infrastructure.

Banking Partner🏦

As I mention above working through a partner institution is the only way to quickly launch a fintech startup (because you don’t want to wait 2 years and spend $2M for Money Transmitter License).

The hardest thing here is to actually make a partnership deal since you are just starting and have zero revenue. Traditional banks don’t want to do business with everybody, they look out for their reputation, so you need to make sure they can see you as a trustworthy partner. If they agree to work with you, great, next step is to check what are their financial requirements.

Pricing can be tricky here. In most cases, you pay a one-time setup fee. This can range from a few thousand up to a couple of ten thousand USD. It should definitely be less than $100K.

Apart from the setup fee, there is an ongoing monthly fee you need to pay. Usually, it is the % of each transaction that is shared between your online bank and your partner bank. As we already mentioned, when your customer uses a debit/credit card there is a fee charged to the merchant, and you share that fee with your partner bank.

Also, note that most banks will ask you to commit to minimum spending. An example that I saw had a $20K monthly minimum, meaning if your partner bank earns $10K from your fees, you still need to pay them $20K for that month.

Also, another thing why you need a partner institution is access to ATMs. Your customers want to be able to withdraw cash without fees (at least a couple of free withdraws per month), so you need a partner with an ATM network.

Below is the list of the most popular online banks and their banking partners. As you can see, a lot of them are using Evolve Bank & Trust as their infrastructure provider.

Probably your best bet is to contact some of them and see if any would like to work with you and your fintech startup.

Investment services📈

In case you are looking to offer investment services, such as investing in stock for ETFs you will need to find a brokerage partner with licenses. The process would be the same as for an online bank - you build your app but the backend services are done via partner.

Until they get all the licenses, you can use providers like Drive Wealth LLC or Apex Clearing.

Card Issuing💳

One of the main products of every online bank is debit cards, so you want to be able to issue digital and physical debit cards to your customers. Personalized debit cards are a great growth hack to attract customers. You can offer different designs or materials.

Here are a few examples:

Treecard - the card is made from sustainably sourced cherry wood and plastic from recycled bottles.

N26 - metal card made from 18-grams of stainless steel

Greenlight - offers an option to put your picture on a card

Luckily there is a great solution for this called Gallileo. Galileo is the platform that supports fintech products - including checking, savings, deposits, lending, and credit cards. They even offer banking-as-a-solution, so it is possible to launch an online bank just using the Galileo platform. But, Galileo is the most famous for its super simple solution for issuing debit/credit cards.

Pricing is simple. You pay a $1000 one-time fee per each debit card product you launch. After that you pay $5 per card you issue to the customer. Every time customer uses the card, you pay up to .10 cents per transaction.

Great thing is that there is no monthly minimum, which is very important when you don’t have a huge volume in the beginning.

Galileo is the only provider I could find that has transparent pricing on its website.

Another solution you might use is Marqueta. Unfortunatelly, for pricing, you will have to contact their sales, but probably they are in line with Galileo pricing.

Know Your Customer (KYC)

To be able to offer online account opening to your customers, first, you need to collect some information about your customer - Know-Your-Customer (KYC). KYC is a set of standards used within the investment and financial services industry to verify customers, their risk profiles, and their financial profiles. Most importantly, it helps you avoid fraud.

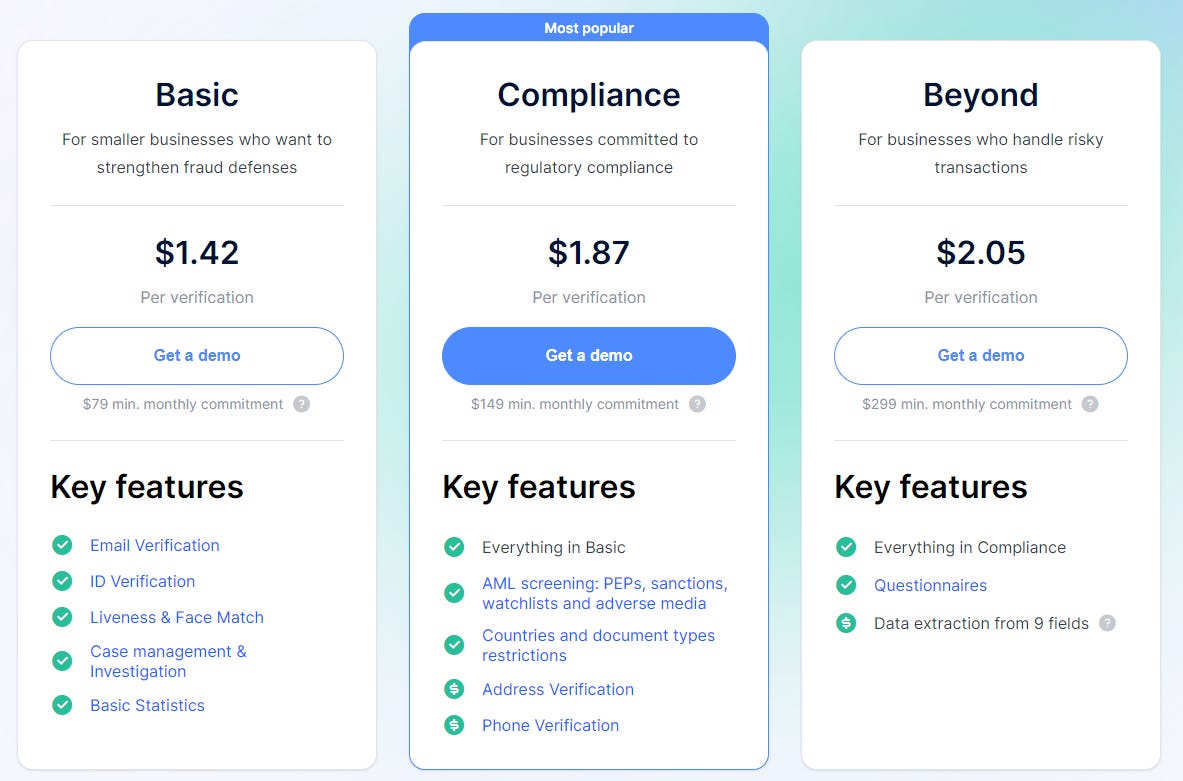

There are really a lot of good KYC providers, such as Microblink or Sumsub. Most of them are self-service solutions that you connect to your app via API.

Pricing is simple - in the beginning, when you have a small volume you pay $1-2 per customer verification. When you reach more than a thousand verifications per month, you can negotiate a lower rate.

All other solutions have similar pricing. As you grow your customer base, you can always negotiate a lower price.

Conclusion

As you can see, when you have all the right info, launching an online bank (or investing app) is less complicated than it looks once you have the right information. Of course, you would still need to build an app and secure initial money for a partnership with a banking provider, but now you know the steps. Let me know how you liked the newsletter.

If you found this useful, please share it with your friends or with anybody considering launching an online bank.

Great read covering off on parts of the core tech stack!

A precursor guide to determine whether you should launch a digital bank in the first place could be cool too - I.e. low risk testing a differentiated idea in the market with a simple landing page including branding + value props