Hi all,

and welcome to 2024! We were offline for 2 weeks (holidays and preparing new things for 2024) but I hope you are ready for a wild ride in 2024, because we sure are!

As far as 2024 goes, we will make things more recognizable (visually and content-wise) and introduce several categories. For instance, Monday will always be reserved for news type of posts (like this one), but on Wednesdays, you can expect a post that is focused on a specific topic.

(Paid subscribers will also experience a few changes)

Anyhow, without further ado, let’s get going!

Btw 👇

Startup news

Financial services funding is 📉📉📉

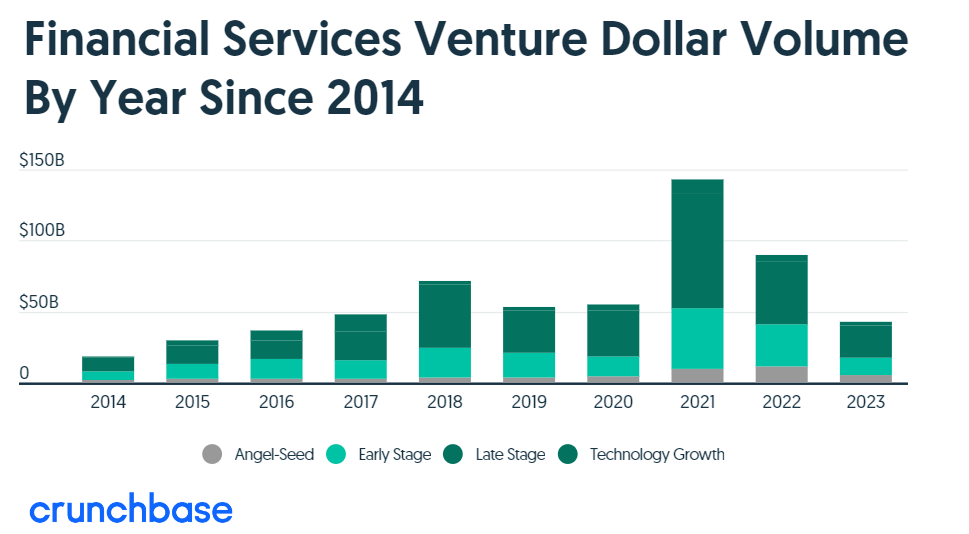

Venture investment in 2023 into financial services and fintech, which just a few years ago was the top sector for startup funding globally, totaled $43 billion, its lowest level in six years, according to Crunchbase data 👇

and 👇

That’s down more than 50% year over year from the $89.5 billion invested in financial services in 2022, and even more dramatically from the $143 billion invested in the sector in the peak market of 2021.

The AI and manufacturing sectors both outpaced fintech in terms of venture dollar investment in 2023 — a first in the last six years. Funding in 2023 to health care startups, including biotech companies, also topped financial services, as it has in prior years.

More info HERE

Big funding rounds last week

Picnic - $389 million round

Picnic is a fast-growing tech company that has developed a mass-market home delivery system for fast moving consumer goods.

The Dutch company achieved total sales of approximately €1.25B in 2023 and expects growth to continue in the coming years due to the trend of new families shopping online and finding the perfect service at Picnic due to its attractive pricing, extensive own-brand, and free delivery.

Fever - $110 million round

Fever is a live-entertainment discovery tech platform aiming to make culture and entertainment more accessible.

Still don’t know what they do?

It’s basically MeetUp but for entertainment. Just about two years ago, New York-based Fever raised $227 million at $1 billion valuation, and now they did $110 million at $1.8 billion valuation.

It’s seems to me soo much money for nothing special…

FINN - $109 million round

FINN, a Munich-based car subscription provider, secures €100 million in Series C funding.

The bulk of the capital will be used to expand the company’s electric car offer, with the goal to more than double the number of low-emission vehicles in its fleet from 40 percent to over 80 percent by 2028.

ExtraHop - $100 million round

ExtraHop provides a cyber analytics platform that delivers visibility for organizations to detect attack activity and remediate threats.

ExtraHop says it ended 2023 with approximately $200 million in ARR.

Second Dinner - $100 million round

The Los Angeles-based game development studio is behind the popular game MARVEL SNAP — which has been downloaded more than 22 million times and produced $200 million-plus in revenue since its launch in 2022. Founded in 2018, the company has raised $130 million so far.

Quora - $75 million round

Quora is a question-and-answer platform that allows users to ask and answer questions on a wide range of topics.

Why funding you might ask?

Well, for AI of course 😅 The company raised the fresh capital to help push growth for Poe, its AI chat platform.

Rokid - $70 million round

Rokid specializes on human-computer interaction tech, offering smart devices, AR gadgets, and robotics software.

Luma AI - $43 million round

Luma AI is a generative AI startup that enables users to transform text descriptions into corresponding 3D models.

Smaller funding rounds last week

Rivero - $7 million round

Founded in 2019, Rivero aims to simplify payment operations for the highly regulated payments industry, filling a gap in the market for fraud recovery, dispute management and payment scheme compliance solutions.

Kajo, the first product, is the only solution on the market for payment scheme compliance and enables all licensees of payment networks to minimise the effort and the risks involved in this process.

Its second product, Amiko, is the only SaaS solution that digitalises the entire fraud recovery and dispute process. This helps issuing banks efficiently manage this process while offering a unique self-service experience to their customers.

Primetag - $3.8 million round

Primetag specialises in influencer marketing analytics and wants to become a meeting point for brands, agencies, agents and influencers to connect and grow their businesses.

It enables users to measure every campaign’s KPI with a full-funnel view in real-time, it’s designed to make influencer marketing easier to manage and scale and more ROI-driven.

Shaka - $1 million round

Shaka is leveraging eSIM technology to allow brands to offer tailored mobile packages, ultimately looking to increase engagement, loyalty, and recurring revenues.

With the investment, the startup says it can begin onboarding customers from the entertainment, retail and fintech sectors that have expressed interest in leveraging the company’s offer.

World news

Microsoft secures number 1 spot

Microsoft closed out Friday as the world's most valuable publicly traded company, pushing its long-time rival Apple off the top spot.

The tech giant hit a market cap of $2.89 trillion while Apple's fell slightly to $2.87 trillion.

Much of Microsoft's success has been credited to it embracing AI, led by the company's lucrative $10 billion investment in Sam Altman's OpenAI.

Snapchat's Evan Spiegel in a Leaked Memo: 'Social Media Is Dead'

In a recently leaked internal memo, Snap Inc.’s CEO, Evan Spiegel, rallied employees towards new objectives to overcome stagnant growth. The memo, a call to arms, was a clear critique of rival social media platforms and set the stage for the company’s strategic blueprint for 2024.

Spiegel’s vision for Snap also included expansion into AR products, citing the expected increase in consumer AR glasses by the end of the decade. He positioned Snapchat as a solution to the “online popularity contest” prevalent on competitor platforms like Facebook and Instagram.

SEC Approves Bitcoin ETFs for Everyday Investors

The U.S. Securities and Exchange Commission voted last Wednesday to allow mainstream investors to buy and sell bitcoin as easily as stocks and mutual funds, a decision hailed by the industry as a game changer.

The SEC decision clears the way for the first U.S. exchange-traded funds that hold bitcoin to be sold to the public. Expectations of U.S. regulatory approval for such funds drove the price of bitcoin to the highest level in about two years. The digital currency traded just below $46,000 late Wednesday, up from $17,000 in January 2023