Hi, ya’all, it’s time for a fintech stock analysis. The company is called Dave and you can buy this stock for 50 cents, so let’s spend 10 min to see if it is a good investment.

Dave’s stock lost almost 95% of its all-time-high price. Dave became famous after Mark Cuban invested money in it. The main idea behind the app is to fight high overdraft fees from traditional banks. It is currently the best cash advancement app in the USA, but its stock price is not following. We will analyze Dave’s business model and financials to check if is it a good stock to invest in. Let’s go👇

Ticker: $DAVE

Website: Dave.com

IPO Date: January 6, 2022

Price at IPO: $8.27 per share

52 Week High: $15.35

52 Week Low: $0.54

Market Cap: $223M

HQ: Los Angeles, CA

Employees: 380

Introduction

Dave is a fintech company primarily focused on short-term lending. It is founded by Jason Wilk The main target is to fight against the high overdraft fees that traditional banks are charging to customers. With Dave, customers can borrow up to $500, with no interest, credit checks, and fees. If everything is free how do they make money? We will try to find out :)

Recently they also launched a banking division (to offer mobile bank accounts) and a service that helps people find part-time jobs (as they call it: Side Hustle).

Mark Cuban invested $3M into the company and in 2021, Dave was number five in INC. Magazine’s list of 5000 fastest growing companies. In 4 years they hit the 10 million users mark. The total funding of the company prior to the Initial Public Offer was around $180M.

The company went public in Jan 2022 via SPAC (Special Purpose Acquisition Company). At IPO, Dave's market cap was $3B, but within a day it dropped to $2B.

In March 2022 (after the IPO), FTX (one of the biggest cryptocurrency exchanges) invests another $100M in Dave, so Dave will be able to offer cryptocurrency services. After that news, the stock recovered for a short period of time.

The app is downloaded more than 11 million times, but in the recent Q2 report, the company stated that the total number of members is 7 million. So, a lot of people download the app, but they still didn’t use it.

Business model and market

Short-term lending became very popular in the USA, especially with the rise of fintech. Dave is part of what is known as Cash Advance Apps - apps that offer users to get paid a few days earlier for the work they have already done. Simplified, the user is borrowing money against a future paycheck. Customers usually can borrow a few hundred dollars and return it in a few days. This money helps them to bridge the gap between salaries.

Turns out there is a huge market for that in the USA - $36B. Around 180M Americans at some point need products like Dave, to help them manage their budget.

Dave is considered to be an industry leader with the best rates (actually, you can borrow money for “almost” free). Dave’s business model currently consists of 3 main pillars: short-term lending, banking, and job marketplace (this is more of a feature, but it's an important part of the growth strategy).

Dave grew its user base very fast and that attracted a lot of competition, so the space is getting crowded. These are the closest Dave’s competitors

Looking at the competition and cost of their service, Dave is by far the cheapest option for the customers. This is the best selling point for Dave. In the next chapter, we will go into pricing details.

Dave also entered into banking, to offer its customers savings accounts, debit cards, and credit score builder. But the competition in the neobank space is already fierce and margins are low. There are over 80 neobanks in the USA and only a few of them can break even. Most of them are depending on VC money in order to keep the doors open and attract new customers.

A positive thing for Dave is that they already have a huge customer base, so they just have to upsell banking offerings to customers. Acquiring a new customer for neobank can cost more than $100. Dave should be able to upsell it to current users for much less.

Opening a banking charter comes with a cost increase. Like almost all neobanks, Dave also doesn’t have Banking Licence, so they are doing business through a partner bank, in this case, Evolve Bank & Trust. That is also creating additional costs for Dave. For example, if you sign up for Dave’s debit card you can get it for free, but it cost them somewhere between $5 and $15 to issue the card, so Dave is losing money in a short time.

The third main feature of Dave is a marketplace for side hustles.

We must admit, this is a very good growth hack for Dave. Dave’s customers can easily browse local jobs with flexible schedules, so they can earn extra cash. While customers wait to get paid, they can use the Dave app to get cash in advance. So far, the side hustle marketplace helped users to earn more than $20M of extra income. A great example of product-led growth. An employee who came up with this idea should get a raise.

How does Dave make money?

There are 4 ways in which Daves makes money

Cash Advancements

Interchange fee

Interest on cash

Side Hustle marketplace referral fee

Primarily, Dave’s core business is cash advancements up to $500. In order to be able to qualify for cash advancements via the Dave app, you need to be a member which cost $1/month. Even if customers don’t use the cash advance in a particular month, they still have to pay a monthly membership for that month.

Dave currently has 7 million users, so they are making $7M per month from memberships. Not bad at all. Some of their competitors charge up to $9.99/month for memberships, so this is a really good price for customers. And the best thing is, even if they double the membership price up to $2/month, they are still the cheapest option.

New users just need to connect the app with their bank account and they are eligible for up to $250 of cash advancement. There are no fees or interest rates and the user must return borrowed amount when the next paycheck arrives (it will be automatically deducted from the account). Later this amount can go up to $500 if a user is on time with payments.

Dave also makes money if a customer wants money right away. After the cash advance is approved it takes between 1 and 3 days to hit the customer’s account. But if a customer wants money within 8 hours, there is a $5.99 fee. I would expect that a lot of people are paying for express service, because most people need money now, not in 3 days.

If the person is late with the payments to Dave, Dave doesn't charge late fees or penalties, however, the person is not allowed to get any new cash advancement until the balance is settled.

Also, there is an optional tip. After a customer returns the money to Dave, he/she will be asked to leave an optional tip to “ help provide an equal financial playing field to millions of Dave members”. The tip can be any amount up to 20% of the borrowed amount. The average tip is $1.

Summary:

Membership: $1/month

Express service fee: $1.99 to $5.99

Tip: suggest $1 per transaction

Interchange fee

Another source of earning for Dave is the interchange fee from their banking division. Every time somebody uses Dave’s debit card, there is an interchange fee charged to the merchant. Usually, this is somewhere between 2% and 5% of the purchase amount. This earning is split between Dave and their banking partner.

Interest on cash

Dave, just like any bank, uses the cash residing on user accounts to lend it out to other institutions, such as said banks. Then, they collect interest from these institutions. The net interest margin for all U.S. banks was equal to 3.35 percent, so if you have millions sitting on customers’ accounts, this adds up to a nice amount.

Side Hustle marketplace referral fee

Their marketplace is mostly for gigs for companies such as DoorDash, Instacart, etc. Whenever Dave’s customer sign for any job, Dave receive a fee from these companies

Maximum revenue potential

So, let's do some maximum monthly revenue calculations for Dave with the assumption that every user borrows the money once a month with the express option.

7M users x ($1/mo membership + $5.99 express service + $1 tip) = $56M per month. Plus all the money from interchange fees, interest, and side hustle marketplace referrals. Probably can go up to $60M per month.

Currently, Dave is making around $15M of revenue every month, so there is room for growth in the future.

Financials

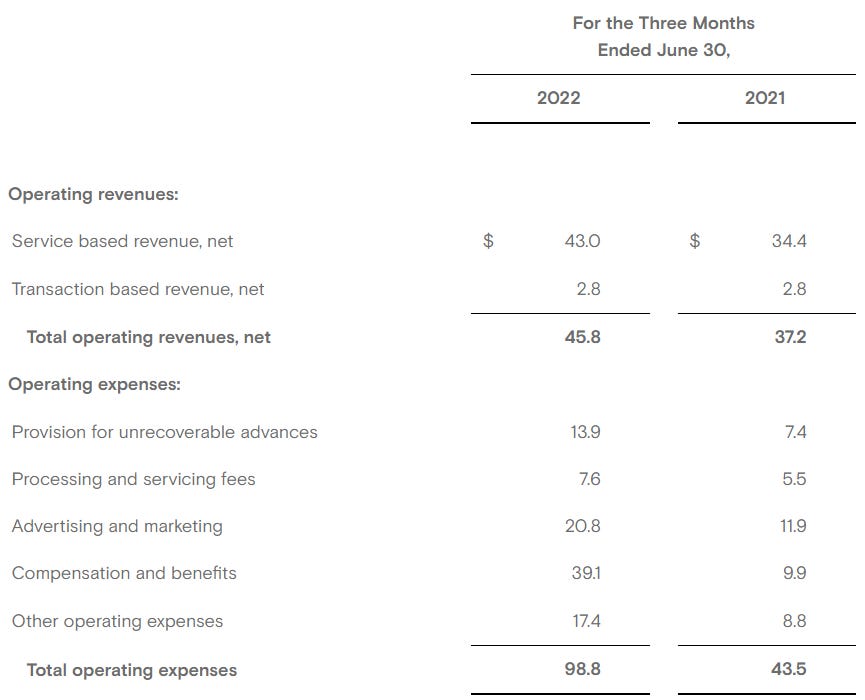

Q2 Results just came out a week ago and growth is there, but financials don’t look very good. At least to us.

Total revenue is $45.8M, while total operating expenses are $98.8M. So, the company is spending almost double what they earn. Obviously, growth is more important than profit at the moment, but at some point, they will have to chase profitability harder. They added 560.000 new members in Q2 which is an impressive number. Also, the company has $257.3 million of cash and cash equivalents, restricted cash, marketable securities, and short-term investments as of June 30, 2022.

Looking at the huge drop in stock price, they will now need to focus more on profitability.

Apart from salaries, the biggest expense is marketing - $20M per quarter. Looking at their website, they need more in-house-made educational content to get more inbound customers from Google searches.

Stock History

As we already mentioned, the stock lost 97% from its all-time high. Early investors in this stock will probably never see positive returns because it's highly unlikely that the stock price will ever go back above $10. Peek price of $15.35 was on Feb 22 and after that went down to around $4. The price spike ($10) that you see in March is due to FTX's investment in Dave. Cryptocurrency exchange invested $100M into Dave and since then the price has just continued to drop. In the last 10 days price of the stock is around $0.6.

Conclusion

In terms of business model and the market opportunity (size), Dave is positioned pretty well to be a successful fintech stock if they can figure out a profitable business. We like the idea and the features of the app and there is a path to profitability with the current business model(s) if the company does some changes.

Dave has a customer base big enough to raise a membership price. Raising a price by $1/month for 7M customers could bring an additional $21M of revenue per quarter, and still be one the cheapest option on the market. With the FTX partnership, they will offer crypto service, but we don’t think this will have much impact (especially because we are into crypto winter). Its biggest strength is the number of users - Dave just needs to figure out how to monetize it better.

Having a banking division with a savings account and debit card is a good start, but for the stock to go up, they will need to get into the credit card business (or some other lending product) - this is the path for neobank to reach profitability.

Positive thing is that the headcount number is relatively small (380) compared to other fintechs that were hiring like crazy in the last year.

Also, with 7 million users and a low market cap, Dave is the ideal target for acquisition. FTX which just invested $100M into Dave could be a potential buyer. If that will be the case, the price could go up to $2-3 dollars per stock. The current stock price is near an all-time low so if anybody likes to gamble this could be a good stock to invest in.

*This newsletter is not investment advice and we are not responsible for any financial loss.

I, too am positioned to be a successful fintech stock; if I could just figure out a profitable business! :)