Hi all,

what happened last week you need to know?

Before we start…

Share if you like it 👇

Subscribe if you want to 👇

Startup news

Big funding news

Quantinuum - $300 million round

Quantinuum locked up a fresh $300 million equity fundraise at a pre-money valuation of $5 billion, as investors are clearly excited about the possibilities of quantum computing.

DailyPay - $75 million round

Waiting for payday can be a drag. New York-based DailyPay just raised a fresh $175 million so you don’t have to do that. The company partners with employers to allow employees to track, transfer, spend or save their pay as they earn it. The new round was made up of $100 million in an expanded credit facility and more than $75 million in equity financing led by Carrick Capital Partners.

Digital Onboarding - $58 million round

Boston-based Digital Onboarding, a customer relations platform for financial services, closed a $58 million investment from Volition Capital. Founded in 2015, the company has raised nearly $63 million so far.

Smaller funding news

Kiln - $17 million round

Kiln enables institutional customers to stake assets, and to whitelabel staking functionality into their offering.

As part of its critical services to secure the blockchains, it runs validators on all major PoS blockchains, with over $4 billion of crypto assets being programmatically staked, and over 4 per cent of the Ethereum network running on multi-cloud, multi-region infrastructure.

Recraft - $12 million round

Most generative AI tools only generate raster images, which cover a portion of all professional design tasks.

By comparison, UK company Recraft develops both raster and infinitely scalable vector images that support professional applications of graphic designs. It enables users to generate and edit vector art, icons, 3D images and illustrations within a brand's style controls, such as the colour palette, geometry of icons, and the style of lines.

Harbiz - €5 million round

Founded in 2022 and currently operating in more than 35 countries, Spanish startup Harbiz is helping over 6,000 fitness professionals to advise and improve the lives of over 120,000 clients.

Harbiz helps wellness professionals manage their entire business through a single platform: exercise routines, planning, communications, bookings, client progress, and more.

Notable News

Tech layoffs are not over?

Amazon 👇

Amazon has announced plans to lay off "several hundred" employees in its Prime Video and MGM Studios branches, after reviewing "almost every aspect" of the company's business, according to a letter obtained by Forbes from Prime Video's Senior Vice President Mike Hopkins.

Twitch, a live-streaming site owned by Amazon, announced plans to lay off 35 percent of its employees (approximately 500 people), wrote CEO Dan Clancy on a blog last Wednesday. He said Twitch "needs to work to bring the company into an optimal state," saying Twitch is "significantly larger than necessary when considering the size of the business." Amazon's Audible audiobook branch also laid off 100 workers.

Google 👇

Last Wednesday, Google laid off "hundreds" of employees from several departments, including engineering and hardware teams, as well as those working on Google Assistant, according to an internal email obtained by the New York Times.

Discord 👇

Discord CEO Jason Citron announced that the platform will lay off 17 percent of its employees – about 170 people – to "improve focus and the way they work to be more agile," reported The Verge.

Unity Software 👇

Unity Software, a video game developer, says it will lay off about a quarter of its employees (about 1800 people) as part of a restructuring plan "to position themselves for long-term and profitable growth."

Reddit getting ready for March IPO?

Social media platform Reddit has drawn up detailed plans to launch its initial public offering (IPO) in March, moving forward with a listing it has been eyeing for more than three years.

It would be the first IPO of a major social media company since Pinterest's debut in 2019, and would come as Reddit and its peers face stiff competition for advertising dollars from the likes of TikTok and Facebook

More info HERE

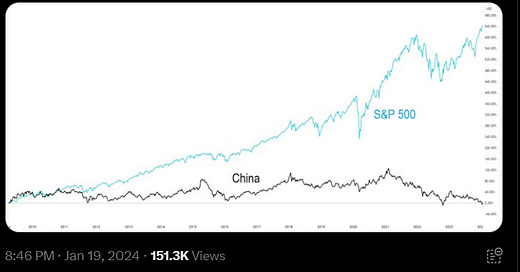

Investors fleeing China are going all in…Japan

Chinese individual investors are piling headlong into Japanese shares as their own market flags—is both a sign of the times and a big hint as to why Japanese stocks are suddenly doing so well in general.

Foreign investors who previously parked a lot of cash in China need somewhere else for their international allocations. A lot of Chinese domestic capital is eyeing the exits too: And Japan is cheaper than the U.S. and, potentially, comes with less political and regulatory risk.

Japan’s Nikkei 225 index has gained 9% already this year, just 6% off its record high in 1989. China’s CSI 300 index, on the other hand, has slid 6%. Hong Kong’s Hang Seng Index, which includes tech heavyweights such as Alibaba and Tencent, has done even worse: losing 12% so far in 2024.

More info HERE

Google to invest $1 billion in UK data centre

X bits (no comment)

Elon Musk text Twitter’s CEO 👇